Navigation for News Categories

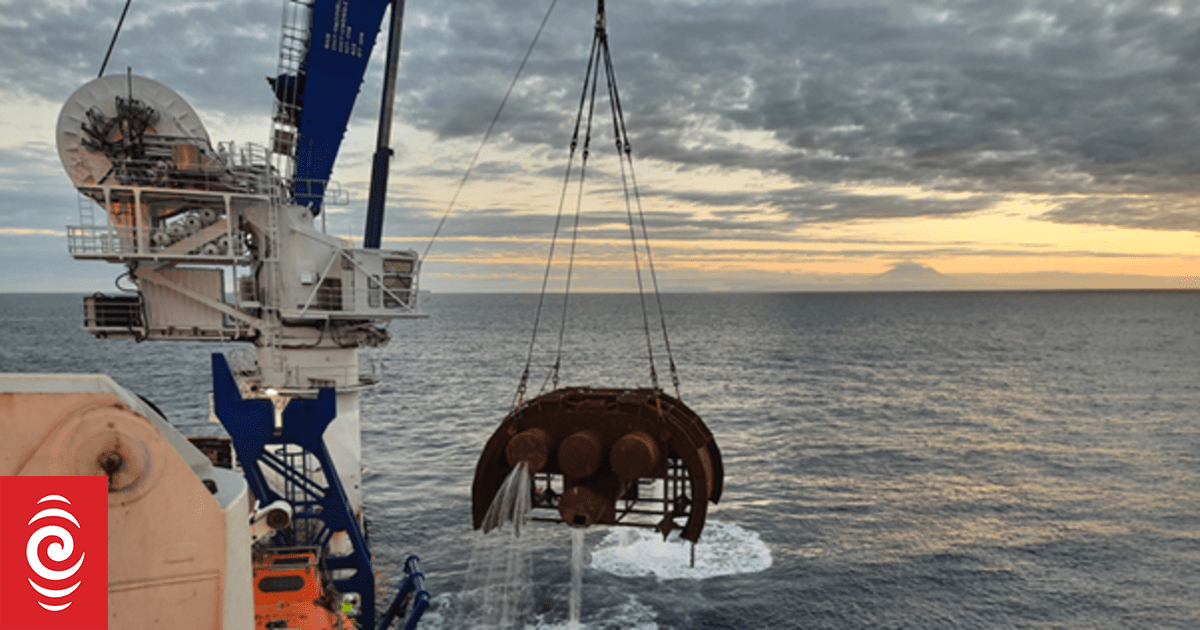

Among the mid-water arches being carried onto the Sapura Constructor.

Picture: MBIE/ Supplied

* The very first line of this story has actually been fixed to state $443m of taxpayer’s cash has actually been reserved for the oil field’s decomissioning and the seventh line gets rid of a declaration that Lloyd Williams exposed info for the very first time today.

An overall of $443 countless taxpayers’ cash has actually been reserved for the decommissioning the unfortunate Tui Oil Field – far greater than earlier price quotes.

The Tui field was deserted in 2019 after the monetary collapse of Tamarind Taranaki, leaving the Crown with the expense for its safe decommissioning

The Ministry of Business Innovation and Employment established the Tui Project to supervise the procedure in 2020.

Tui Project director Lloyd Williams stated at first, Cabinet consented to proper $154.6 m to decommission the Tui Oil Field.

“These approximated expenses were based upon a 2015 research study commissioned by the then owners of oil field. Cabinet kept in mind at the time that the real expenses might vary depending upon a series of elements, which were outside the Crown’s control.

“There was an immediate requirement at the time to proper funds to abide by commitments under the general public Finance Act 1989 and form a Tui Project group to start preparing and getting ready for the decommissioning.”

Extra financing authorized by Cabinet in May 2021 brings the job’s budget plan to $443.4 m, consisting of contingency financing for unforeseen expenses.

“However, we anticipate the overall expenses to be significantly lower than this figure. The last expenses will be validated over the next couple of months as part of the task’s close-out.”

Environment Justice Taranaki scientist Catherine Cheung was “stunned however not suprised” at the expense taxpayers were dealing with for decommissioning the Tui field.

“The federal government has actually constantly been soft-pedaling the genuine expenses of the extractive markets ecologically. They make a mess and after that they leave.”

Environment Justice Taranaki was among a variety of groups which campaigned for modifications to the Crown Minerals Act to make it more specific that business was accountable for decommissioning expenses.

An ammendment to the act in 2021 presented penalities if business did not fulfill decommissioning requirements.

Business who offered a license or licence were now likewise accountable for its decommissioning in eternity, implying if the present owner stopped working to fulfill its commitments, they would be next in line.

Harder tests for authorization acquisitions were likewise presented.

Cheung feared the brand-new federal government might withdraw those arrangements.

“But it appears like this fast-track costs might be reversing that eliminating the defense once again due to the fact that the Crown Minerals Act is at danger of being thinned down once again.

“We’ve simply heard the prime minister is a lot backing the extractive sector and financial development through this fast-tracking expense that is coming through this afternoon, it’s insane truly.”

Cheung stated what her group desired was no brand-new oil or gas or coal or seabed mining allows to be given.

“It’s careless, we can’t keep doing it for financial development. Generating income off nature, off the environment is financially self-destructive.”

Williams stated the boost in overall anticipated expenses was due to a variety of aspects such as:

- Hold-ups in between production ceasing and demobilisation, creating extra expenses to keep the drifting production storage and unloading vessel (FPSO) in the field and associated operating and upkeep expenses throughout the agreement;

- Escalation in the day-to-day market rates for vessels;

- Addition of extra activities to fulfill excellent ecological and functional security requirements (e.g. flushing of flow-lines and healing of anchors);

- Prospective modifications in technical scope and vessels needed;

- Hold-ups or modifications due to regulative or market aspects, such as rig/vessel accessibility;

- Accounting for unfavorable climate condition.

Williams stated the unexpected departure of Tamarind Taranaki and transfer of decommissioning obligation to Ministry of Business, Innovation and Employment (MBIE) needed an immediate reaction to in order to make sure the continuous security and regulative compliance of the Tui Field operation.

And the job had actually not lacked its obstacles, he stated.

- A fast-track contract needed to be reached with the BW Umuroa, the owner of the FPSO, to eliminate it from the field throughout Phase One of the decommissioning task;

- Stage Two – elimination of subsea facilities – and Phase Three – plugging of the wells – needed marine approvals from the Environmental Protection Authority triggering hold-ups with Phase Two start as quickly as approvals were readily available in March 2023 followed by Phase Three the list below year;

- Stage Three, the plugging of wells, was the technically the majority of requiring job and took about 2 months longer than anticipated.

“Despite this, the last stage of the task, which included recurring jobs from the previous stages, has actually now been finished suggesting the overseas decommissioning activities have actually been finished within the initial schedule,” Williams stated.

Recently, MBIE revealed the last of the subsea facilities had actually been gotten rid of from the ocean.

In February the Sapura Energy Australia, utilizing its building assistance vessel Sapura Constructor, cut and recuperated the staying 2 wellheads.

Previously, Sapura had actually gotten rid of 4 mid-water arch systems. Each of these systems made up a 60-tonne arch the size of 2 double decker buses, suspended on chains above a 100-tonne base.

“The Tui Project was established 4 years back and there’s been an amazing effort behind the scenes, on and off the water, to decommission and get rid of about 7000 tonnes of facilities,” Williams stated.

“There’s a high degree of technical problem with bringing these enormous structures onboard. Sapura’s entire project was anticipated to take substantially longer, so it’s excellent to see it completed so effectively and well ahead of schedule.”