Geely is taking strides towards ending up being a worldwide vehicle leader as it lastly notes a renowned cars brand name after a months-long hold-up.

Lotus Technology, the electrical car department of Lotus, majority-owned by Geely after a funding handle 2017started trading its shares on Nasdaq on Friday. The brand name appeared under the ticker LOT, accomplished through a merger with a so-called blank-check business

In Spite Of China being Lotus’ biggest single market, global markets are set to make a higher contribution to profits development and margin growth, Feng Qingfeng, president of Lotus Group and senior vice president of Geely Holding Group, informed a Friday media call.

As soon as a legend in the racing world with its light-weight and aerodynamic cars, UK-founded Lotus was for many years filled with monetary difficulty due in part to an inequality in between high financial investment expenses and low-volume output.

The $880 million infusion of capital from the offer is anticipated to money Geely’s enthusiastic strategy to completely amaze the renowned 75-year-old racing brand name by 2027 and enhance its service beyond the super-luxury cost sector worldwide.

Worldwide electrification boom

Around the time Emira– the last Lotus design with an internal combustion engine– was launched in mid-2021, Geely set its sights on the growing international high-end EV market set to take pleasure in double-digit development over the years, according to Oliver Wyman, consultant on the offer.

China’s second-biggest car manufacturer by sales is set to broaden in the United States and South Korea in the 2nd half of this year with the intro of Coventry-designed, Wuhan-manufactured Lotus EVs including German engineering and Tesla-like automated driving functions.

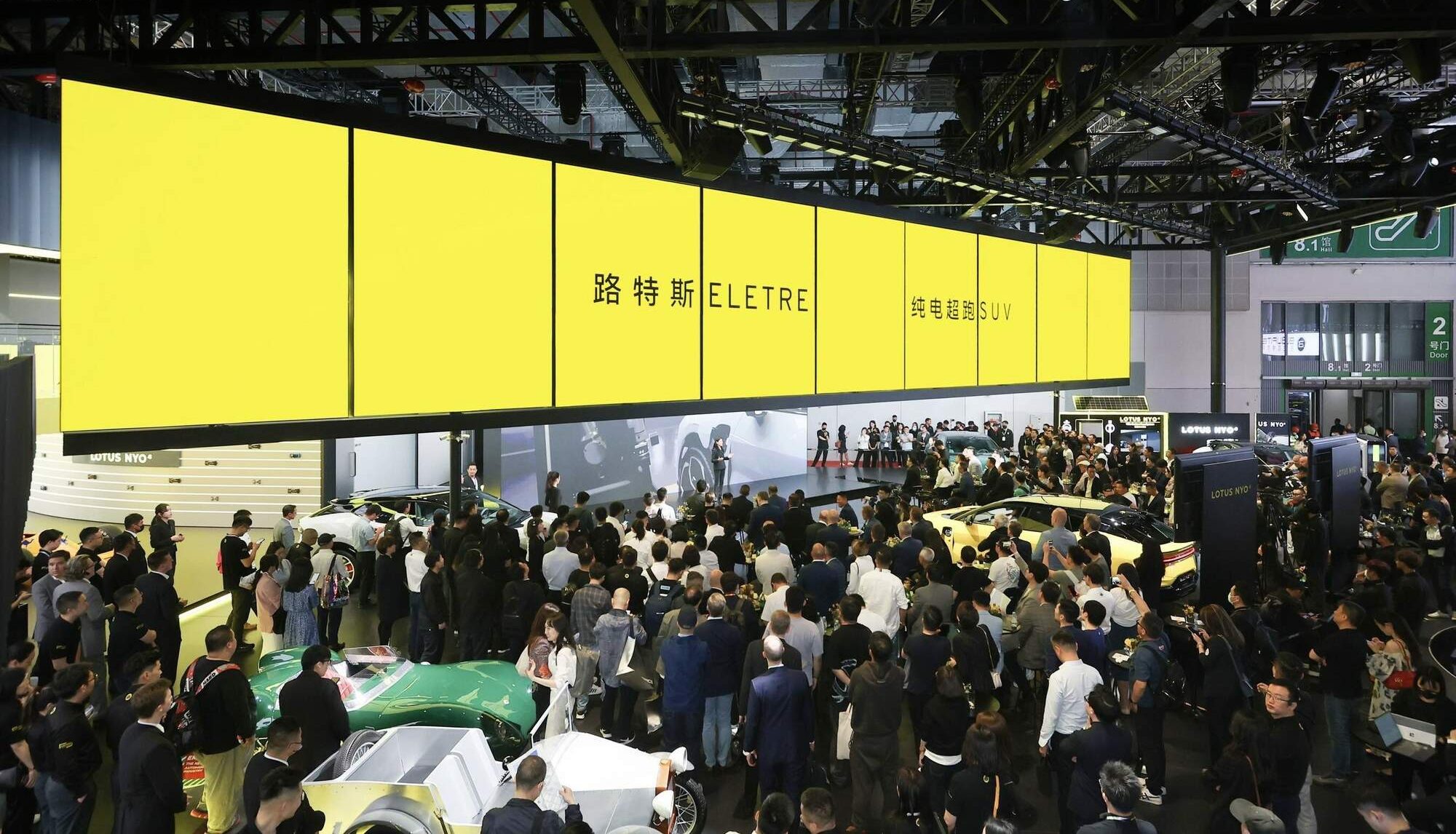

Sales of the Eletrean $115,000 sports energy automobile and initially of the new-age Lotus items, will start in the United States as early as September, followed by the shipment of the similarly-priced Emeya sedan next year, stated Feng. Last July, Feng informed the Financial Times that Lotus may utilize an existing plant owned by Geely-backed Volvo Cars in South Carolina, or perhaps open an extra brand-new United States factory.

The management on Friday did not provide any upgrade on the strategy however revealed “complete self-confidence” in its growth, with its local retail network set to be broadened to 80 display rooms from 47 in North America by 2025, in spite of increasing US-China stress. International markets will represent approximately 60% of Lotus’ overall sales by 2025, while China is set to contribute the staying 40%, according to Feng.

Long roadway to revival

Taken public by means of an unique function acquisition business on Friday, the UK-originated and Chinese-backed EV maker now has a market price of approximately $7 billion, less than a sixth of arch-rival Porsche. Lotus has actually set an enthusiastic objective of offering 150,000 EVs every year in 2028, up from 21,500 systems last year, consisting of a little number of gasoline-powered cars and trucks.

The brand-new stage brings various difficulties. In addition to financial unpredictability worldwide, customer belief for EVs is weak in general, particularly in Europewhere Lotus is set to run 105 retailers by 2025. These obstacles are intensified by policy and geopolitical dangers for Chinese-backed EV makers offering abroad.

EV sales in China seem moving into a slower equipment this every year of speeding up developmentEVs now represent just 7-8% of brand-new automobile sales in the section priced from $80,000, lower than the “low teenagers” development rate standard approximated by the business, Feng acknowledged. He continued to promote “strong development capacity” in the world’s most significant vehicle market.

Management thinks that a clear sales and marketing message originated from its years of storied racing history will allow Lotus to stand apart from competitors and bring it into closer competitors with Volkswagen’s Porsche, which provided over 40,600 electrical Taycans worldwide in 2015.

Lotus Tech anticipates economies of scale from increased volume and competitive labor expenses to bring its gross margin to at least 21% in 2025, up from 4.7% as of last June. The business has actually banked on a technique comparable to that of Porsche, which broadened into more cost effective way of life high-end, from a pure concentrate on advanced cars.

With a tested performance history of reversing loss-making Volvo in simply 3 years after its 2010 takeover, Geely has actually revealed it can be skilled at cross-border relocations. The concern now is, will it achieve success this time?

Jill Shen is Shanghai-based innovation press reporter. She covers Chinese movement, self-governing cars, and electrical automobiles. Get in touch with her by means of email: jill.shen@technode.com or Twitter: @jill_shen_sh

More by Jill Shen