Download our 2024 AI Superguide to find 200 best-in-class AI tools.

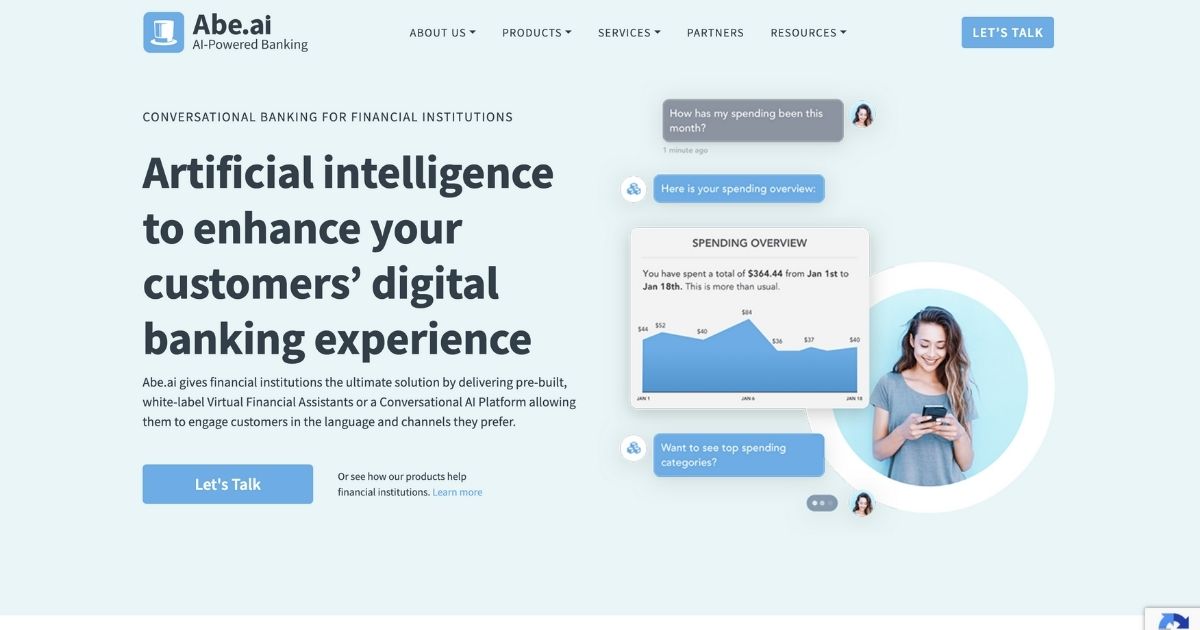

Abe.ai is an ingenious company tool that intends to change the digital banking experience for banks and their consumers. By utilizing the power of expert system (AI), Abe.ai supplies pre-built, white-label Virtual Financial Assistants (VFA) or a Conversational AI Platform, making it possible for banks to engage with consumers in their favored language and channels.

Among the essential benefits of Abe.ai is that it improves both the monetary health of customers and the functional effectiveness of banks. Through using AI, customers can gain from a Virtual Financial Assistant that uses their information to support their monetary health and wellbeing. This implies that consumers can get customized suggestions and assistance on handling their financial resources, resulting in increased monetary literacy and much better decision-making. At the exact same time, banks can end up being more operationally effective, acquiring important insights and information on their consumers while likewise enhancing their total user experience.

The innovation behind Abe.ai has actually been particularly developed for usage in banks, cooperative credit union, and wealth supervisors, making sure that it is customized to satisfy the special requirements of the monetary market. This expertise permits Abe.ai to use customized natural language understanding (NLU), making it possible for consumers to engage with the AI in a conversational and natural way, as if they were speaking with a teller. This level of tailored interaction improves the user experience and increases consumer complete satisfaction.

Another substantial function of Abe.ai is its native financing intelligence abilities. Clients can just reveal their requirements or desires, and the AI will instantly figure out the most proper cash motion rails to send out funds based upon the discussion. This improves monetary deals and gets rid of the requirement for clients to browse through several channels or systems.

Abe.ai likewise focuses on compliance in its platform. The tool consists of design management and compliance tracking, making sure that all interactions are recorded and can be discussed to regulators. This level of openness and responsibility is vital in the greatly regulated monetary market, supplying banks with the assurance that their AI interactions are certified and fulfill market requirements.

Abe.ai makes use of sophisticated maker knowing methods to produce more robust and natural discussion with customers, allowing a smooth and interesting experience for clients when handling their financial resources. By continually gaining from client interactions, the AI ends up being more efficient in comprehending their special requirements and choices, resulting in more individualized and pertinent support.

Abe.ai– Features

- AI-powered VFAs for client assistance and engagement at scale

- Focused AI engine with much better information and insights

- Deep combinations into Fintech banking for an easy user experience

- Conversational AI Platform for owning AI roadmap and information

- Leveraging AI in financing for much better client experiences and performance

- Increased engagement through individualized interactions

- Combination into conventional and non-traditional digital channels

- Improved security and personal privacy throughout all channels with existing and brand-new procedures

- Reduced service expense with self-service alternatives and contact center combinations

Abe.ai– Pricing

Offered upon demand– Free demonstration.

Go to abe.ai for more.

Maintain to date with our stories on LinkedIn Twitter Facebook and Instagram