The suit implicated WBD and crucial executives of making incorrect declarations about the health of HBO Max and its customer numbers to clear the method for a merger.

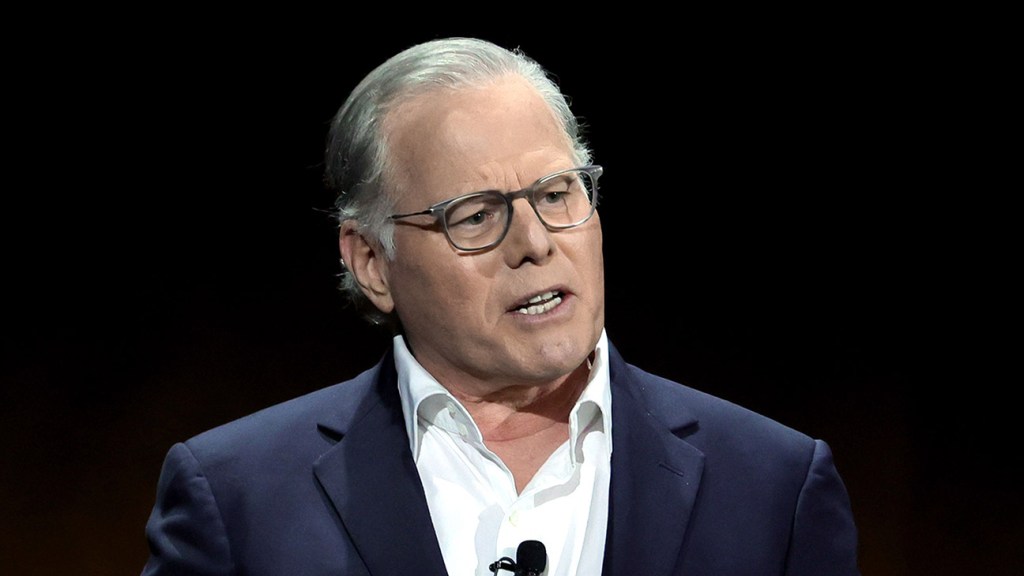

Warner Bros. Discovery CEO David Zaslav

Ethan Miller/Getty Images

Warner Bros. Discovery and its leading brass will not need to deal with a claim from financiers implicating them of concealing negative monetary details about the business’s potential customers leading up to the 2022 merger of Discovery and AT&T’s WarnerMedia.

U.S. District Judge Valierie Caproni on Monday discovered that WBD didn’t overemphasize customer figures and was not needed to divulge info about wider modifications to its organization method as it associated to third-party licensing and the most likely shuttering of CNN+. Other claims over the success of WarnerMedia’s financial investment in material to sustain its blossoming streaming platform and the business’s shift far from licensing motion pictures for theatrical circulation in favor of a direct-to-streaming design were likewise dismissed. WBD decreased remark for this story.

The proposed class action, led by Ohio Attorney General Dave Yost, declared Discovery, along with WBD president David Zaslav and CFO Gunnar Wiedenfels, synthetically pumped up WBD’s stock by misinforming financiers about the health of the HBO Max streaming service, to name a few things. The supposedly incorrect declarations included the variety of customers the merged business would have; WarnerMedia’s material licensing method; prepare for CNN+; and the degree to which WarnerMedia had actually moved its focus to growing its streaming platform.

According to providing files for the merger, HBO, HBO Max and Discovery in 2021 had 95.8 million customers. The fit declared that the info was deceiving since it consisted of the overall variety of customers for all 3 services without defining the number of them were nonpaying or signed up for noncore services (believe Eurosports Player, Motortrend, and Discovery Kids).

The court concluded that the omission does not increase to an infraction of securities law since the offering products, as an entire, were not deceptive. In the problem, financiers did not argue that the reported figures were unreliable and, additionally, yielded that the files divulged that the figures consisted of unactivated memberships.

And while WBD might have reported what financiers called “half-truths,” Caproni stated that combining business are “not needed to reveal a truth just since it might matter or of interest to an affordable financier.” The judge described, “The Offering Documents reported customer varieties of the to-be-merged business that were precise and were accompanied by the business’ methods; the methods plainly divulged that WarnerMedia consisted of unactivated accounts which Discovery consisted of customers to all of its direct-to-consumer services.”

The financiers’ claims over WarnerMedia’s failure to divulge that the business mainly stopped licensing arrangements with 3rd parties in favor of straight carrying material to HBO Max, which they declare triggered a decrease in WBD’s earnings, didn’t fare any much better. Particularly, the match disagreed with a declaration from Discovery in Feb. 2022 in which it stated that WarnerMedia is accrediting material to “over 20 platforms and outlets” and is “a material maker and material owner producing considerable profits, complimentary capital and most notably, optionality.”

The court stated that WarnerMedia had no task to expose that it was unwinding reaching as lots of licensing offers. A business is just needed to divulge modifications in its company strategies, it discovered, when it formerly mentioned intents to specifically abide by that specific method and rotated without notifying financiers.

Before the merger, a substantial part of WarnerMedia’s profits originated from certifying its material to 3rd parties. When it released HBO Max in 2020, the business rotated to investing billions of dollars to establish brand-new material and, a year later on, chose to at the same time launch brand-new films on its streaming platform and in theaters.

Furthermore, Caproni concluded that WBD likewise had no responsibility to reveal info about CNN+, which shuttered a couple of days after the merger closed.

“Plaintiffs do not contest that the disclosures in the Offering Documents were precise,” the judge composed. “They argue rather that Defendants were bound to supply information about CNN+ since it was the only news streaming platform of either of the merging business. Complainants do not discuss, nevertheless, how Defendants’ supposed pre-Merger strategy to cancel CNN+ made declarations about the more comprehensive material technique of the prepared Merged Company deceiving.”

In the 6 months after the merger was finished, WBD stock fell be more than 50 percent.

Yost brought the proposed class action on behalf of the Ohio Public Employees Retirement System and the State Teachers Retirement System of Ohio. His workplace did not right away react to ask for remark.