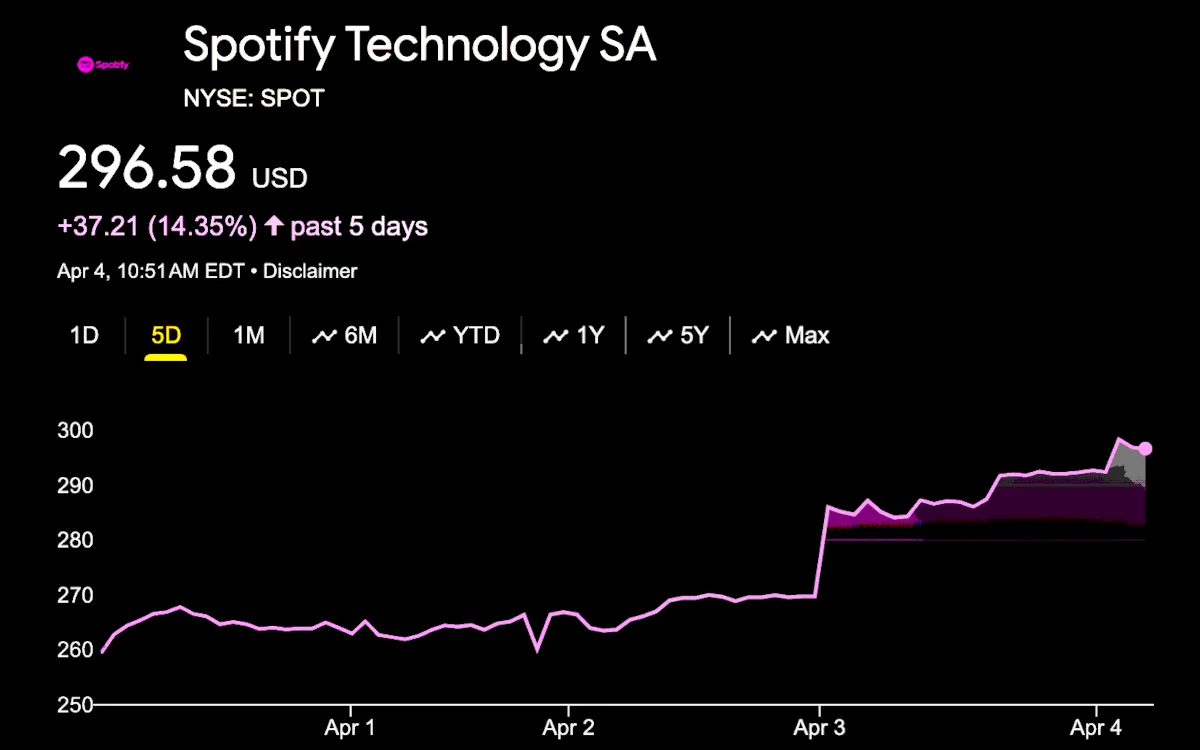

A picture of Spotify stock development since early trading on Thursday, April 4th, 2024.

Spotify stock (NYSE: SPOT) has actually experienced a double-digit evaluation spike– which raised shares to a 52-week high– after reports indicated prepare for additional rate boosts.

When trading began today, SPOT leapt to almost $297, up around 14 percent throughout the previous 5 days. The rally continued into the afternoon, as Spotify stock touched the discussed 52-week high of $304 per share.

The latter represents the stock’s biggest per-share rate not just throughout the previous year, however given that market patterns and the statement of (an preliminaryoffer for The Joe Rogan Experience raised SPOT to around $400 in Q1 2021. When the market closed, SPOT had actually settled at $295.96, still up 57 percent from 2024’s start and 126 percent from early April of 2023.

As kept in mind, financiers’ optimism has actually shown up not following the main statement of rate bumps, however on the heels of associated reportsAccording to the latter, Spotify will verify the news faster instead of later on.

That’s due to the fact that $1 to $2 walkings are anticipated to present in fresh strategies, incorporating audiobook listening in addition to music and podcasts, in Australia, the U.K., and more by April’s end. The existing system, where paid users get 15 hours of no-additional-cost audiobook gain access to monthly, will eventually be retired, the reports insinuated.

(A comparable cost bump is supposedly being teed up for the U.S. later on in 2024, and Spotify provides a standalone audiobook membership .)

Besides the more pricey (audiobook-equipped) tier, customers will supposedly be able to check out the existing bundle, with unrestricted access to music and podcasts, for the exact same expense as in the past. In the U.S., that rate is $10.99 each month for specific accounts; Spotify last summer season carried out boosts in the States and a wide range of other markets.

Other higher-priced bundles– amongst them Supremiumwhich will apparently consist of additional functions and higher-quality audio– are likewise in the works. Larger image, these more pricey choices represent an essential action on Spotify’s journey to long-lasting success; music’s margins are razor thin for business, which has actually dropped billions on podcasts and audiobooks.

Time will, naturally, expose whether this success push provides the wanted outcome. Financiers are obviously favorable, and Spotify, which laid off 17 percent of its group in December, has actually divulged strategies to stay regularly in the blackToday, the entity officially called Christian Luiga, an officer with Stockholm-headquartered “leading defence and security business” Saab, primary monetary officer

Saab is a financier in and partner of Ek-backed AI defense business Helsing; Ek has actually likewise installed financing forAir Street Capitalan AI-focused VC with stakes in a number of defense start-ups.