Oil fell, paring a modest month-to-month gain, after United States unrefined stocks broadened and as traders prepared to parse United States information that’ll assist frame expectations for financial policy.

(Bloomberg)– Oil fell, paring a modest regular monthly gain, after United States unrefined stocks broadened and as traders prepared to parse United States information that’ll assist frame expectations for financial policy.

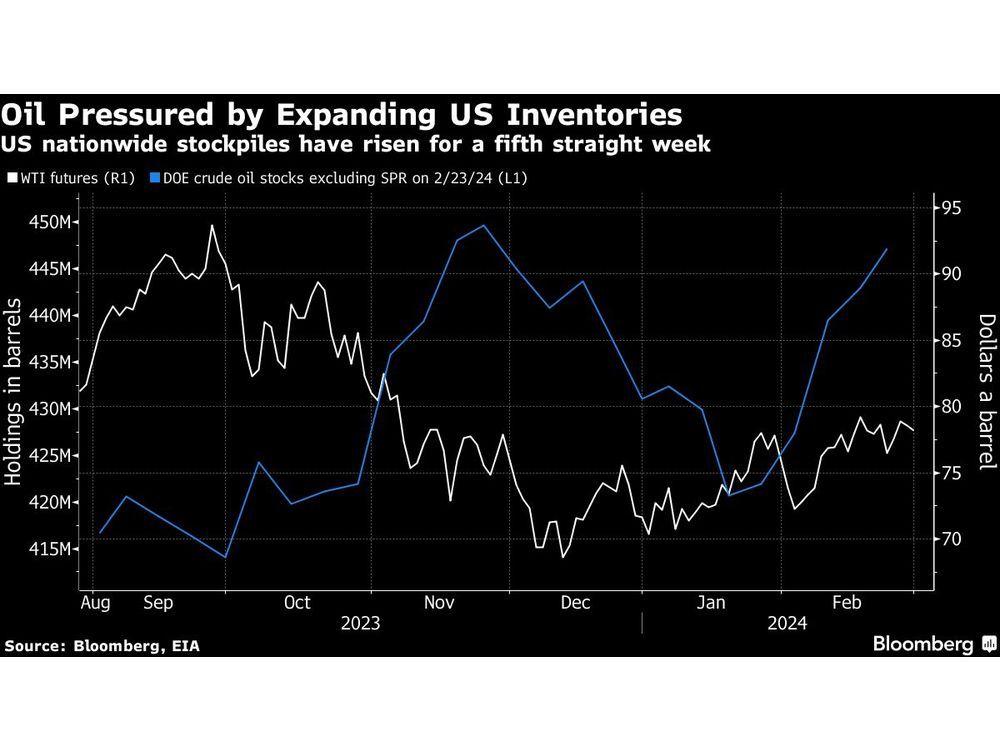

West Texas Intermediate dropped towards $78 a barrel following a 0.4% decrease in the previous session, when Brent closed below $84. Nationwide United States stockpiles grew for a 5th straight week, although the 4.2 million barrel develop was smaller sized than a market report had actually forecasted. Cushing stocks likewise got.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to check out the most recent news in your city and throughout Canada.

- Special short articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily material from Financial Times, the world’s leading worldwide organization publication.

- Limitless online access to check out short articles from Financial Post, National Post and 15 news websites throughout Canada with one account.

- National Post ePaper, an electronic reproduction of the print edition to see on any gadget, share and talk about.

- Daily puzzles, consisting of the New York Times Crossword.

SIGN UP FOR UNLOCK MORE ARTICLES

Subscribe now to check out the current news in your city and throughout Canada.

- Unique short articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily material from Financial Times, the world’s leading international company publication.

- Limitless online access to check out short articles from Financial Post, National Post and 15 news websites throughout Canada with one account.

- National Post ePaper, an electronic reproduction of the print edition to see on any gadget, share and discuss.

- Daily puzzles, consisting of the New York Times Crossword.

REGISTER/ SIGN IN TO UNLOCK MORE ARTICLES

Produce an account or check in to continue with your reading experience.

- Gain access to short articles from throughout Canada with one account.

- Share your ideas and sign up with the discussion in the remarks.

- Delight in extra posts each month.

- Get e-mail updates from your preferred authors.

Check in or Create an Account

or

Post material

Short article material

The Federal Reserve’s preferred inflation gauge is due later on Thursday, and follows a string of reserve bank authorities stating in current weeks that they’re in no rush to begin cutting rates of interest. Their choice will affect the dollar, the worth of products, and larger conditions for energy need.

Crude is set for a 2nd regular monthly gain, although costs stay within a tight trading band. The advance has actually been supported by supply cuts from OPEC and its allies, and the group is extensively anticipated to consent to extend decreases into the 2nd quarter. Still, issues about the need outlook stay, with China’s intake development most likely to slow due to a softer economy.

At present, favorable signals continue, with timespreads in a bullish, backwardated pattern. The marketplace “does feel reasonably tight,” according to Trafigura Group’s primary financial expert, Saad Rahim, who mentioned aspects consisting of indications of life in international production and petrochemicals. “You’re hearing the expression ‘upside run the risk of’ a lot more than you have in the previous number of years.”

To get Bloomberg’s Energy Daily newsletter into your inbox, click on this link.

Short article material