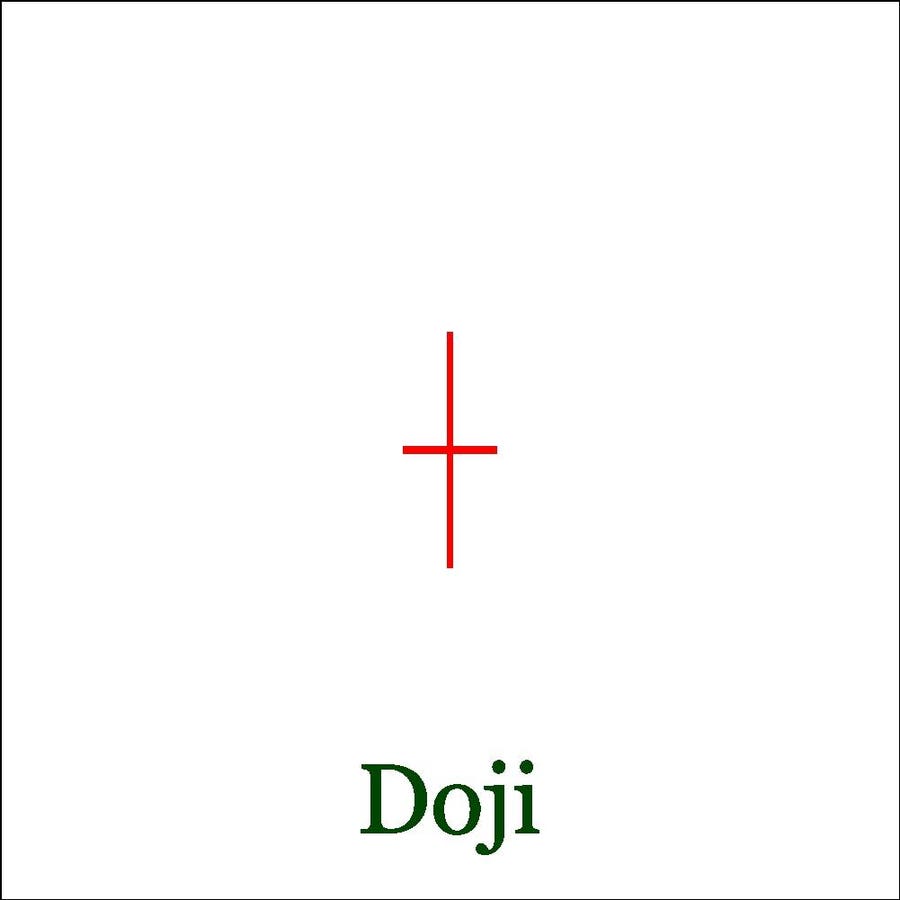

Doji – design candlestick analysis

At the end of monthly, I run a scan on stock and ETFs to try to find the development of brand-new doji purchase or offer signals. Dojis are formed when the opening and closing costs are close together. After a doji is formed a close above the doji high or listed below the doji low will create a buy or offer signalThe regular monthly signals are usually more powerful and more reputable than the signals on the weekly or day-to-day information. The signal remains in result as long as the doji low (buy signal) or doji high (sell signal) are not surpassed.

Apple Monthly

In my scan after the close on Friday, May 31st2024 Apple Inc. (AAPL) turned up as it produced a month-to-month doji purchase signal. In April, AAPL opened at $170.96, and closed at $170.10 with a high of $178.12 and a low of $163.85. It closed May at $192.32 well above the doji high. The close was 14.8% above the doji low and likewise above the annual pivot at $171.43.

The regular monthly starc+ band is at $215.64 with the annual R1 at $219.69. On a strong regular monthly close above the resistance at $199.62, line a, the width of the trading variety has upside targets in the $275 location. The volume increased in May and the Vol Confirm has actually moved above the preliminary MA however is still listed below the longer-term signal line. The regular monthly DTS and Vol Confirm (produced in addition to the chart by Jerry A) turned favorable in May. The JA_Aspray Insight is increasing as AAPL is beginning to lead the S&P 500 greater however has actually not yet signified that AAPL is a market leader.

Apple Weekly

APPL was up 1.25% for the week however closed listed below the week’s high at $192.99 which is now near-term resistance. The weekly drop, line a, was broken 3 weeks earlier and is now at $187.19. The brand-new regular monthly pivot for June is at $184.39 with the increasing 20-week EMA at $181.32. These assistance levels need to hold when AAPl remedies.

The weekly relative efficiency (RS) procedures the efficiency of AAPL to the S&P 500. The RS has actually moved above its WMA which is an indication that AAPL is now leading the S&P 500 greater.

The on-balance-volume (OBV) has actually held the assistance at line b and moved above its WMA. This is an indication that volume has actually been increasing as AAPL has actually moved higher.

The day-to-day technical research studies are likewise favorable with the increasing 20-day EMA at $186.70 where brand-new purchasing might be thought about. New regular monthly doji purchase signals can typically take 2-3 months to turn lucrative.