Banks have actually looked for rewards from the Reserve Bank of India (RBIand the Centre on sustainability-linked loans, a classification of funding that plays an essential function in the nation’s push towards conference environment difficulties however has industrial dangers due to unverified application history.

“Banks have actually asked for unwinded standards on RWA (risk-weighted possessionsfor sustainability-linked loans along with some dispensation on upkeep of CRR (money reserve ratiofor amounts paid out as such loans,” a source familiar with the advancements stated to ET. “There is a continuous conversation on green funding designs and how finest banks can adjust to these designs,” the source stated.

In a sustainability-linked loan, the rate of interest charged on the loan is linked to a business’s execution of sustainability criteria. If standards are satisfied, the rates of interest are fulfilled, hence incentivizing business debtors to fulfill sustainability targets. These criteria are broadly connected to ecological, social and governance standards.

An e-mail sent out to the RBI looking for talk about the matter did not get an action by the time of publication. A federal government authorities stated conversations are on with all stakeholders consisting of the RBI on various elements of ESG loaning“Already, there are propositions on consisting of loaning towards EVs, photovoltaic panels and green hydrogen in the concern sector,” he stated, asking for privacy.

RWA indicates bank capital that should be reserved in accordance with dangers originating from direct exposures. The CRR is a regulative reserve ratio which mandates banks to reserve a particular part of money with the RBI. The CRR is presently at 4.50% of banks’ net need and time liabilities, a proxy for deposits. Green funding has actually progressively included on the radar of the RBI and the federal government, which is devoted to substantial shifts to renewable resource. Big foreign banks have actually played an essential function in structuring sustainability-linked loans for big corporations in India.

In July 2023, Bank of America had actually structured a part of a $150 million loan to L&T in accordance with sustainability-linked targets, ET had actually reported.

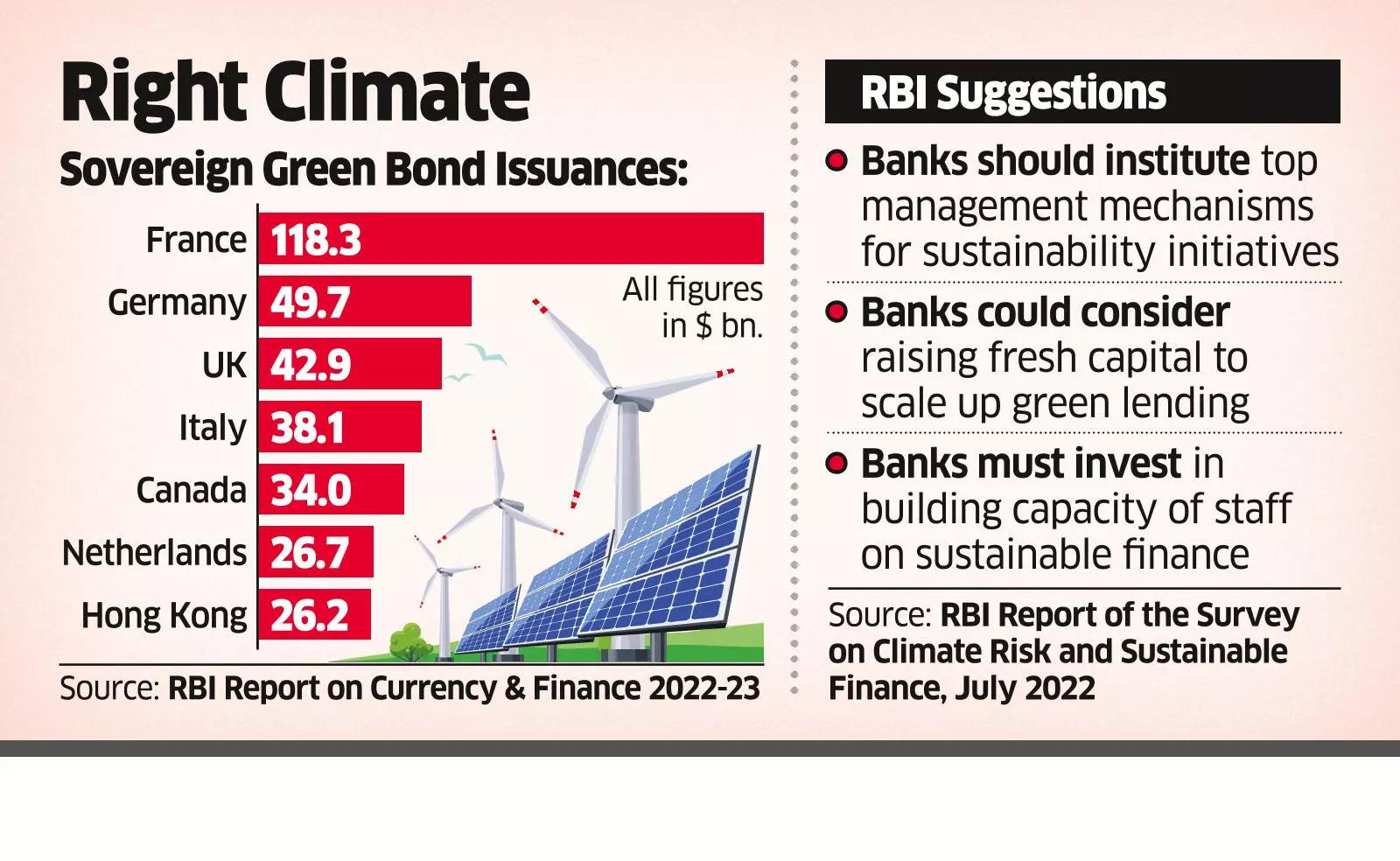

In its Report of the Survey on Climate Risk and Sustainable Finance released in July 2022, the RBI stated that “although banks have actually started taking actions in the location of environment danger and sustainable financing, there stays a requirement for collective effort and more action in this regard.”

(You can now register for our Economic Times WhatsApp channel