Ahead of the Lok Sabha election, the crisis of joblessness unifies India as couple of things do. Why are necessary areas of India out of work? How do jobless Indians live? Why is the work offered inadequate to make an income? How do Indians protect work? The length of time is the wait? With India out of work, The Wire reveals a series that checks out among the most crucial survey problems of our time.

New Delhi: A number of financial indications expose a story at chances with the federal government’s representation of financial success.

Information on car sales, decreasing usage need, high loanings, reducing cost savings, and decreasing rural need, to name a few variables, each unfurl an unique aspect of an economy having a hard time underneath the surface area.

Contributed to that, increasing joblessness unsettled labour low-grade tasksa decreasing labour involvement rate require a wider evaluation that is required to resolve these pushing concerns.

India’s GDP is growing and it’s set to end up being the world’s third-largest economy. Huge FMCG business raise issues over a relentless downturn of rural needAll this is intensified by a historical decrease in cost savings.

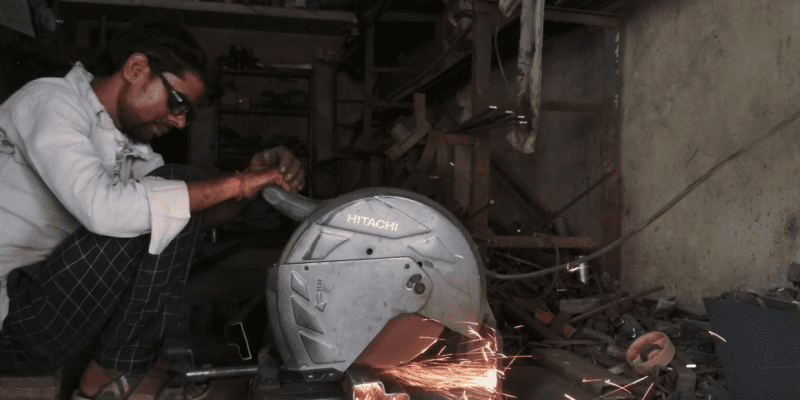

Illustration: Pariplab Chakraborty. Picture: Intifada P. Basheer and Azam Abbas

Utilizing Sales Pulse information assembled by HowIndiaLives The Wire looks into an analysis of how Indians are handling to sustain themselves with their existing tasks, instead of prospering under the federal government’s’Viksit Bharat’ effort.

If FMCG sales are slow, family cost savings are decreasing, and loaning levels are skyrocketing, it might recommend that employees are dealing with difficulties in sustaining their living requirements and might be simply enduring rather than flourishing.

In addition, an absence of information likewise obstructs the measurement of how an economy takes in.

“The problem is we have not had an usage study. There was an usage study for 2017-18, however the federal government dumped that a person since they didn’t like the outcomes. A dripped variation of that study revealed that rural intake had really tipped over that six-year duration, from 2011-12 to 2017-18. And ever since they have actually not had an usage study. They’re expected to be doing one now, however we’ll not get those outcomes for a minimum of another year,” popular advancement economic expert Jayati Ghosh stated, while talking with The Wire on whether Indian employees are loving the growing GDP or simply making it through.

“And why would you refrain from doing an intake study? Since those studies inform us the number of bad individuals exist remain in the nation, where they are, what they do; they [these surveys] inform us about circulation, since these provide us some indicator of who can consume what,” she included.

“The other study which is [also] a much better indication is the labour force study. The federal government has actually enabled that study to continue, however I do not understand for how long they will, since that has actually likewise disappointed great outcomes,” she even more stated. “That [The labour force survey] programs us that genuine earnings are basically stagnating.”

“Note that these are typical genuine incomes and these can get misshaped at the upper end, and make it look greater.”

“So, if we truly need to know how employees are doing, we need to be taking a look at the average salaries,” she stated, including that’s what lots of nations do. “They take a look at the typical incomes. That is, the middle of the circulation.”

“Since the typical incomes are stagnating, it’s rather possible that the mean salaries have in fact boiled down in genuine terms. Some individuals are really dealing with this information,” she stated.

Keep in mind that the average can be altered by outliers, specifically if there are substantial earnings variations within the population.

Check out: Unpaid Labour growing, Muslims Not Looking for Work: What the PLFS Data Reveals

There are 2 fascinating sets of information– lorry registrations and provident fund circulation by big, medium and little companies– that might provide a peek of the financial wellness of the employees.

The information utilized to develop the charts listed below is since February 2023.

Changes in two-wheelers, stable development in hybrid and electrical lorries

Lorry registrations are likewise thought about a proxy for retail sales.

Two-wheeler sales information are frequently thought about a crucial sign of intake need, specifically in nations like India where they are a popular mode of transport. They show the acquiring capability of the middle class.

The information reveals that throughout the COVID-19 lockdown, registrations of two-wheelers dropped to 161,314 systems in May 2020 and kept changing till January 2023. They appear to have actually been recuperating ever since.

As on September 30, 2023, they stood at 1.31 million systems, greater than 1.16 million systems in the very same duration in 2019.

It plainly reaches its peak in the month of November every year.

What is notable here is the strength of the dip throughout the pandemic and the changes afterwards.

On the other hand, have a look at the registrations of hybrid lorries within the eco-friendly classification and electrical cars.

Lorry registrations in the sustainable classification (see listed below) reveal a constant increase. As earlier discussed, this classification consists of hybrid lorries.

Keep in mind that hybrid cars tend to be more pricey as compared to their standard equivalents. Hybrid automobiles likewise need more upkeep than the traditional ones. The concern is, how numerous individuals from the middle class and lower-middle class can manage purchasing hybrid designs of cars and trucks?

“In reality, high-end vehicles are likewise succeeding and not simply the EVs. EVs are absolutely pricey. Therefore are hybrid [vehicles]They are all far more [expensive] than the routine [vehicles]All high-end automobiles are doing well. That informs you precisely who’s getting from all this development,” Ghosh stated.

News company IANSpointing out a report by Cyber Media Research, stated that India saw a 120% development in the 2nd quarter of 2023, driven by a 400% rise in hybrid automobiles.

Remarkably, in the chart below, registrations of electrical (battery run) cars peaked when the COVID-19 lockdown had actually begun. After the pandemic, the need has actually regularly increased. Their adoption, specifically at a time when over 120 million individuals in India lost their tasks, might suggest plain financial variations in the nation.

Keep in mind than EV sales have actually been accelerating in spite of issues over an absence of charging stations and policy obstructions. Once again, which section of the population purchases EVs and hybrid automobiles?

The impressive rise in high-end cars and trucks reveals that the buying power of these purchasers has actually grown tremendously, and they are not thinking twice to invest Rs 50 lakh to Rs 1 crore, according to The Hindu’s State of The Economy podcast on the high-end vehicle market development.

Rural need weak point in FMCG sector

Individually, fast-moving durable goods (FMCG) sales act as an essential sign of usage need in an economy. These consist of sales of products such as tooth paste, biscuits, cleaning agents, dairy items, individual care items, and so on.

Modifications observed in FMCG sales can be credited to modifications in financial conditions, such as changes in earnings levels, work rates, and inflation.

Mint reported that rural need weak point dragged FMCG business’ profits development in the October-December quarter of fiscal year 2024. Volume development stayed soft for hair oil, health and food beverages, and appeal and individual care sections.

According to NielsenIQ, the FMCG sector is anticipated to grow at 4.5-6.5% in 2024, dramatically lower than the robust 9.3% development experienced in 2023 and 8.4% in 2022.

Company Standard had actually reported in November that relentless low need in the FMCG sector is triggering supply chain blockage, resulting in a boost in stock days, with stocks collecting at suppliers.

Huge business such as Hindustan Unilever and Dabur have likewise stated that the rural markets are lagging city. Lots of have even raised doubts about a revival in rural need, according to Mint

Medium-sized companies saw sharp decrease in PF contributions

Provident Fund (PF) contributions by big, medium and little companies show how individuals conserve in an economy. It might likewise be an indication of social security within an economy.

This information is a great sign on how employees are performing in an economy. “Even when you sign up, let’s say, for the EPF, you might not have the ability to do anything with regular monthly payment, specifically when you alter tasks. [Many time] employees do not even understand [they have an EPF]and it gets dropped from their pay when they sign up with another company, and they do not even understand that it’s portable. They do not always bring it with them. They really lose. It’s like a tax on their wage instead of really cost savings,” Ghosh stated.

“Secondly, they’re refraining from doing the studies that they need to be. There was an all-India Debt and Investment study, which was due, which would provide us a concept about home cost savings. And just how much dissavings occurs at the lower level. They [the government] are not gathering the essential information that wold provide us this info,” she stated.

“But, what you’ve simply explained in regards to the PF of the big companies versus the others [medium and small firms]it speaks quite of the wider image that is coming out of business success,” she included.

The teacher explained a report which stated that 90% of the business revenue in India was made by the leading couple of companies.

“The leading 20 earnings generators in India (“the Leviathans”) now represent 90% of the nation’s business revenues. Beyond controling the nation’s earnings swimming pool, the Leviathans likewise reinvest these revenues much more effectively back into their companies,” Marcellus Investment Managers stated in May 2020.

“There’s decreased success, and sometimes, unfavorable success. And we understand that there’s a great deal of churning in the little and micro business. Some are shutting down and after that individuals begin something else,” she even more stated.

In the 3 charts listed below, it appears that PF contributions by all companies experienced a considerable decrease throughout the COVID-19 pandemic. The most noticable fall, as shown by the curve, happened in medium-sized companies, whereas the drop in PF contributions from big companies appears less steep.

While these charts correspond for both little and medium companies, PF quantities paid by big companies reveal a sharp boost in 2022. They appear to have actually increased regularly till February 2023, till when the information is readily available.

Relentless decrease in little company labor force

The 3 charts listed below represent the variety of staff members in little, medium and big companies of all sectors, consisting of production, services, farming and trading.

While big companies have actually increased their labor force, after a sharp dip in 2020, little companies have actually borne the significant impact of the pandemic. The labor force in little companies decreased greatly two times, in 2020 and in 2021, and it has actually been falling because the in 2015.

Keep in mind that variations in the labor force size can affect PF contributions by companies.

A boost in the labor force typically results in greater PF contributions by companies. On the other hand, a decline in the labor force causes a decrease in PF contributions by companies, as they utilize less individuals.

A decline in labor force size can represent obstacles in the economy, such as joblessness, decreased customer need, and lower cost savings rates amongst employees.

Based on the Reserve Bank of India information, Indians have actually been conserving less and obtaining more to invest. Home cost savings struck a 47-year low in the fiscal year 2023. In addition, yearly monetary liabilities of homes have actually increased dramatically in FY23.

This suggests that families have actually been mostly obtaining to satisfy their usage requires.