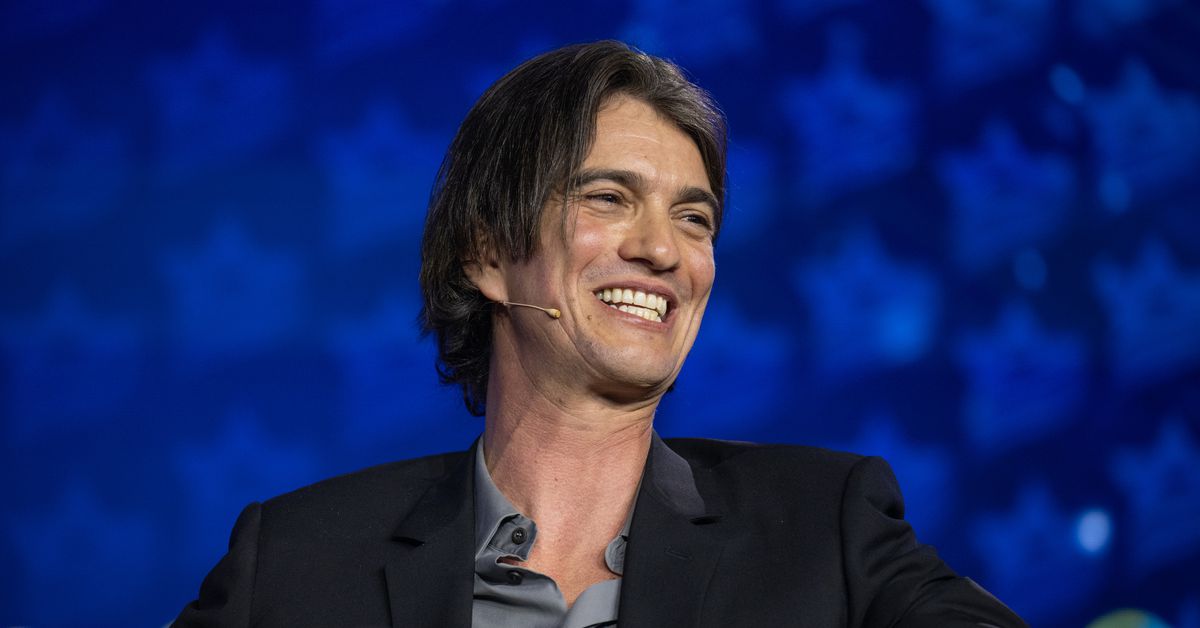

5 years after driving WeWork into the ground, co-founder and ousted CEO Adam Neumann has actually now hatched a strategy to purchase it out of insolvency. In a letter to WeWork’s consultants gotten by The New York TimesNeumann and his brand-new property company Flow Global reveal interest in purchasing the co-working area service– however declares WeWork has actually been disregarding efforts to get more details so they can create a quote.

Neumann and his realty business Flow Global have actually been checking out a purchase of WeWork given that December 2023, with the aid of financing from Dan Loeb’s hedge fund Third Point. As kept in mind in the letter composed by Neumann’s lawyer, Alex Spiro– the very same individual who represents Elon Musk– WeWork does not appear interested in amusing Neumann’s possible deal.

“We compose to reveal our discouragement with WeWork’s absence of engagement even to offer info to my customers in what is planned to be a value-maximizing deal for all stakeholders,” Spiro composes. I question why? With Neumann at the helm, the when-$47 billion business threw away strategies for a going public in 2019. That’s around the exact same time Neumann stepped down (however not before taking a $1.7 billion paymentobviously).

Japanese tech company SoftBank purchased out 80 percent of the business later on that year. Eventually, brand-new management and financing weren’t enough to conserve the business, as WeWork applied for insolvency last November. Still, Neumann and his financiers think there’s some hope.

“In a hybrid work world where need for WeWork’s item ought to be higher than ever … the synergies and management proficiency provided by an acquisition by my customers might considerably go beyond the worth of the Debtors on a stand-alone basis,” the letter checks out.

The letter does not information just how much Neumann and Co. would in fact pay to get WeWork, however it specifies they’re “all set to send a comprehensive proposition” to acquire WeWork or its properties. The only thing standing in their method is, well, WeWork. As exposed in the letter, the collapsed company currently rejected a deal of $1 billion in financing from Neumann in October 2022– and I believe that practically promotes itself.