… as dollar supply enhances

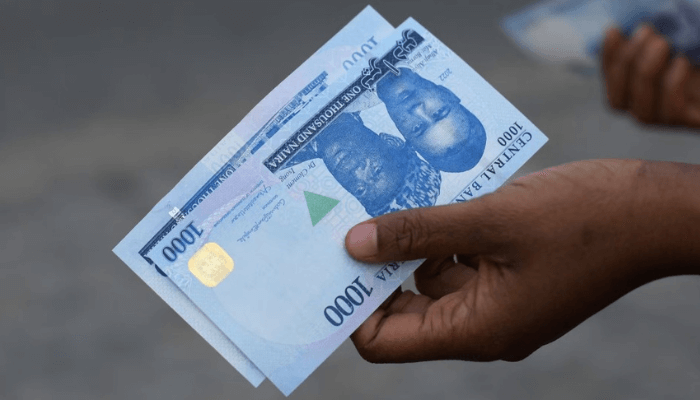

The naira, Nigeria’s currency, on Wednesday, enhanced to N1250 to a dollar, getting 0.8 percent (N10) over N1,260 closed on Tuesday at the parallel market, widely called the black market.

Compared to the level on February 20, 2024, naira has actually acquired 46 percent of its worth versus the dollar from the most affordable of N1,825/$ on the parallel market.

At the Nigerian Autonomous Foreign Exchange Market (NAFEM), naira acquired 2.41 percent as the dollar was priced estimate at N1,278.58 on Tuesday, more powerful than N1,309.39 closed on Thursday, the last trading day of March 2024, information from the FMDQ Securities Exchange suggested.

The gratitude of the regional currency was credited to the a number of forex (FX) policies carried out by the Central Bank of Nigeria (CBN), to increase dollar supply and improve openness in the FX market.

On June 14, 2023, the CBN eliminated market division and collapsed all into the Investors & & Exporters window (Now, Nigerian Autonomous Foreign Exchange); and reintroduced the Willing Buyer, Willing Seller structure, to name a few reforms.

CBN in August 2023, resumed Forex sales to BDCs however restricted the purchasing and offering spread out by BDCs to +/ -2.5 percent of the weighted average of deals carried out the previous day on the I&E window.

In January 2024, the peak bank set the Net Open Position (NOP) of banks in Nigeria at a limitation of 20 percent brief or Zero percent long holding of foreign currency properties and liabilities.

In January 2024, the CBN directed the International Money Transfer Operators (IMTOs) to price quote an exchange rate for naira payment to recipients based on the dominating market cost.

The banking and financing sector regulator, in February 2024, ceased any type of cap on the spread on interbank Forex deals and constraints on the sales of interbank earnings. In the exact same month, the CBN restricted the payment of Personal Travel Allowance (PTA) and Business Travel Allowance (BTA) to electronic channels just.

According to FSDH Research, the application of these steps has actually reduced the volatility of the Naira in the FX markets.

In March 2024, the volatility of the naira was minimized following numerous reforms by the CBN to enhance openness and inflows into the FX market. On March 28, the NAFEM closing rate was N1309.4, a substantial gratitude from a peak of N1,650 on February 26, 2024.

“We think that the current FX reforms paired with high-interest rates and enhanced oil production will bring stability to the FX market,” experts at FSDH stated.