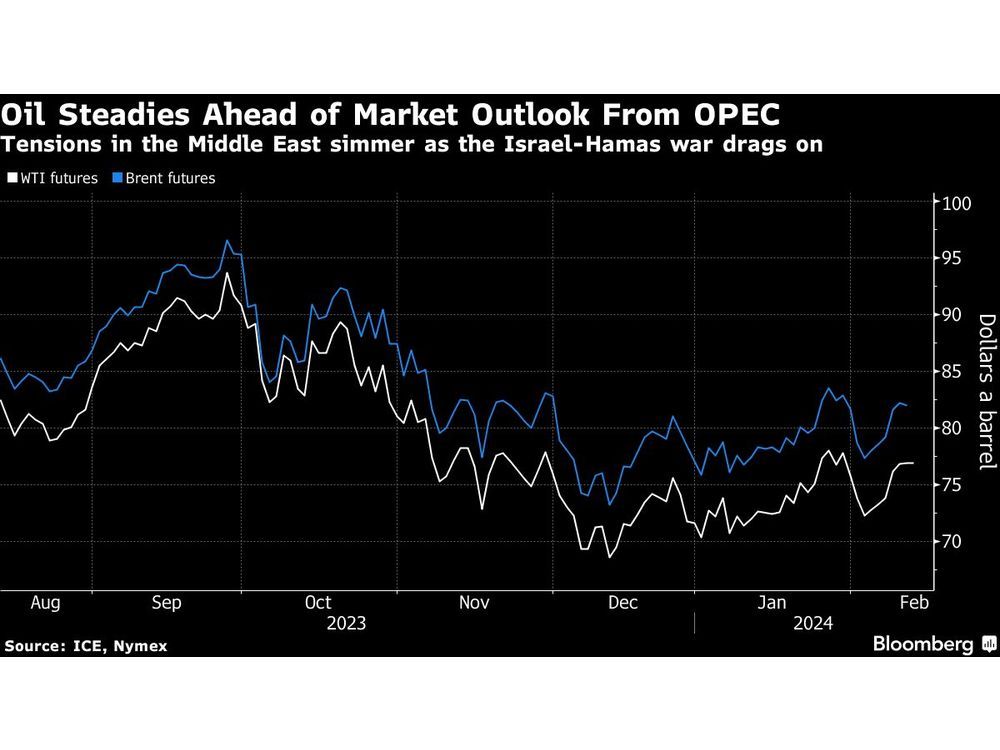

(Bloomberg) — Oil was steady ahead of a market outlook from OPEC, and as traders also monitored developments in the Israel-Hamas war.

Brent crude traded above $82 a barrel after ending slightly lower on Monday, while West Texas Intermediate was near $77 after capping its longest run of daily gains since September. The monthly report from the Organization of the Petroleum Exporting Countries will shed light on global balances as the cartel and its allies curb production. Morgan Stanley recently raised price targets, citing factors including OPEC’s better-than-expected compliance with output cuts.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

Sign In or Create an Account

or

Article content

Article content

In the Middle East, tensions remain elevated. Israel launched strikes on Rafah in the Gaza Strip in its war against Hamas, even as US President Joe Biden made the case for a six-week pause in the fighting. Tehran-backed Houthi rebels in Yemen continue to harass vessels in the Red Sea, disrupting shipping.

The European Union, meanwhile, has proposed new trade restrictions on about two dozen firms, including three China-based ones, accused of supporting Russia in its war against Ukraine. While the companies mostly deal in technology and electronics, the plan follows Western nations taking a stronger line to enforce their price cap on Russian crude.

Oil has been trading in a $10 a barrel band this year, with nervousness over the conflict in the Middle East and OPEC supply cuts offset by ample output from outside the group and an uncertain demand outlook. China, the biggest importer, has been beset by pervasive deflationary pressures, while Goldman Sachs Group Inc. has highlighted risks to consumption.

The OPEC+ alliance plan to decide early next month whether to extend oil output cuts into the second quarter. Ahead of that, Iraq has said its supply is now in line with the group’s earlier accord, while the UAE said it’s committed to working with the alliance to ensure market stability.

Article content

What’s of interest to the market is “what OPEC+ decide to do with their voluntary supply cuts, which expire at the end of March,” said Warren Patterson, head of commodities strategy for ING Groep NV in Singapore. “Our balance sheet suggests that the market will be in surplus in the second quarter of 2024 if the group fails to roll over part of these cuts.”

After OPEC’s outlook, the International Energy Agency will release its corresponding view on Thursday. Trading volumes in Asia will also likely be thin on Tuesday with many markets off for the Lunar New Year holidays.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

Article content