Capitec Bank Holdings Ltd., South Africa’s top-performing share post-democracy, is moving focus to expand its organization by leveraging its effective retail banking method. CEO Gerrie Fourie visualizes targeting small companies in the casual sector, intending to strengthen the bank’s existence in company banking and insurance coverage, following a rise in stock worth and record-breaking revenues.

Register for your morning brew of the BizNews Insider to keep you up to speed with the material that matters. The newsletter will land in your inbox at 5:30 am weekdays. Registerhere

By Adelaide Changole

Capitec Bank Holdings Ltd., South Africa’s best-performing share because the development of democracy, wishes to utilize its retail banking technique to grow its service banking and insurance coverage systems.

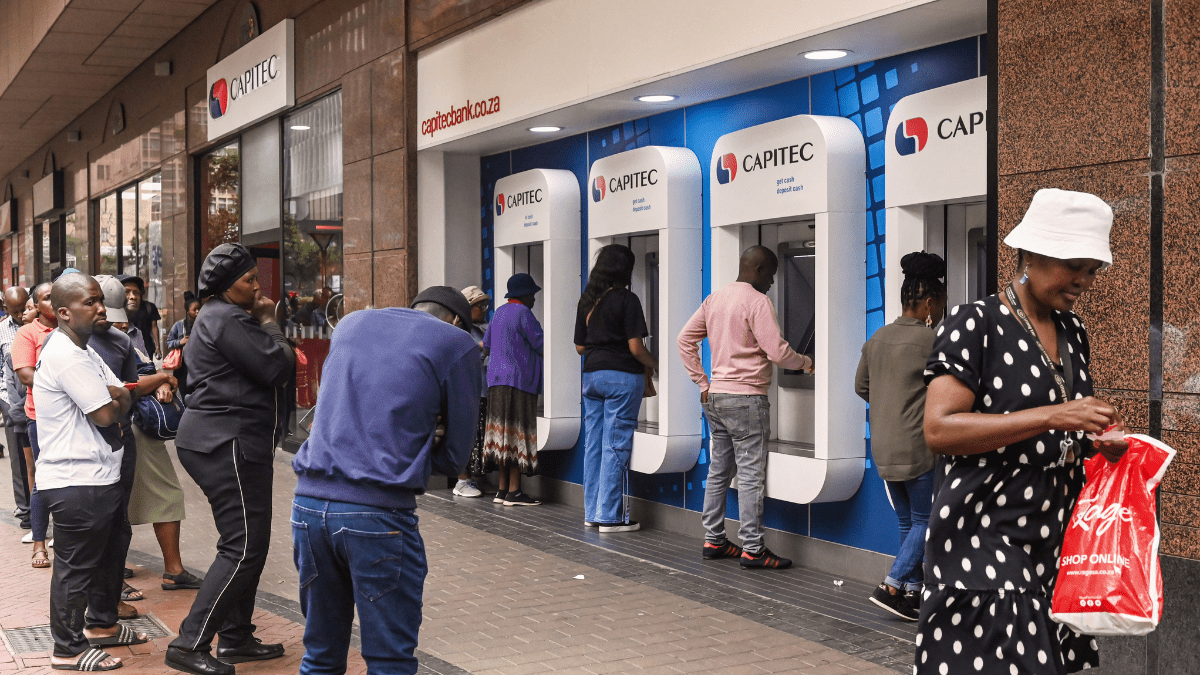

The Stellenbosch, South Africa-based lending institution, which developed the nation’s most significant bank by consumer numbers by concentrating on low-income depositors and unsecured financing in among the world’s most unequal countries, will look for to charm small companies in the casual sector to broaden even more, Chief Executive Officer Gerrie Fourie stated.

“If I take a look at South Africa, we’re not going to get joblessness down and get the economy growing through the federal government and economic sector,” he stated at a rundown on Tuesday. “It’s the business owners that we require to support.”

The stock leapt as much as 9%, the most in 7 months, after reporting record revenue that beat experts’ quotes. Capitec’s shares have actually risen 1,277-fold given that the business noted on Feb. 18, 2002, exceeding a six-fold advance in the benchmark FTSE/JSE Africa All Share Index.

“I’m thrilled in what is lying ahead in business banking area,” Fourie stated. Capitec is still constructing the system and “we are hectic simply making sure we can deal with the capability,” he stated.

Capitec was established by Michiel le Roux in 1997, 3 years after Nelson Mandela led the African National Congress to success in the country’s very first election after completion of apartheid. The lending institution was spun off from monetary services business PSG Group Ltd. in March 2001, and noted on the Johannesburg Stock Exchange in February 2002.

Over the previous twenty years, Capitec has actually tempted 22 million clients and end up being the third-largest loan provider by market price, although with 208 billion rand ($10.8 billion) of possessions it ranks as the tiniest of the significant loan providers. Requirement Bank Group Ltd. has 3 trillion rand of properties.

“There’s still adequate development capacity over the next 10 years,” Harry Botha, an expert with Anchor Capital Pty Ltd., stated before the revenues statement. “The bank still has significant development capacity through cross-sell and up-sell of its existing item.”

Still, the greatest loaning expenses in 14 years injured Capitec’s low-income consumers and increased the bank’s uncollectable bill to 10% in the year through February, compared to about 1% for its larger competitors. The bank has actually likewise pared back unsecured loaning, as problems rose 37%.

As an outcome, providing to people climbed up simply 2%, while credit to corporates leapt 23%. It’s likewise developing its insurance coverage section and broadening payment services. The diversity increased non-lending earnings by 26% to 19.58 billion rand.

The bank proposed a dividend payment of 48.75 rand per share for the duration, beating agreement price quote of 45.17 rand.

Read likewise:

- BNC # 6: Gerrie Fourie Q&A– What sets Capitec apart, lessons in management and welcoming optimism

- BNC # 6: Gerrie Fourie– Entrepreneurial masterclass from SA’s most effective CEO

- The dawn of the ‘Finternet’: What to get out of the digital age of financing– Andy Mukherjee

© 2024 Bloomberg L.P.

Checked out 77 times, 77 go to(s) today