Federal Reserve Chair Jerome Powell is anticipated to double down on his message that there’s no rush to cut rates of interest, particularly after fresh inflation information revealed that rate pressures continue.

(Bloomberg)– Federal Reserve Chair Jerome Powell is anticipated to double down on his message that there’s no rush to cut rate of interest, specifically after fresh inflation information revealed that cost pressures continue.

Powell is headed to Capitol Hill, where he’ll provide his semiannual financial policy statement to a House committee on Wednesday and a Senate panel on Thursday. The United States reserve bank chief and almost all of his associates have actually stated in current weeks that they can manage to be client in choosing when to cut rates provided underlying strength in the United States economy.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to check out the most recent news in your city and throughout Canada.

- Unique posts from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily material from Financial Times, the world’s leading worldwide company publication.

- Endless online access to check out posts from Financial Post, National Post and 15 news websites throughout Canada with one account.

- National Post ePaper, an electronic reproduction of the print edition to see on any gadget, share and discuss.

- Daily puzzles, consisting of the New York Times Crossword.

SIGN UP FOR UNLOCK MORE ARTICLES

Subscribe now to check out the current news in your city and throughout Canada.

- Unique short articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily material from Financial Times, the world’s leading international service publication.

- Unrestricted online access to check out short articles from Financial Post, National Post and 15 news websites throughout Canada with one account.

- National Post ePaper, an electronic reproduction of the print edition to see on any gadget, share and discuss.

- Daily puzzles, consisting of the New York Times Crossword.

REGISTER/ SIGN IN TO UNLOCK MORE ARTICLES

Develop an account or check in to continue with your reading experience.

- Gain access to posts from throughout Canada with one account.

- Share your ideas and sign up with the discussion in the remarks.

- Take pleasure in extra posts each month.

- Get e-mail updates from your preferred authors.

Check in or Create an Account

or

Short article material

Post material

The “risk of moving prematurely is that the task’s not rather done, which the actually excellent readings we’ve had for the last 6 months in some way end up not to be a real indication of where inflation’s heading,” Powell stated in an interview with CBS’s 60 Minutes on Feb. 5.

That mindful method has actually been verified in current weeks by information revealing inflation got last month. It’s not most likely to please Democrats, who are nervous about how the course of rates might impact the November governmental election and down-ballot races. They’re anticipated to push the Fed chief on why authorities are keeping loaning expenses so high, running the risk of damage to the economy, when they’ve made a lot development on inflation.

- For more, check out Bloomberg Economics’ complete Week Ahead for the United States

The information emphasize for the week will be the regular monthly tasks report on Friday. Economic experts task payrolls development moderated in February to 200,000 following a 353,000 rise a month previously that was the biggest in a year. The unemployed rate is seen holding at 3.7%, while per hour profits development most likely cooled.

On Wednesday, the Fed will release its Beige Book study of local company contacts from throughout the nation. Other information in the coming week consist of different February studies of buying supervisors at company, along with figures on the January trade balance and task openings.

By registering you grant get the above newsletter from Postmedia Network Inc.

Post material

Short article material

What Bloomberg Economics Says …

Powell is anticipated to preserve a hawkish position in his semiannual statement to Congress, indicating to markets that the Fed remains in no rush to cut rates. If that causes tighter monetary conditions, it will keep the pressure on the economy and raise the possibility of extra lagged effects from financial policy.”

— Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou. For complete analysis, click on this link

Somewhere else, other political set-piece occasions from China’s National People’s Congress to the UK spending plan will draw attention, as will rank choices in the euro zone and Canada that are anticipated to reveal no modification.

Click on this link for what took place recently, and listed below is our wrap of what’s turning up in the worldwide economy.

Asia

The National People’s Congress in China will be at the focal point in Asia as financiers, financial experts and policymakers expect indications that Beijing is prepared to take more substantial stimulus steps.

China’s development target for the year might likewise provide ideas on how strongly the nation’s management will pursue a healing. The most recent rate information and cumulative trade figures for January and February will show how extreme China’s slide into deflation is ending up being, along with the absence of significant assistance for the economy through exports.

Post material

February inflation figures for Tokyo are most likely to reveal a strong uptick as the effect of aids a year ago fades, a result that might sustain bets on a March rate trek from the Bank of Japan at a time when the labor market has actually tightened up.

Board member Junko Nakagawa will supply the most recent signaling from the reserve bank on Thursday.

Economic experts in Australia will tweak their development projections on Tuesday after bank account information comes out. Gdp is due the following day, with warm development anticipated to continue.

Development figures for South Korea are most likely to remain mostly the same after a modification, however customer costs are anticipated to warm up once again in information due on Wednesday.

Malaysia is anticipated to keep rates the same at 3% on Thursday.

- For more, check out Bloomberg Economics’ complete Week Ahead for Asia

Europe, Middle East, Africa

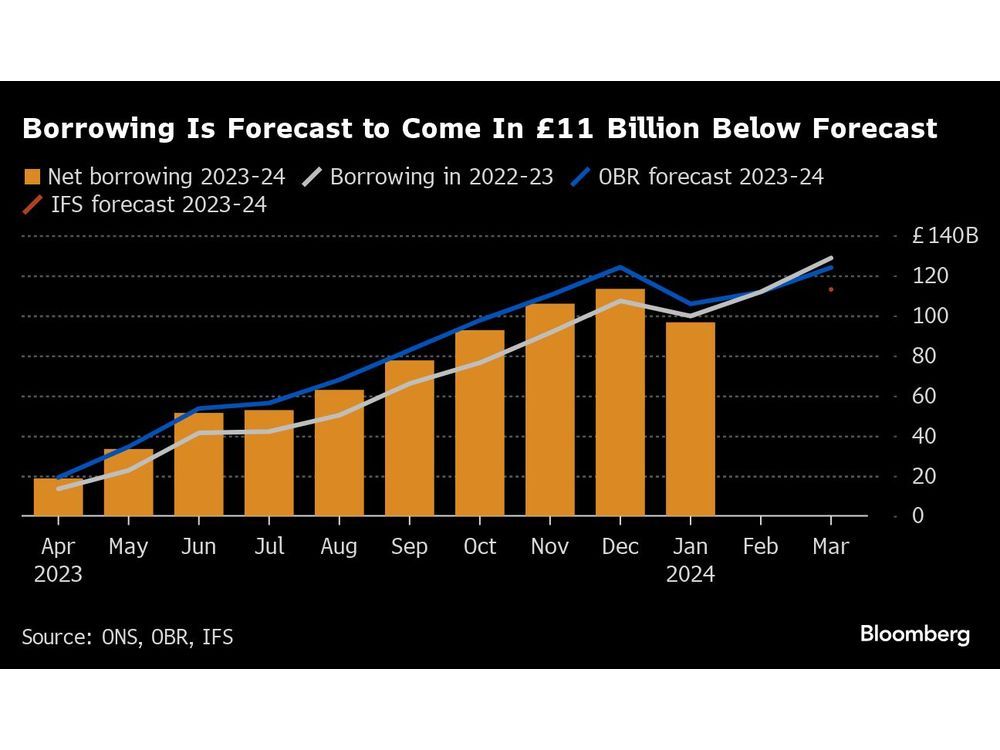

In the UK, Chancellor of the Exchequer Jeremy Hunt will reveal his budget plan on Wednesday in what might be the last such statement before a basic election that’s most likely this year.

Speculation in current days has actually fixated possible free gifts for citizens, and an end to the “non dom” status utilized by rich immigrants. Hunt might have restricted space for maneuver on tax cuts.

Short article material

In the euro zone, the European Central Bank choice on Thursday will be the centerpiece. Policymakers will reveal their very first quarterly projections of the year, which might reveal that they’re moving closer towards providing a rate cut in coming months.

Faster-than-expected inflation in numbers launched on Friday might still provide authorities factor for care, and they’re likewise waiting for information on wage offers to guarantee that the complete speed of consumer-price gains isn’t getting shown in pay.

Information in the euro area will provide a reading on the strength of production in essential economies. Industrial numbers from Germany, France and Spain are all due.

Switzerland, whose central-bank chief simply revealed his departure for later on this year, will launch inflation on Monday that’s anticipated by economic experts to have actually slowed to 1.2%, the weakest because 2021.

Turning east, Polish financial authorities are prepared for to keep their rate the same at 5.75% on Wednesday, while their Serbian peers the next day will expose if they’re deciding to hold loaning expenses at 6.5% once again.

In Turkey, experts forecast information on Monday will reveal inflation sped up to 66% in February, a result that’s approximately in line with projections from the reserve bank.

Post material

And the next day in South Africa, a report is most likely to reveal that the country skirted an economic downturn, assisted by a growth in its mining and production markets. The economy is anticipated to have actually grown 0.3% in the 4th quarter of 2023.

- For more, check out Bloomberg Economics’ complete Week Ahead for EMEA

Latin America

Brazil’s January commercial production information might reveal 2024 leaving to a strong start.

In Luiz Inacio Lula da Silva’s very first year back in workplace, output balanced 0.1%, far listed below the 3.4% typical seen throughout his very first stint as president. Output balanced -1.2% over the next 12 years.

Brazil will likewise dish out the reserve bank’s weekly study of economic experts, bank account, foreign direct financial investment, month-to-month trade figures, bank financing and federal government financial obligation information.

In Peru, the majority of experts have actually been looking fo the reserve bank to provide a seventh straight quarter-point interest-rate cut to 6% at its conference on Thursday. February inflation information published Friday revealing an unforeseen dive in customer rates most likely makes complex the choice.

On the ever-critical inflation front, the early agreement anticipates that customer rate information will reveal inflation slowed in Colombia and Mexico while increasing somewhat in Chile.

Post material

Mexico’s double-barreled publishing Thursday of mid-month and February customer cost readings will likely reveal adequate cooling to green light Banxico to provide a much waited for rate cut at its March conference.

In Colombia, both the heading and core readings will slow to keep BanRep alleviating on March 22, while Chile’s reserve bank– which sees inflation striking the target in the very first half– will not resent the minor uptick reported here.

- For more, check out Bloomberg Economics’ complete Week Ahead for Latin America

— With help from Paul Jackson, Vince Golle, Laura Dhillon Kane, Piotr Skolimowski, Paul Wallace, Monique Vanek and Robert Jameson.

Post material