Canadian stocks are attractive, given the dividend growth that the benchmark S&P/TSX composite index offers and the prospect of waning disinflationary pressure, says Bank of America Corp. strategist Ohsung Kwon.

“Own dividends, own inflation, own Canada,” he said in a research note on Feb. 5. “2024 could be a banner year for dividends as cash yields drop and a global recovery cycle lifts beaten-down high-dividend stocks.”

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

Article content

Article content

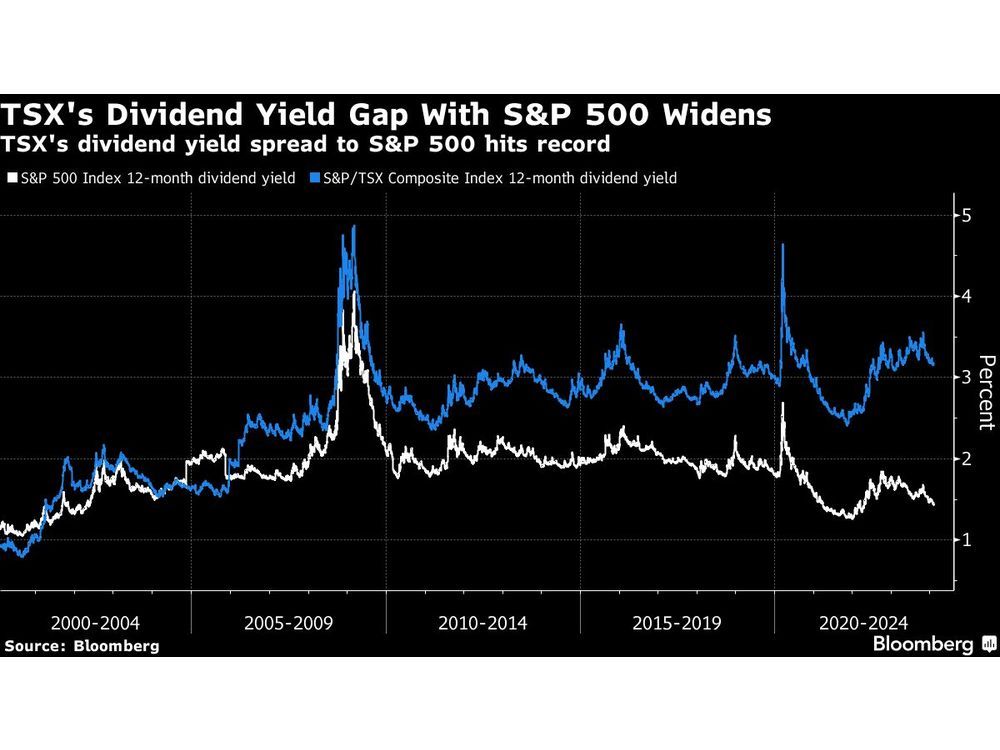

The S&P/TSX composite dividend yield of 3.2 per cent is just over two times the level offered by the S&P 500, a record spread, according to BofA.

Still, it would take higher commodity prices for Canada’s benchmark to post “meaningful outperformance” relative to the S&P 500, according to Kwon.

But he sees plenty of appeal in the S&P/TSX composite, which trailed the U.S. gauge in 2023 as disinflation took hold, but outperformed it in 2022 as inflation was a dominant theme.

Given that much of the disinflation in this cycle has already taken place and with the bank expecting Canada’s economy to close the growth gap with the U.S., the Canadian benchmark “offers a great entry point” at 15 times earnings per share, Kwon said. The multiple for the S&P 500, which has been advancing in large part led by Big Tech shares, is around 22.

The outlook for inflation and geopolitics are the two biggest risks that investors see for equities this year, and Canada could offer a hedge against both, especially given current global tensions, according to the research.

Kwon pointed out that the TSX’s three historical upward cycles relative to the S&P 500 came during inflationary periods, and two were in wartime, including in the 1940s.

Bloomberg.com

Article content