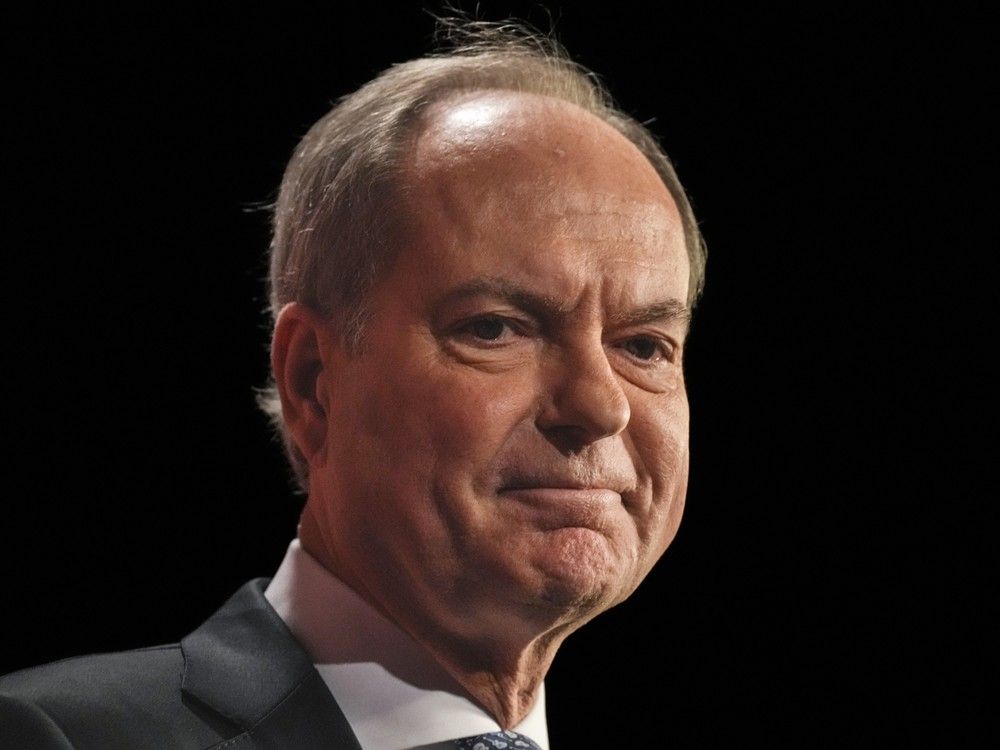

Financing Minister Peter Bethlenfalvy acknowledged the difficult financial times Tuesday, stating life had actually hardly ever been this costly, though his budget plan included couple of brand-new cost procedures.

Released Mar 26, 2024 – 4 minute read

TORONTO– Ontario is postponing its course to stabilize as sluggish financial development drags the province’s books even more into the red, with a $9.8-billion deficit spending forecasted for the coming.

Financing Minister Peter Bethlenfalvy acknowledged the tough financial times Tuesday, stating life had actually hardly ever been this pricey, though his spending plan included couple of brand-new price steps.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to check out the most recent news in your city and throughout Canada.

- Special posts from Elizabeth Payne, David Pugliese, Andrew Duffy, Bruce Deachman and others. Plus, food evaluations and occasion listings in the weekly newsletter, Ottawa, Out of Office.

- Unrestricted online access to Ottawa Citizen and 15 news websites with one account.

- Ottawa Citizen ePaper, an electronic reproduction of the print edition to see on any gadget, share and talk about.

- Daily puzzles, consisting of the New York Times Crossword.

- Assistance regional journalism.

SIGN UP FOR UNLOCK MORE ARTICLES

Subscribe now to check out the current news in your city and throughout Canada.

- Special short articles from Elizabeth Payne, David Pugliese, Andrew Duffy, Bruce Deachman and others. Plus, food evaluations and occasion listings in the weekly newsletter, Ottawa, Out of Office.

- Unrestricted online access to Ottawa Citizen and 15 news websites with one account.

- Ottawa Citizen ePaper, an electronic reproduction of the print edition to see on any gadget, share and discuss.

- Daily puzzles, consisting of the New York Times Crossword.

- Assistance regional journalism.

REGISTER/ SIGN IN TO UNLOCK MORE ARTICLES

Develop an account or check in to continue with your reading experience.

- Gain access to posts from throughout Canada with one account.

- Share your ideas and sign up with the discussion in the remarks.

- Delight in extra short articles monthly.

- Get e-mail updates from your preferred authors.

Check in or Create an Account

or

Post material

Short article material

“The pressure of handling a federal government spending plan fades in contrast to the pressures numerous households are dealing with as they handle their household budget plan in a time when whatever is costing more,” Bethlenfalvy informed the legislature.

“These are the genuine difficulties and genuine issues of reality and genuine individuals, of making lease, of footing the bill, of paying for groceries. And the finest method to assist individuals is by getting the huge choices. Making wise financial investments. Viewing the expenditure line. And many of all, keeping expenses on individuals low.”

The deficit for 2024-25 is practically double what the province predicted in the fall financial upgrade. That file had actually likewise considered a go back to surplus the list below year, which was currently postponed a year from the 2023 spending plan. Bethlenfalvy now forecasts that a little surplus will not occur till 2026-27. In 2025-26, the deficit is anticipated to be $4.6 billion.

The $214.5-billion spending plan projections genuine GDP development of simply 0.3 percent in 2024, and Bethlenfalvy stated he had actually decided to increase the deficit instead of cutting costs or raising taxes or costs on Ontarians.

Post material

“We are going to follow through on a strategy that is working– understanding that the greater deficits, compared to what we forecasted in 2015, will be time-limited, while the roi will be felt for years,” he stated.

Brand-new cash in the spending plan consists of an extra $2 billion over 3 years for home and neighborhood care– which sees care offered in the house or in a neighborhood setting by nurses, individual assistance employees and others– an extra $965 million for medical facilities, a $200-million neighborhood sport and leisure facilities fund and $120 million more for autism treatments.

The Progressive Conservative federal government is likewise putting $100 million more into its Skills Development Fund as it wants to flood the labour market with increasing varieties of competent trades experts.

The province is preparing vehicle insurance coverage reforms, putting cash towards 4 authorities helicopters for Greater Toronto Area forces, supporting a brand-new York University medical school focused on training household medical professionals, and increasing the eligibility limit for a program that assists households with the expense of electrical power.

Post material

NDP Leader Marit Stiles stated there were lots of spaces in the budget plan, which she stated didn’t put enough towards cost effective real estate or increasing main healthcare.

“I see absolutely nothing here that’s going to support Ontarians in their everyday lives,” she stated.

In addition to the slow economy, the budget plan file likewise mentioned greater public-sector incomes, increased facilities costs and gas tax relief as factors for the deficit figures.

Bethlenfalvy and Premier Doug Ford revealed previously today that a 5.7-cent per litre cut to the gas tax, initially presented in 2022 and initially set to end in June, would now continue to completion of the year. The budget plan reveals that relocation is costing the treasury $620 million.

The federal government is investing billions more on more comprehensive public-sector payment, especially in health and education, after a court stated its wage restraint law unconstitutional in February. The province has actually mainly counted on big, multi-billion-dollar contingency funds to spend for retroactive payments it has actually needed to make, however moving forward the contingency fund is set at a more basic level of $1.5 billion.

Post material

Ontario’s financial resources on the profits side have actually likewise degraded because the last budget plan, Tuesday’s file reports, stating they have actually reduced by $7.3 billion for the upcoming , due to both slower development and lower tax evaluation details from the federal government.

A current federal statement of a two-year cap on worldwide trainee research study allows will adversely impact Ontario’s books considering that colleges’ financial resources are combined into the province’s monetary declarations.

Colleges have actually significantly depended on the much greater tuition charges paid by global trainees to strengthen their financial resources in the face of low operating financing from the province and a multi-year domestic tuition freeze.

The budget plan reveals the province’s net financial obligation increasing above $439 billion in the approaching year.

Liberal financing critic Stephanie Bowman kept in mind that the Progressive Conservatives had actually included $100 billion in net financial obligation because concerning power in 2018, and slammed the federal government for handling to both stack on financial obligation while likewise underspending on services such as healthcare.

“There are great deals of things this federal government is picking not to do to repair the crisis in front of them since they like tasks,” she stated.

“They like constructing things that are including billions of dollars of financial obligation and yet we have crises after crises in every file in this province. I would really challenge individuals to call a file that is not on fire here.”

For this , the province is anticipated to end 2023-24 with a $3-billion deficit, an enhancement from the $4.5 billion expectation Bethlenfalvy had simply a month back, when he provided the third-quarter financial resources.

Post material