Upgraded – April 01, 2024 at 04:25 PM.

IT Dept informs SC, it does not wish to trigger issues to celebrations before surveys; Court schedules Congress appeals for July 24, post-elections

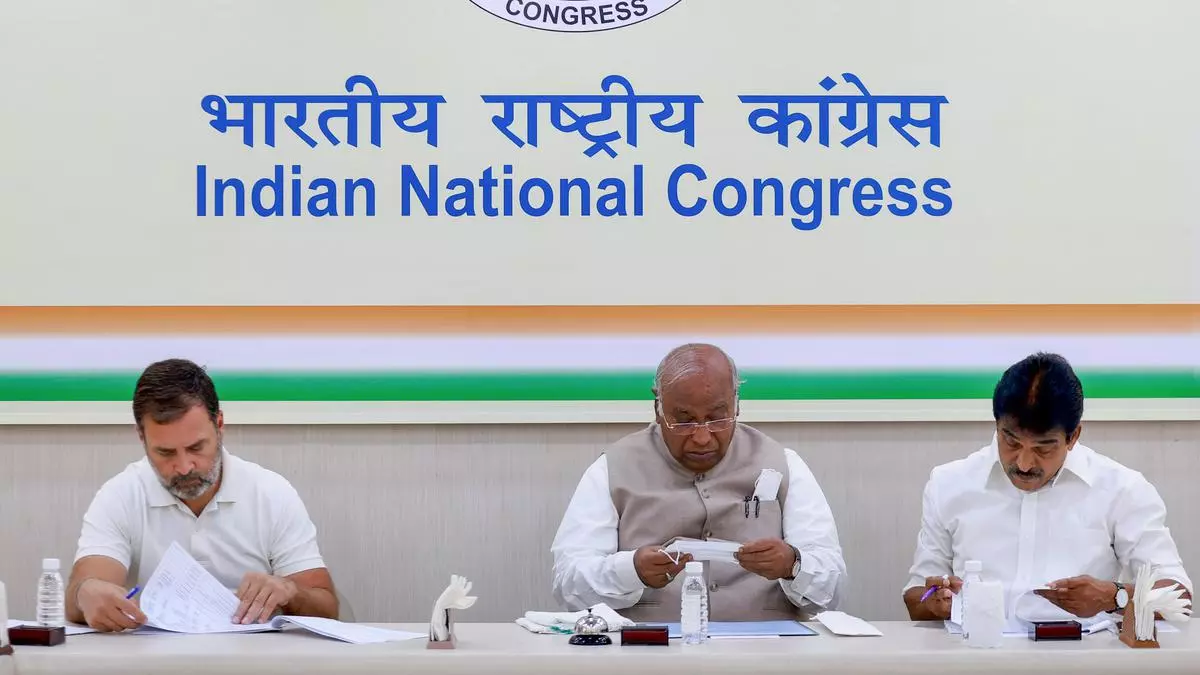

In the middle of claims of “tax terrorism”, the Income Tax department in the Supreme Court on Monday specified its willpower to not take any “coercive actions” versus the Indian National Congress on tax needs to the tune of around 3500 crore raised in March in view of the General Elections

At the really beginning of the hearing before a Bench headed by Justice BV Nagarathna, Solicitor General Tushar Mehta mentioned that “considering that the election is going on, we do not desire any issue to develop for any political celebration. We will not take any coercive actions till the case is heard once again on July 24, 2024”.

“He (Mehta) has actually rendered me speechless,” senior supporter AM Singhvi responded to the turn of occasions.

Difficulty had actually been installing for the Congress with fresh notifications from the Income Tax department raising a tax need of 1,745 crore for the evaluation years 2014-15 to 2016-17. With the most recent notification, the Income Tax department had actually raised an overall need of 3,567 crore from the Congress.

Fresh tax notifications for 2014-15 (663 crore), 2015-16 (about 664 crore), and 2016-17 (around 417 crore) were released. This followed the termination of tax exemptions for political celebrations, implemented based upon a March 2016 Delhi High Court judgment.

The Congress has actually challenged the High Court order that gross invoice was taxable. “Gross invoice is never ever taxable. Just overall earnings is taxable. We are a political celebration, not a profit-making organisation,” Mr. Singhvi argued.

Mehta stated the overall of over 3500 crore was a “block evaluation” of the previous 7 years. This omitted the 135 crore recuperated from the celebration through accessory. He stated the department has actually voluntarily made the “concession” to prevent coercive procedures in view of the dominating scenarios of the elections.

He highlighted that the Congress was approved freedom, although the tax needs surpassing 3500 crore in March 2024 are not straight associated to pending appeals in the Supreme Court.

The pinnacle court arranged the case for a hearing on its benefits. In its order, it kept in mind that while the problems in the appeals are yet to be chosen, the Solicitor General mentioned that the Income Tax department does not mean to intensify the circumstance, and no coercive steps will be taken relating to the need of roughly 3500 crore.

The court even more taped the declaration of the department that the Congress need not have any “apprehensions relating to any coercive actions”.

The Congress had actually raised the concern that the variety of tax notifications provided on the eve of the Lok Sabha surveys would tilt the equal opportunity in favour of the judgment BJP.