Download our 2024 AI Superguide to find over 200 other AI tools.

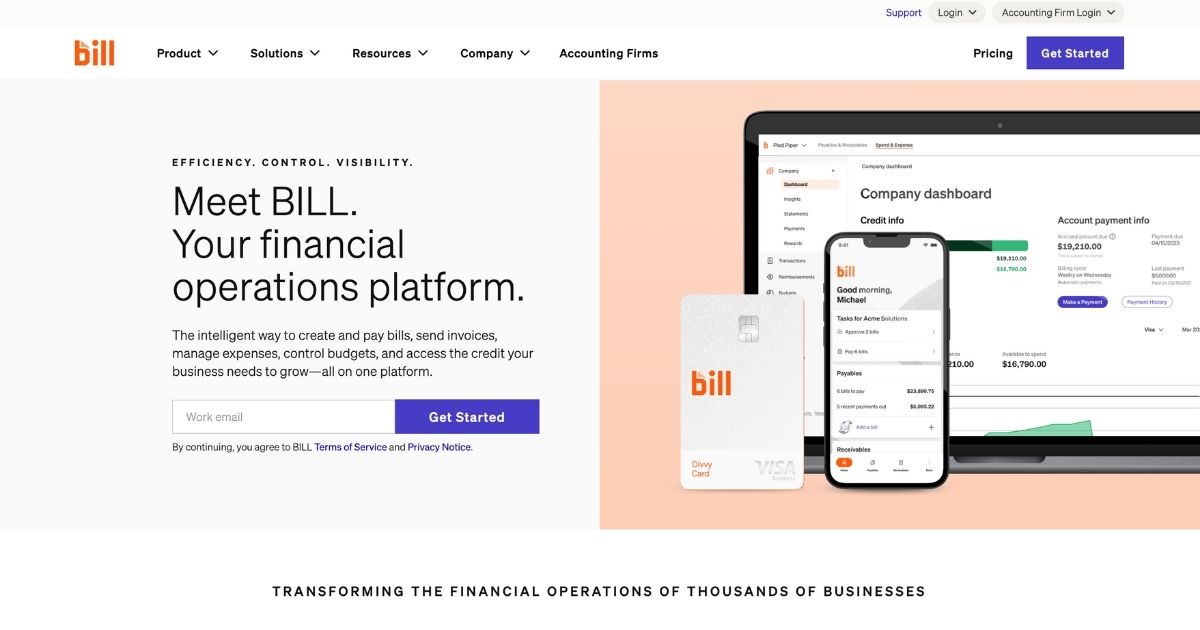

Presenting BILL, an all-in-one monetary operations platform created to streamline your organization’s monetary jobs. This smart tool permits you to quickly produce and pay expenses, send out billings, handle expenditures, control budget plans, and gain access to the credit you require to grow your service.

With BILL, you can conserve time on payments through accounts payable automation, simplifying your whole AP procedure from costs development to approvals and payments. Plus, the software application perfectly synchronizes with your accounting software application, making it even simpler to handle your financials.

Among the standout functions of BILL is its capability to enhance your capital. The platform uses access to line of credit varying from $500 to $5 million, permitting you to quickly ask for funds and set budget plans. Furthermore, you can track your invest utilizing a business card and complimentary software application, offering you higher control over your financial resources.

Making money has actually never ever been simpler with BILL. You can develop expert billings and have the versatility to pick how you send them. Plus, you can get payments straight to your checking account by means of ACH or charge card. This structured procedure permits you to earn money approximately 2 times quicker, enhancing your capital.

Handling your monetary operations is made basic with BILL. The platform incorporates perfectly into your tech stack, supplying one login and an aggregated capital job list. Furthermore, BILL immediately synchronizes with leading accounting software application, making it even much easier to automate your monetary jobs.

If you’re a monetary company aiming to broaden your services, BILL can assist. The platform permits you to automate accounting jobs, provide customer expense pay, and offer invest and cost management services. By using BILL, you can enhance your customers’ monetary operations, maximizing important time for your company to concentrate on development chances.

EXPENSE– Features

- AP automation for structured payment procedures

- Access to credit limit and invest control for capital optimization

- Faster payment collection with expert invoicing and versatile payment alternatives

- Consolidated management of AP, AR, invest, and costs on a single platform

- Combination with existing tech stack and automated sync with leading accounting software application

- Automation of accounting jobs for structured customer monetary operations

- Customer costs pay performance for broadened services and development chances for companies.

EXPENSE– Pricing

The prices prepares for BILL are as follows:

- Accounts Payable: Essentials– $45/user/month, Team– $55/user/month

- Business: Recommended Plan– $79/user/month

- Business: Custom Pricing

- Invest & & Expense: $0/user/month (with access to credit limit from $500 to $5M).

See bill.com for more.

Maintain to date with our stories on LinkedIn Twitter Facebook and Instagram