SA Rugby, overseeing the reigning world champions, the Springboks, aims to double sponsorship revenue for the 2027 World Cup, valuing its commercial rights at $375 million. Seeking approval for a 20% stake sale to Ackerley Sports Group, SA Rugby aims to secure $42 million in 2027, doubling last year’s level. This move reflects a trend among rugby federations worldwide to raise funds from private equity, diversifying investment risk. Ackerley Sports Group, known for investing in various sports sectors, was chosen over CVC Capital Partners. The Springboks, symbolic of successful transformation, have won the World Cup a record four times.

Sign up for your early morning brew of the BizNews Insider to keep you up to speed with the content that matters. The newsletter will land in your inbox at 5:30am weekdays. Register here.

By Loni Prinsloo and Antony Sguazzin

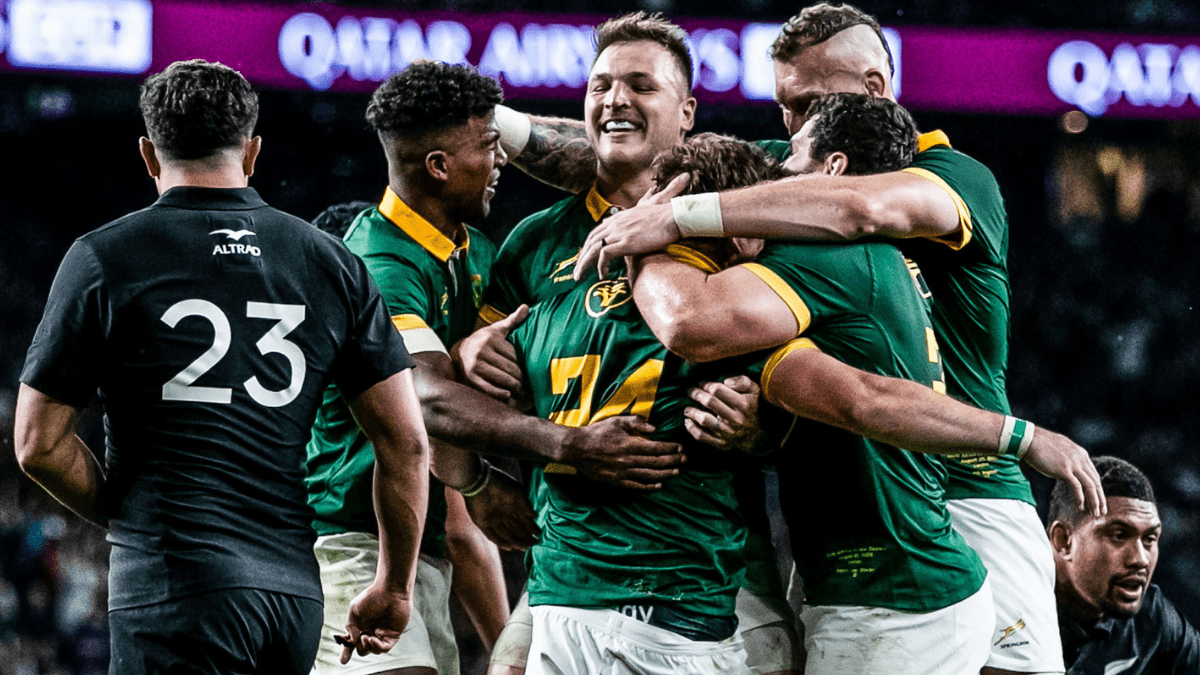

SA Rugby, which oversees the reigning world champion Springboks team, expects to double sponsorship revenue by the 2027 World Cup on the back of a planned private equity deal that values its commercial rights at $375 million.

The organization, following the Springboks’ back-to-back World Cup victories including last year’s triumph in France, is seeking approval at a May 30 general council meeting to sell a 20% stake of the rights to Seattle-based private equity firm Ackerley Sports Group, according to SA Rugby Managing Director Rian Oberholzer.

“If we only had to worry about the Springbok balance sheet,” a deal wouldn’t be necessary, Oberholzer said by email in response to a Bloomberg News query. “But we’re a national federation as well, required to support and promote rugby across the country with many mouths to feed.”

The prospective deal is part of a growing trend among national federations of the world’s most successful rugby teams to raise funds from private equity. Money managers are increasingly turning to sports leagues and federations rather than teams to diversify their investment risk.

SA Rugby targets sponsorship revenue of 800 million rand ($42 million) in 2027, about double last year’s level, according to Oberholzer.

All Blacks

In 2022, Silver Lake Management agreed to a 7.5% stake in the commercial activities of New Zealand Rugby for NZ$262.5 million ($160 million). New Zealand’s All Blacks lost in the World Cup final last year to the Springboks. Rugby Australia borrowed A$80 million ($52 million) from Pacific Equity Partners last year.

Ackerley was selected over Six Nations Rugby competitions investor CVC Capital Partners in December, according to Oberholzer. SA Rugby plans a number of information sessions on the deal for its general council members members before May 30, he said.

Under the agreement with Ackerley, South African rugby unions will retain sole responsibility for all sporting matters, such as team management, and SA Rugby will maintain a majority stake in the company it is planning to set up to hold the rights, according to Oberholzer.

Seattle-based Ackerley Sports Group, formed last year by brothers Christopher and Ted Ackerley of Ackerley Partners LLC, invests in the sports sector with a focus on leagues, teams, venues, media, technology and development.

The Ackerley family has owned stakes in several sports franchises including Seattle SuperSonics and Seattle Storm in basketball, the Seattle Seadogs in soccer and the Seattle Kraken hockey team. Last year a private holding company for the family bought a minority stake in England’s Leeds United Football Club.

The Springboks have won the World Cup a record four times, gaining global recognition as the team, once an emblem of apartheid, has been held up as an example of successful transformation.

Read also:

- Record-breaking crowds in URC round 8 as SA rugby sets the precedent

- Is this the future of SA Rugby? Baby Boks prepare for battle.

- What SA’s politicians can learn from the Springboks – Sean McLaughlin

© 2024 Bloomberg L.P.

Visited 5 times, 5 visit(s) today