On Friday afternoon, on the flooring of the yearly conference of Berkshire Hathaway investorsI encountered my seatmate from the flight from Washington, D.C. to Omaha– a charming female working the Geico cubicle.

“Bill Murray is here,” she informed me. I informed her I ‘d keep my eyes peeled.

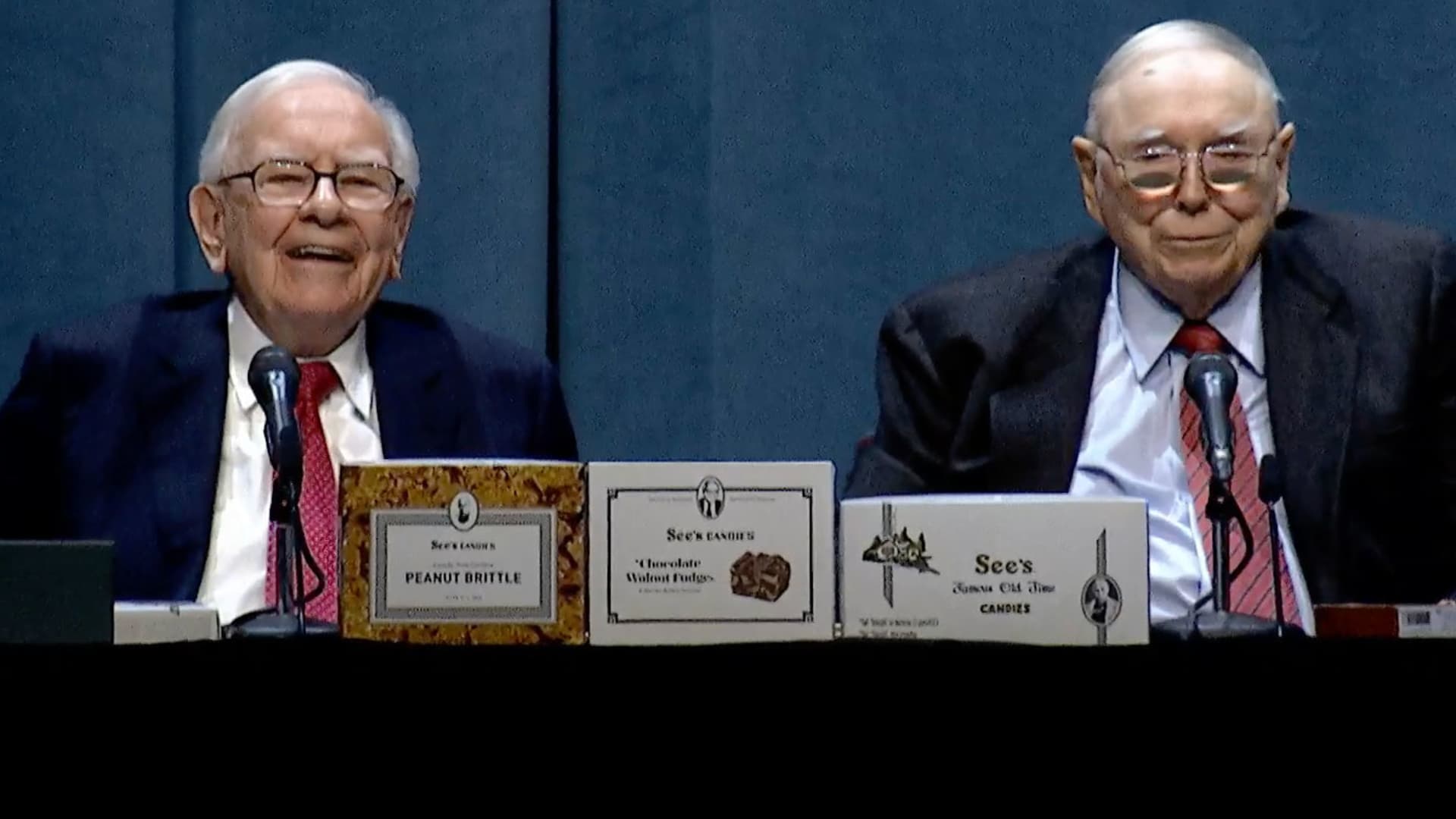

Obviously, to the 10s of countless investors who flock each year to Nebraska, Murray, or any other star, is 2nd fiddle to the genuine star of the program, Warren Buffettand in years past his right-hand guy Charlie Mungerwho passed away in 2023.

Around these parts, the honchos at Berkshire do have one crucial thing in typical with Murray: everybody who’s fulfilled them appears to have a story.

Previously on Friday, I participated in VALUEx BRK among the lots of events of financiers that emerge around Omaha as sort of satellite Berkshire conferences. Run by Guy Spier, supervisor of the Zurich-based Aquamarine Fund, the occasion included talks from a broad selection of worth investing lovers, from financial investment supervisors to academics to authors to Munger’s long time assistant Doerthe Obert.

Practically everybody who had actually come across among the Berkshire stars shared a few of the knowledge they imparted. Here’s what you can gain from their stories.

Select the ideal partner

Monsoon Pabrai, handling partner and portfolio supervisor of Drew Investment Research, remembered a lunch where she and her sibling– both girls at the time– rested on either side of Buffett. She took mindful note of the three-and-a-half-hour discussion, however tends to go back to one piece of guidance.

“The one that constantly stuck to me was that he looked me and my sis in the eye, since we’re females, or girls, and stated, ‘The essential choice you make is who you wed,'” she stated. “I believe that opts for both partners in a marital relationship. It’s actually crucial who you choose to be your life partner.”

It’s recommendations that Buffett echoed at the investor conference on Saturday.

In reaction to a concern about guidance everybody requires to hear, Buffett advised investors to consider the method they ‘d like their obituaries to check out and to pursue life appropriately. “Certainly in my day it would have been weding the individual who might assist you do that,” he stated.

Provide yourself some motivation … and responsibility

William Greene, author of “The Great Minds of Investing” spoke along with professional photographer Michael O’Brien about the experience of profiling and photographing Munger.

An encounter with his pal, Berkshire board member Chris Davis, advised him of an essential piece of guidance from Munger: surround yourself with pictures of your idols.

“Charlie informed him really early on, put pictures of individuals you appreciate in your workplace, since they’re individuals you do not wish to dissatisfy.”

Munger notoriously owned a bust of his hero, Benjamin Franklin, Greene kept in mind. Greene, in turn, has a bust of Munger.

“I believe this concept of structuring your physical environment to have images of individuals you appreciate is an actually great hack. It’s tilting the chances of you acting decently,” Greene stated.

Make time on your own

Gillian Segal, author of “Getting There: A Book of Mentors” discussed her perseverance in pin down an interview with Buffett. After stopping working to get across him from another location, she pinned him down at a fundraiser, where he consented to provide her a couple of minutes of his time.

When it came time to arrange their conference, Segal remained in for a surprise.

“Once I had actually gotten in previous [Buffett’s assistant]she was informing me all of the offered times, and it resembled, ‘OK, today he’s readily available Monday,’ and it was a big block of time. Tuesday, substantial block of time, Wednesday, he has this. Thursday, big block of time,” she states. “And I simply recognized he is who he is due to the fact that he protects his time. And he has time to do the essential things. He’s not overscheduled.”

Opportunities are, you do not have almost as lots of people as Buffett does requesting your time– or an assistant who is a professional at securing it. It’s an example that’s helpful for anybody: To be effective in your profession, you’ll require time to provide it your undistracted attention.

Remain in your lane

Munger’s long time assistant Doerthe Obert informed a list of captivating, individual stories about Munger, from his concentrate on his work to his efforts at dieting.

Her recollections of her working relationship with Munger are useful for anybody who has staff members. “We had such a great working relationship, and he simply trusted me totally,” she stated. “You’ll manage it– whatever it was. You’ll get it done.”

Trusting his assistant to do her work let Munger do his.

And when it pertained to the working relationship, Munger mored than happy to remain in his lane, too.

When I asked her what, if anything her manager taught her about investing, Obert demurred.

“He never ever spoke to any person about investing when,” she informed me.

Never ever? Not even in passing?

“No. Since if he offered some suggestions and it [might not] exercise,” she stated. “If he loses some cash, it’s not so bad. If I would lose a lot? He didn’t desire that duty.”

Wish to make additional money beyond your day task?Register for CNBC’s brand-new online course How to Earn Passive Income Online to find out about typical passive earnings streams, pointers to get going and real-life success stories.

Plus, register for CNBC Make It’s newsletter to get suggestions and techniques for success at work, with cash and in life.