Oil steadied after the biggest gain in a week, with OPEC+ set to affirm its policy of production cuts amid tensions in the Middle East and Russia.

Author of the article:

Bloomberg News

Yongchang Chin

Published Mar 25, 2024 • Last updated 1 hour ago • 1 minute read

(Bloomberg) — Oil steadied after the biggest gain in a week, with OPEC+ set to affirm its policy of production cuts amid tensions in the Middle East and Russia.

Global benchmark Brent traded near $87 a barrel after rising 1.6% on Monday, while West Texas Intermediate was above $82. OPEC+ delegates aren’t seeing a need to change supply policy at a review meeting next week, according to several national officials, with quotas in place until June proving effective. The Houthis renewed threats against Saudi Arabia if it supported US strikes.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

Sign In or Create an Account

or

Article content

Article content

Crude has risen almost 13% so far this quarter after breaking out of a tight range that it was in for the first couple of months. Attacks by Ukraine on Russian refineries have aided gains, together with signs of strength in some product markets including gasoline. The positive overall market outlook has spurred hedge funds to increase their bullish bets on Brent.

Signs of a shift in monetary policy have also aided sentiment. The Federal Reserve has signaled a willingness to cut interest rates later this year, buoying appetite for risk assets including oil. Crude futures have been tracking equity benchmarks in recent sessions.

“The risks of supply disruptions persist,” said Yeap Jun Rong, a market strategist at IG Asia Pte in Singapore, citing the Russia-Ukraine war as more refiners are hit. Weakness in the US dollar so far this week has also been supportive, he said.

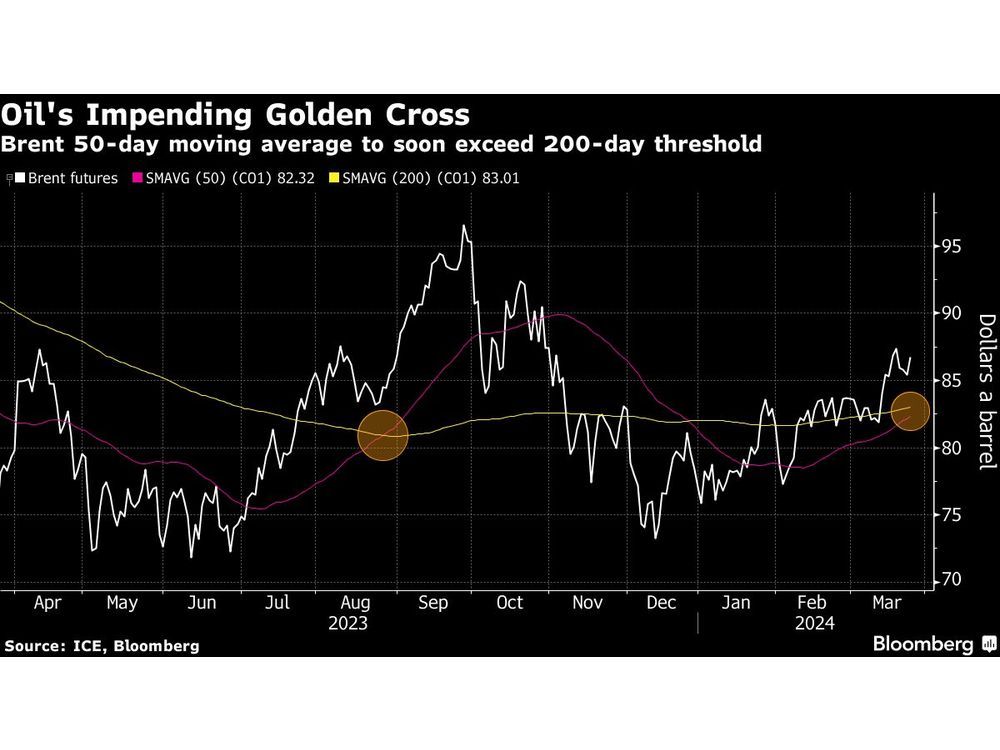

The technical backdrop is positive, too, with Brent’s moving averages close to forming a golden cross, a bullish pattern. That’s when an asset’s 50-day moving average exceeds the corresponding 200-day figure. Its last formation for the generic contract in August preceded Brent surging by more than $10 a barrel to above $95.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

Article content