Japanese building and construction, mining, and commercial devices maker Komatsu reported strong third-quarter outcomes, with sales up 5.6% from the exact same duration a year ago to 971.9 billion yen.

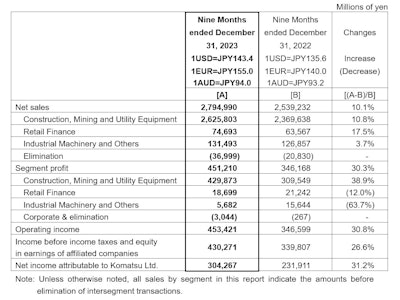

Taking a look at the very first 9 months of the , Komatsu’s net sales have actually grown 10.1% to 2,794.9 billion yen, while running earnings increased 30.8% to 453.4 billion yen. The business associated the development to enhanced market price in many areas and the Japanese yen’s devaluation, which balance out increased repaired expenses and product rates.

Komatsu kept its outlook for the ending March 31, 2024. It still anticipates full-year net sales to increase 3.3% and operating earnings to grow by 11.7%.

Building, Mining and Industrial Equipment Demand by Region

For the very first 9 months of the , sales of building, mining and commercial devices increased by 10.8% compared to the exact same duration in 2015, to 2,625.8 billion yen.

Building devices sales stayed stable in North America, while need softened in Latin America, Europe and Asia.

Komatsu states need for its mining devices stayed strong and sales increased from the matching duration a year earlier, driven by parts sales and service development which show high device usage, enhanced market price in the majority of areas of the world and the Japanese yen’s devaluation.

In the commercial equipment section, sales likewise increased thanks to development in sales of big presses for the vehicle production market.

Komatsu saw the list below efficiency by area:

- Japan: Need for brand-new devices stayed flat while sales increased from the matching duration a year earlier, generally supported by better market price.

- The United States and Canada: Sales for mining devices increased. Sales for building devices differed by market, with sales bottoming out in the real estate sector and staying consistent in the leasing, facilities advancement, and energy-related sectors.

- Latin America: Financial unpredictability triggered need for building and construction devices to slow. Mining devices stayed strong, with sales increasing from a year earlier.

- Europe: Significant markets such as the UK, Germany, Italy and other nations saw need for building and construction devices fall due to increasing rate of interest and high energy rates. Regardless of that, sales increased from the year prior due to the Japanese yen’s devaluation and enhanced asking price.

- CIS: Supply chain limitations and the continuous circumstance in Ukraine triggered sales to fall dramatically over the exact same duration in 2015.

- China: Need stayed weak, and sales reduced throughout the duration, as impacted by stagnant financial activities and slow realty market conditions.

- Asia: Need for mining devices in Indonesia stayed consistent. Hold-ups in the public works budget plans and financial unpredictability triggered need for building and construction devices to fall in Indonesia, Thailand and Vietnam. As an outcome, sales likewise reduced from the matching duration a year earlier.

- Oceania: Need for mining and building devices stayed stable and sales increased.

- Middle East: Jobs in Saudi Arabia, the United Arab Emirates, and other oil-producing nations, in addition to post-earthquake restoration requirements in Turkey, supported need for building and construction devices. As an outcome, sales increased dramatically from the very same duration in 2015.

- Africa: Sales increased from the matching duration a year earlier, supported by constant need for mining and building and construction devices and increased parts sales and service earnings.

Komatsu

Komatsu