European stocks rose to a fresh record high as solid earnings from the likes of Anheuser-Busch InBev NV and Siemens Energy boosted sentiment.

Author of the article:

Bloomberg News

Macarena Muñoz

Published May 08, 2024 • 2 minute read

(Bloomberg) — European stocks rose to a fresh record high as solid earnings from the likes of Anheuser-Busch InBev NV and Siemens Energy boosted sentiment.

The Stoxx 600 Index was 0.3% higher by the close in London for its fourth straight day of gains. The food & beverages sector led the advance, with AB InBev rallying after reporting better-than-expected volumes and sales in North America. Alstom SA soared after the troubled train maker outlined a capital increase of about €1 billion ($1.1 billion) to shore up its balance sheet, while an outlook upgrade lifted Siemens Energy AG.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

Sign In or Create an Account

or

Article content

Article content

Puma SE, JD Wetherspoon Plc and Ahold Delhaize NV were among others posting forecast-beating results. Auto stocks bucked the firmer trend, however, with luxury carmaker BMW AG sliding after it said higher costs had hit profits.

“The blue chips on the European markets continue to set the direction,” said Guillermo Hernandez Sampere, head of trading at asset manager MPPM.

European stocks have added 2.1% already this month, getting a boost from corporate earnings and expectations the European Central Bank will start cutting rates from June. The FTSE 100 also hit a fresh record, lifted by commodities outperformance.

Also on the central bank front, last week’s weaker US jobs data has lent confidence that the Federal Reserve can start cutting rates this year. On Wednesday, Sweden’s Riksbank kicked off its rate cutting cycle, easing policy for the first time in eight years. Stockholm’s equity index rose 0.5%, touching a new record high before reversing gains ahead of a holiday.

For more on equity markets:

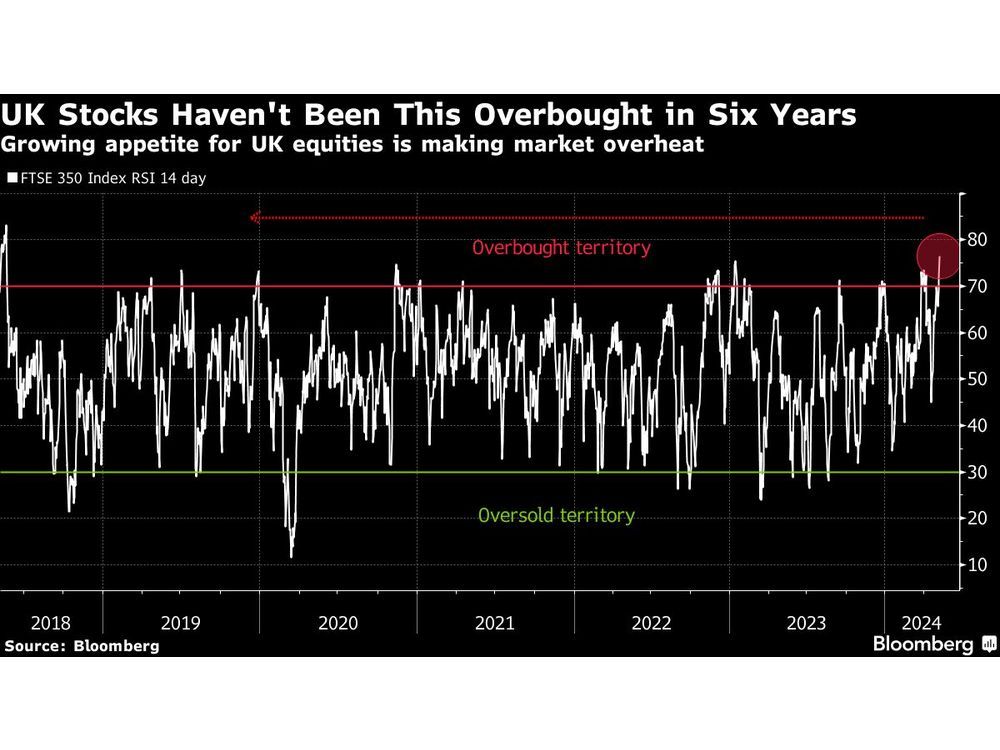

- Once a Laggard, UK Market Now Risks Overheating: Taking Stock

- M&A Watch Europe: Alstom, International Paper, Ascential, BASF

- TotalEnergies Has Plenty of Reasons to Exit Paris: ECM Watch

- US Stock Futures Little Changed; Treace Medical Falls

- Home Prices Stay Grounded: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

—With assistance from Michael Msika.

Article content