The household of Italian billionaire Massimo Moratti accepted offer a managing stake in refiner Saras SpA to the products trading huge Vitol Group, in an offer which valued the business at about EUR1.7 billion ($1.9 billion).

(Bloomberg)– The household of Italian billionaire Massimo Moratti consented to offer a managing stake in refiner Saras SpA to the products trading huge Vitol Group, in an offer which valued the business at about EUR1.7 billion ($1.9 billion).

Privately-owned Vitol has actually been banking substantial revenues over the previous couple of years as very first the Covid-19 pandemic and after that Russia’s intrusion of Ukraine let loose huge volatility throughout oil, gas and power markets. With the impact of those shocks now on the subside, Vitol and other cash-rich traders have actually been on a purchasing spree, wanting to secure larger margins longer term.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to check out the most recent news in your city and throughout Canada.

- Special short articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily material from Financial Times, the world’s leading international company publication.

- Unrestricted online access to check out short articles from Financial Post, National Post and 15 news websites throughout Canada with one account.

- National Post ePaper, an electronic reproduction of the print edition to see on any gadget, share and talk about.

- Daily puzzles, consisting of the New York Times Crossword.

REGISTER FOR UNLOCK MORE ARTICLES

Subscribe now to check out the most recent news in your city and throughout Canada.

- Unique short articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily material from Financial Times, the world’s leading international organization publication.

- Unrestricted online access to check out posts from Financial Post, National Post and 15 news websites throughout Canada with one account.

- National Post ePaper, an electronic reproduction of the print edition to see on any gadget, share and talk about.

- Daily puzzles, consisting of the New York Times Crossword.

REGISTER/ SIGN IN TO UNLOCK MORE ARTICLES

Develop an account or check in to continue with your reading experience.

- Gain access to short articles from throughout Canada with one account.

- Share your ideas and sign up with the discussion in the remarks.

- Take pleasure in extra short articles monthly.

- Get e-mail updates from your preferred authors.

Post material

Short article material

The Moratti household reached an offer to offer about 35% of Saras at EUR1.75/ share, according to a declaration from the household. Angelo Moratti, among Massimo Moratti’s nephews, might likewise offer his staying 5% which is connected to a collar derivate agreement.

Vitol, referred to as the world’s biggest independent oil trader, will then introduce a takeover quote for the staying Saras shares. Bloomberg News initially reported Vitol’s talks with Moratti Feb. 7.

Vitol has actually been getting stakes in refineries and retail fuel networks, along with purchasing United States upstream oil and renewables. The Saras offer will provide Vitol a stake in a refinery that feeds into the rewarding Mediterranean market and beyond. When finished Vitol will have financial investments in over 800,000 barrels each day of refining capability.

“Saras’s service is extremely complementary to Vitol’s core operations,” Vitol CEO Russel Hardy stated, keeping in mind that the refinery was “an essential European energy possession.”

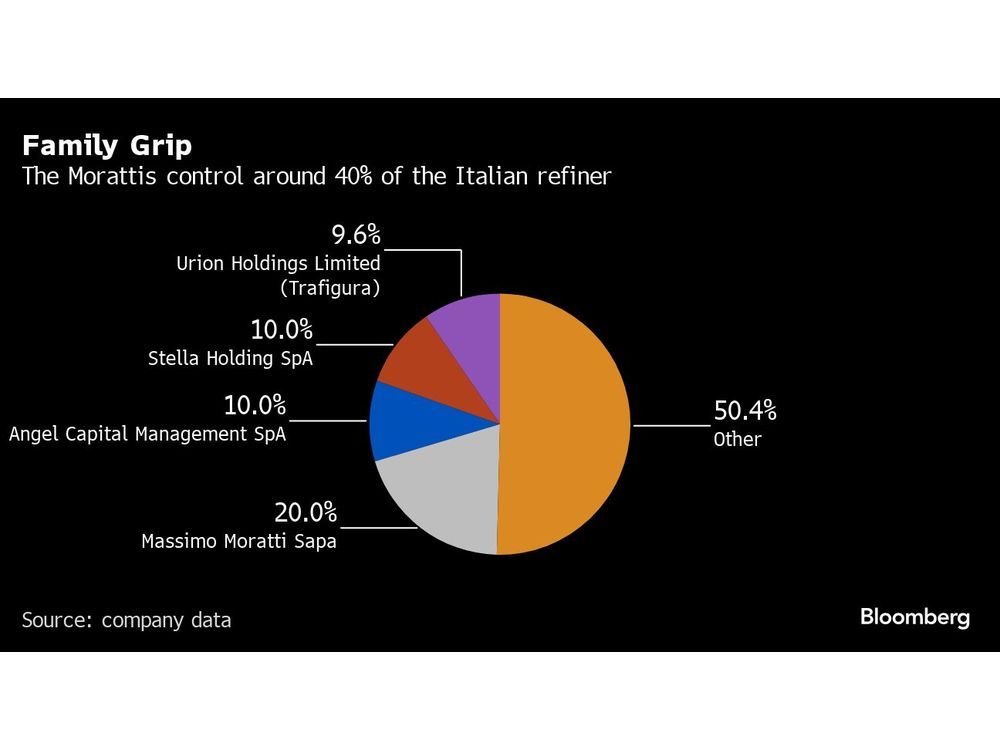

The Moratti household has a 40% holding in Saras, providing control of the company. Massimo Moratti, the chairman and president and a previous owner of Inter Milan football club, holds 20%. His nephews Gabriele Moratti and Angelo Moratti each own 10% through holding business.

Short article material

“62 years after my daddy established it, together with my nephews, I think that the very best guarantee for the future success of the Sarroch refinery is the aggregation with a leading gamer in the international energy sector, such as Vitol,” Massimo Moratti stated in the declaration.

Established in the 1960s by the household, Saras runs the 300,000 barrels-a-day Sarroch refinery on the island of Sardinia. Products trader Trafigura Group has about 9.6% of the refiner after offering about 4% last month.

The refinery is thought about reasonably advanced, indicating it has the ability to fine-tune the crudes it processes and the fuels it makes. It is the biggest single-site plant in southern Europe although Italy’s ISAB center, which is divided into northern and southern areas, is larger when integrated.

Conclusion of the deal undergoes regulative approvals consisting of the Italian federal government’s golden power treatment, the Moratti declaration stated.

“This deal provides a chance for Vitol to purchase a top quality possession, well positioned to serve both Italy’s and Europe’s existing and future energy requirements,” the business stated in the declaration.

The Moratti household is recommended by BofA Securities and Four Partners Advisory as monetary consultants and Linklaters as legal consultant. Vitol is encouraged by J.P. Morgan as sole monetary consultant and by Chiomenti and Weil, Gotshal & & Manges as legal consultant.

Post material