Topline

The New York attorney general of the United States’s workplace argued Friday that the $175 million bond previous President Donald Trump installed in the civil scams case versus him and his business is inadequate and must be thrown away, declaring the business that financed the bond hasn’t revealed it has the “monetary capability” to pay it ahead of a Monday hearing on the bond’s fate.

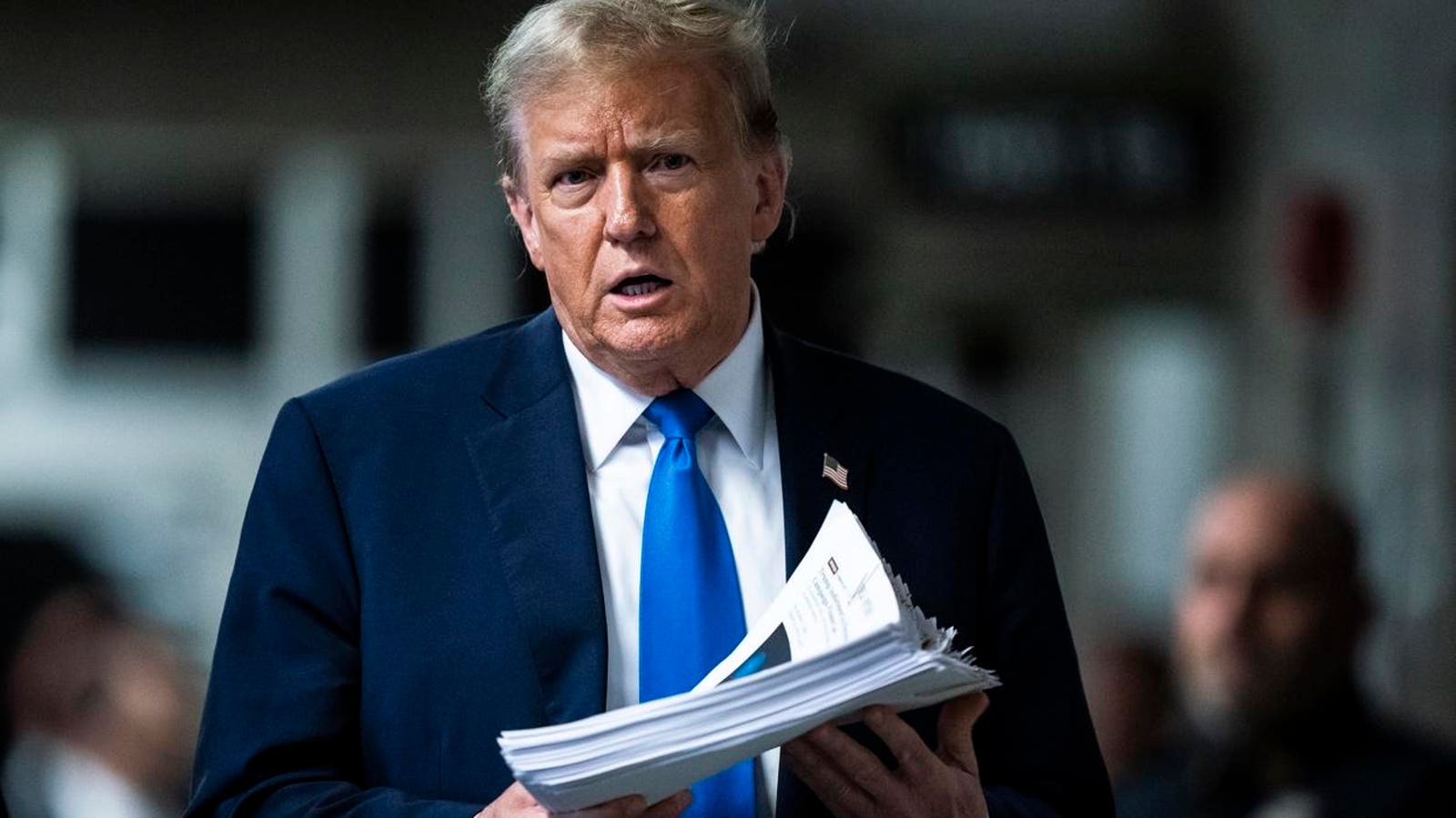

Former President Donald Trump speaks with press reporters at Manhattan criminal court on April 18.

Secret Facts

Trump was bought to publish a $175 million bond in the civil scams case– just a portion of the more than $464.2 million he and his co-defendants owe in overall– after he and his partners were discovered responsible for fraudulently misstating the worth of possessions on monetary declarations in order to get more beneficial service offers and show a greater net worth for Trump.

Trump published the $175 million bond in April, which was financed by Knight Specialty Insurance Company (KSIC), a California-based business chaired by billionaire Don Hankey, who informed Forbes he approached Trump about financing the bond, instead of the other method around.

The New York attorney general of the United States’s workplace, which brought the scams case, challenged the bond days after it was published, requesting KSIC to supply more info about its financials to show it might in fact cover the complete $175 million– triggering the insurance provider to safeguard its financial resources in an upgraded filing Monday.

In a brand-new submitting Friday, the chief law officer’s workplace argued the details KSIC supplied was still inadequate since absolutely nothing about what the business offered in fact reveals they have the monetary capability to pay the $175 million if Trump can’t– keeping in mind the business reports it’s just worth $138 million, which is smaller sized than the size of the bond, and declaring it is utilizing a “shadow” business in the Cayman Islands to “appear more solvent than it in fact is.”

Trump’s security likewise has concerns, the state argues, since the filing declares Trump is utilizing $175 million in money to collateralize his bond– however there’s absolutely nothing recommending that cash is “locked,” indicating Trump might withdraw a few of that $175 million at any time and therefore would not have enough to cover the bond if he needed to pay.

The state likewise implicates KSIC’s management, consisting of Hankey, of being “neither reliable nor proficient.”

Chief Critic

Trump’s legal representative Cliff Robert and KSIC have not yet reacted to ask for remark. In their filing safeguarding the bond, Trump’s legal representatives and KSIC explained the business as being “appreciated” and “well-capitalized,” arguing its “solvency and significant monetary reliability … allow it to please all responsibilities under the bond.”

What To Watch For

Judge Arthur Engoron will hold a hearing in New York state court on Monday about the bond concerns and whether the KSIC-backed bond can hold. The state has actually asked Engoron to state the bond void and need Trump to change it with a bond underwritten by a brand-new business within 7 days.

Forbes Valuation

$4.9 billion. That’s Trump’s net worth since Friday afternoon, according to Forbes’ real-time trackeras the ex-president’s possessions have soared in the wake of his business Trump Media & & Technology Group going public. Just roughly $413 countless his overall net worth is comprised of money and liquid possessions, nevertheless, suggesting that while Trump can cover the whole $175 million himself, he might not cover the $454.2 million– and counting— he’s been bought to pay in overall in the scams case.

Secret Background

Trump and his co-defendants– including his children and previous Trump Organization CFO Allen Weisselberg– were discovered responsible in February for fraudulently pumping up the worth of their possessions following a monthslong trial. Engoron figured out there was “frustrating proof” revealing Trump and his boys accepted monetary declarations regardless of understanding appraisals were incorrect, buying Trump to pay $454.2 million plus post-judgment interest— collecting at a rate of more than $111,000 daily– on top of smaller sized fines for Trump’s boys and Weisselberg. An appeals court reduced the quantity that Trump needed to publish bond for to $175 million after Trump’s attorneys opposed that he could not discover any business who wanted to cover the complete bond quantity. Trump published the KSIC-backed bond right after. If he loses the scams case on appeal, he will still be on the hook for the complete payment, despite the fact that he just needs to pay part of it now to protect the bond.

More Reading

MORE FROM FORBESTrump Posts $175 Million Bond Thanks To Billionaire Don HankeyBy Zach Everson

MORE FROM FORBESTrump’s Net Worth 2024: Which Assets Are Up, Which Are DownBy Kyle Mullins