WASHINGTON (AP)– The Biden administration revealed a guideline Tuesday to top all charge card late charges, the most recent effort in the White House push to end what it has actually called scrap costs and a relocation that regulators state will conserve Americans as much as $10 billion a year.

The Consumer Financial Protection Bureau’s brand-new guidelines will set a ceiling of $8 for a lot of charge card late charges or need banks to reveal why they ought to charge more than $8 for such a cost.

The guideline would bring the typical charge card late charge below $32. The bureau approximates banks generated approximately $14 billion in charge card late costs a year.

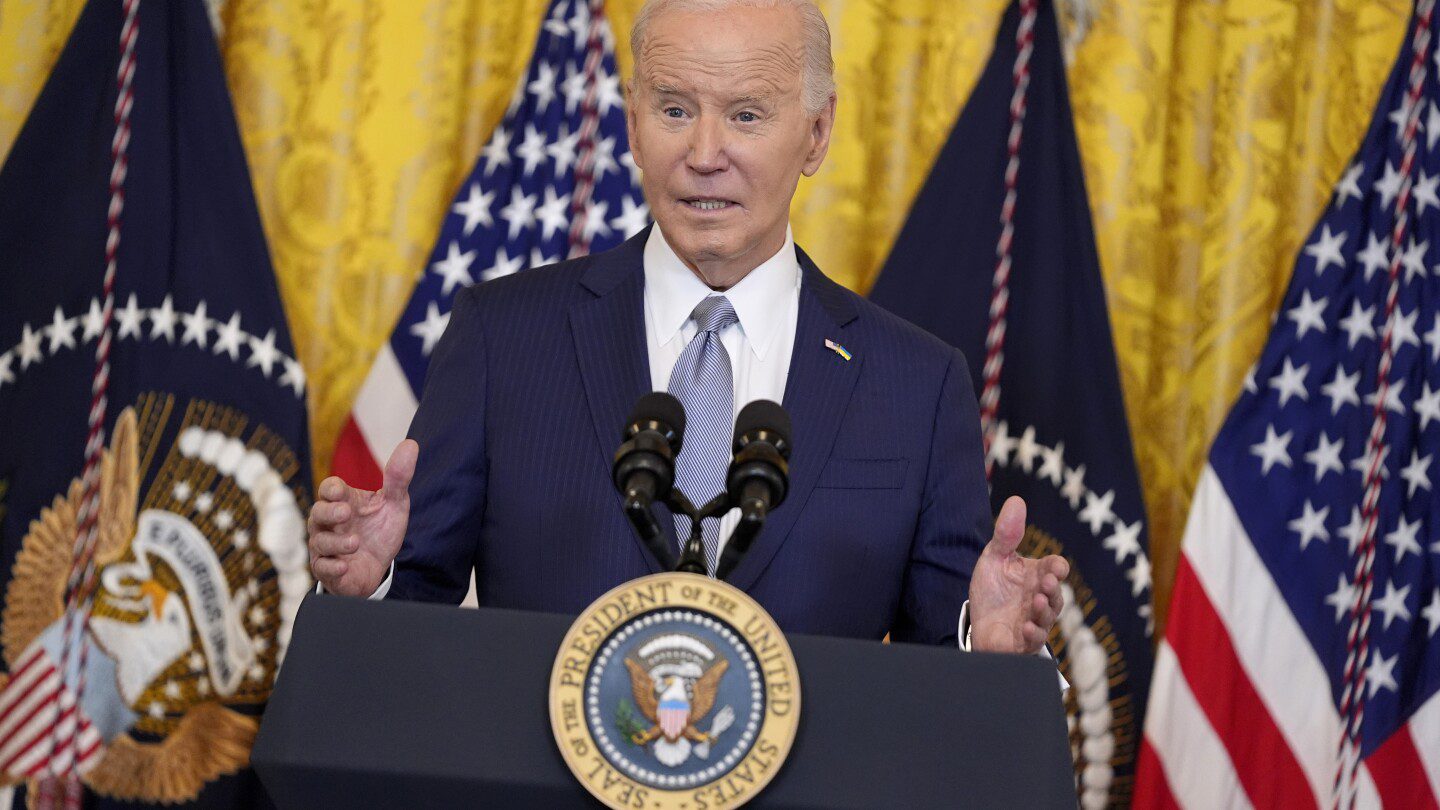

President Joe Biden highlighted the proposition together with other efforts to lower expenses to Americans at a conference of his competitors council on Tuesday. The Democratic president likewise stated he’s forming a brand-new strike force to punish unlawful and unreasonable prices on things like groceries, prescription drugs, healthcare, real estate and monetary services.

Biden stated at the start of the council conference that the existing late charges are creating 5 times more cash than what it costs charge card business to gather late payments.

“They’re padding their revenue margins and charging diligent Americans more,” Biden stated. “It’s a great deal of cash.”

The president likewise kept in mind that business are efficiently raising costs by putting less potato chips in the bags cost supermarket. Even the “Sesame Street” character Cookie Monster has actually observed so-called “shrinkflation” by stating on social networks that he’s paying more for less cookies, Biden stated.

The strike force will be led by the Justice Department and the Federal Trade Commission, according to a White House declaration.

The Biden administration has actually depicted the White House Competition Council as a method to conserve individuals cash and promote higher competitors within the U.S. economy.

The White House Council of Economic Advisers produced an analysis showing that the Biden administration’s efforts in general will get rid of $20 billion in yearly scrap charges. The analysis discovered that customers pay about $90 billion a year in scrap charges, consisting of for shows, home leasings and vehicle dealerships.

The effort appears to have actually done little to assist Biden politically ahead of this year’s governmental election. Simply 34% of U.S. grownups authorize of Biden’s financial management, according to a brand-new study by The Associated Press-NORC Center for Public Affairs Research.

Sen. Tim Scott, R-South Carolina, slammed the CFPB cap on charge card late charges, stating that customers would eventually deal with higher expenses through greater rate of interest and less access to credit.

“It will reduce the schedule of charge card items for those who require it most, raise rates for lots of customers who bring a balance however pay on time, and increase the possibility of late payments throughout the board,” Scott stated.

Rob Nichols, the CEO of the American Bankers Association, stated the CFPB “depended on problematic presumptions and a mischaracterization of the crucial function late costs play in promoting accountable customer habits.”

The U.S. Chamber of Commerce stated it will submit a claim to attempt to avoid the federal firm from topping late costs at $8.

“The Consumer Financial Protection Bureau has actually surpassed its authority,” stated Neil Bradley, the chamber’s executive vice president and primary policy officer. “The firm’s last charge card late charge guideline penalizes Americans who pay their charge card costs on time by requiring them to spend for those who do not.”

Americans held more than $1.05 trillion on their charge card in the 3rd quarter of 2023, a record, and a figure specific to grow as soon as the fourth-quarter information is launched by the Federal Deposit Insurance Corp. next month. Those balances are now bring interest on them, which is the greatest it has actually been given that the Federal Reserve began tracking the information back in the mid-1990s.

Even more, more Americans are falling back on their charge card financial obligations . Delinquency rates at the significant charge card companies such as American Express, JPMorgan Chase, Citigroup, Capital One and Discover have actually been trending up for a number of quarters. Some experts have actually ended up being worried Americans, especially poorer families injured by inflation, may be taking on too much financial obligation.

“Overall, the customer is credit healthy. The truth is that there are beginning to be some substantial indications of tension,” stated Silvio Tavares, president and CEO of VantageScore, one of the nation’s 2 significant credit scoring systems, in an interview last month.

The development of the charge card market is partially why Capital One revealed it would purchase Discover Financial last month for $35 billion. The 2 business, which are 2 of the biggest charge card companies, are likewise 2 business whose consumers frequently bring a balance on their accounts.

This is not the very first time policymakers have actually weighed in on charge card costs. Congress in 2010 passed the CARD Act, which prohibited charge card business from charging extreme charge costs and developed clearer disclosures and customer defenses.

The Federal Reserve released a guideline in 2010 that topped the very first charge card late charge at $25, and $35 for subsequent late payments, and connected that cost to inflation. The CFPB, which took control of the guideline of the charge card market from the Fed after it was developed, is proposing going even more than the Fed.

The bureau’s proposition is comparable in structure to what the bureau revealed in January when it proposed topping overdraft charges to just $3. Because suggested policy, banks would be needed to either accept the bureau’s criteria or program regulators why they must charge more, an approach that couple of bank market executives anticipate to utilize.

Biden has actually made the removal of scrap charges among the foundations of his administration’s financial program heading into the 2024 election. Charges that banks charge clients have actually been at the center of that project, and the White House directed federal government regulators in 2015 to do whatever remains in their power to even more cut the practice.

In another relocation being highlighted by the White House, the Agriculture Department stated it has actually settled a guideline to stop what it considers to be misleading agreements by meat processors and to prohibit retaliation versus little farmers and ranchers that collaborate in associations.

___

Sugary food reported from New York.