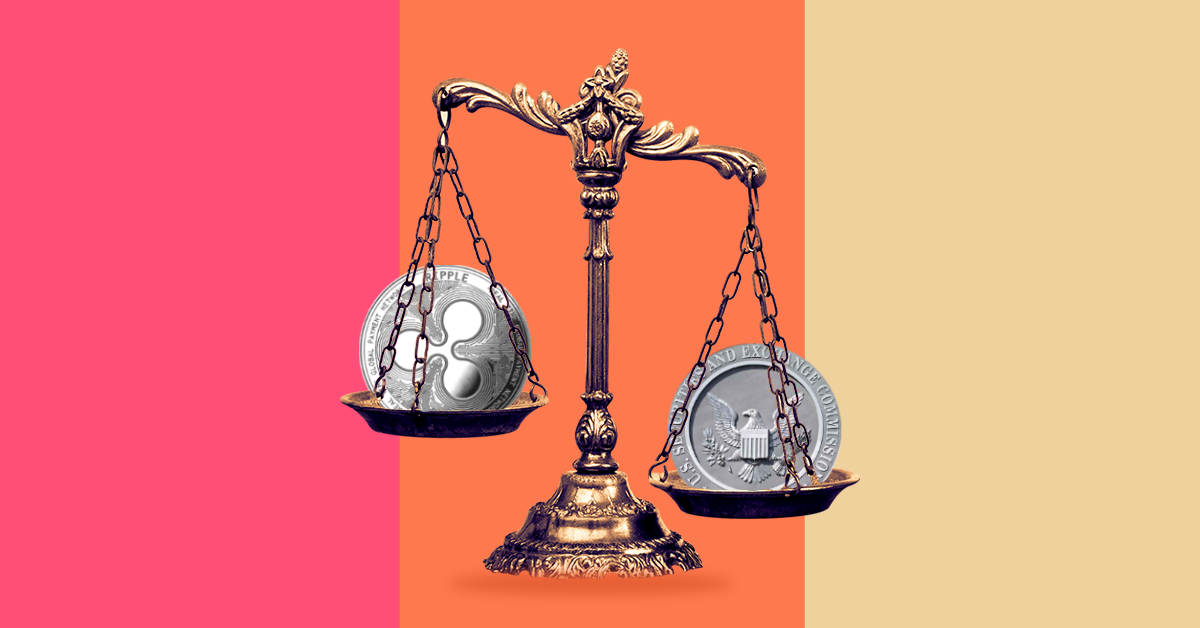

Famous crypto influencer ‘MetaLawMan’ who was just recently active on Twitter has actually clarified the SEC’s case versus Ripple, particularly focusing on the SEC’s current filing concerning damages and disgorgement. On X he published hsi assertion that the SEC has not convincingly included anything to the conversation on victims or why disgorgement should be the preferred solution.

According to MetaLawMan, the SEC basically depends on one district lawsuit, SEC v iFresh, which held that the “budgeting damage” requirement is fulfilled when an investor’s financial investment is inflated synthetically. This is the perspective of the SEC.

It asserts that those institutional purchasers who paid a lower discount rate for XRP instead of others, are those who suffered an inflated rate which is a clear sign of budgeting damage. MetaLawMan revealed doubt whether the realities of this case were properly translated, he stated it was a misconception of the Second Circuit’s declaration in SEC v. Govil.

“The SEC’s dependence on iFresh as precedent for developing budgeting damage raises issues,” MetaLawMan kept in mind, explaining that the judge who authored the iFresh choice designated it “NOT FOR ELECTRONIC OR PRINT PUBLICATION.” He even more commented, “It utilized to be incorrect to mention a choice with a ‘not for publication’ classification. It’s the weakest possible authority for anything.”

SEC’s Justification for Disgorgement

The SEC’s grievance that Ripple breached the securities laws, submitted in the court, lays out why the court must provide an injunction and a disgorgement order. The SEC states that the injunction would be affordable if the court releases it to avoid more infractions, due to the fact that Ripple’s primary organization still consists in the sale of unregistered XRP tokens. The SEC declares that Ripple’s just recently formed company structure might be connected to future infractions, given that it means to put out more unregistered crypto properties.

The court filing mentions that “Ripple has strong rewards to offer XRP even if doing so breaks the law.” It continues, “That it has actually increased ODL [On-Demand Liquidity] sales, even after the SEC sued it over those sales, shows as much.” This thinking, together with Ripple’s rejection to confess misdeed and viewed deflection of blame, underpins the SEC’s ask for injunctive relief.

The filing of the SEC likewise includes the position that Ripple’s claim of the lack of budgeting damage to the financiers is irregular. SEC states, “Pecuniary damage can happen when disclosure failures result in inflated rates.” It even more argues that even if they earned a profit by purchasing and offering XRP, however still suffered the monetary loss under the synthetically inflated cost due to the absence of appropriate disclosure.

Probability of Injunctive Relief and Disgorgement

He acknowledged that the court may follow the iFresh method and discover that the Ripple institutional financiers suffered budgeting damage, however it is still unlikely. By this, he mentioned the SEC’s disparity when it counts on a non-binding case to show its case, whereas the SEC itself validates its disgorgement without any concrete proof.

Even though MetaLawMan slams the SEC’s technique, the court filing reveals that the SEC’s objective is to prevent reoccurrence through the injunctive relief and imposition of fines and charges that penalize and prevent the future infractions. It even more stresses that SEC is identified to hold Ripple accountable for its deeds and the method it stopped working to offer correct disclosure practices throughout its company deals.

At the end of the day, the result of this case may be important for the crypto world in regards to the SEC’s controling method, with the crypto world neighborhood and legal specialists being really mindful to the SEC’s actions in this matter.

Inspect Out: Ripple vs SEC Lawsuit Nears Conclusion: Who Will Win? Specialists Weigh In