Gain access to Bankamong the prominent organizations in the Nigerian monetary sector, has actually revealed its ingenious offline banking platform, www.901.ng to supply consumers with an extra digital channel to handle and perform continuous day-to-day deals.

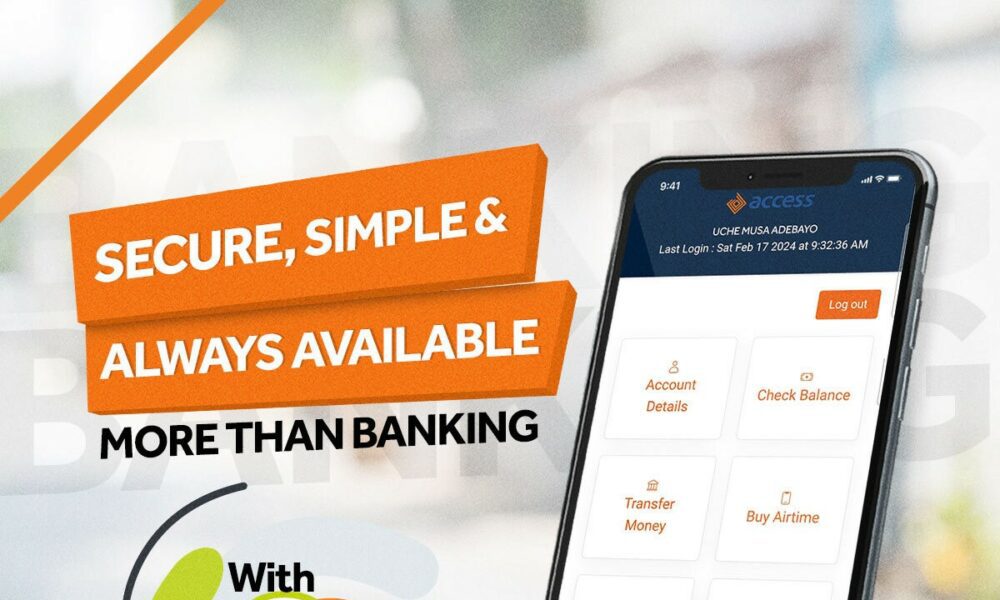

With this ingenious service, Access Bank is redefining benefit and security in banking, making sure continuous access to monetary services even in the lack of web connection.

Speaking with reporters throughout a media round table chat at the bank’s head workplace just recently, Victor EtuokwuDeputy Managing Director, Access Bank, stated;

In today’s hectic digital age, connection is frequently considered given. Millions of people worldwide still deal with obstacles accessing online banking services due to numerous factors such as bad web facilities, remote areas or security issues.

Acknowledging this space, Access Bank has actually established this service to empower our clients to bank firmly, anytime, anywhere, regardless of web accessibility. We are devoted to leveraging innovation to boost the banking experience for all our clients.

With the intro of our offline banking platform www.901.ngwe are breaking barriers and empowering people and companies to handle their financial resources with self-confidence, even in offline environments.

Restating Victor’s remarks, Njideka EsomejuGroup Head, Consumer Banking, Access Bank, informed newsmen that Access Bank’s offline banking platform www.901.ng declares its among the bank’s core worths– Innovation and sets a brand-new requirement for availability and security in the banking market.

As part of its continuous dedication to quality, Access Bank will continue to progress its offerings to satisfy the developing requirements of its varied consumer base. A few of the essential function of this offline banking platform consists of:

- A basic method to send out cash.

- Purchase airtime, and pay expenses whilst sustaining no additional costs or concealed charges.

- No web membership needed and no session costs.

Head of Digital Channels, Access Bank, Oluremi Gabriel Speaking at the instruction stated;

What we have today is a first-of-its-kind, and what it does is permit consumers to do their standard banking with or without information. This development is driven by information as we understand what clients wish to do and we have actually made it extremely simple and offered to our consumers specifically when they lack information.

Gain access to Bank is among the leading Nigerian banks devoted to offering ingenious and customer-centric monetary services. With a concentrate on digital change and neighborhood engagement, Access Bank continues to redefine the banking experience for its clients.

Sponsored Content