Navigation for News Categories

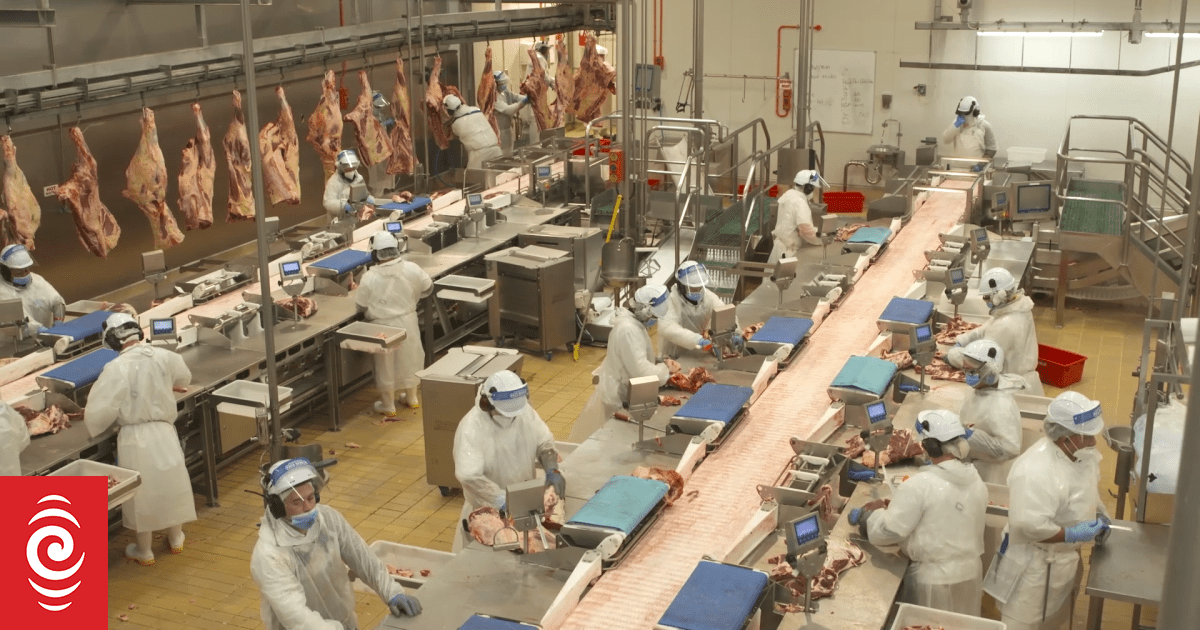

Alliance Group meatworks in Southland.

Image: RNZ/ Nathan McKinnon

Red meat cooperative Alliance is asking its farmers to assist raise share capital to guarantee it stays 100 percent farmer-owned, in the face of substantial monetary pressures.

Alliance Group paid for 9 out of the last 10 years – in 2015, it reported a $70 million loss after tax in the year to Septembera major dive on the year before’s $73.6 million earnings.

Market volatility, inflationary pressures and damaging international markets lagged the current drop.

After alerting its farmer-shareholders at its AGM in 2015, Alliance’s board has actually authorized increasing the basic share-holding from 12 to 16 shares per animals system processed, and farmers will likewise deal with an additional three-dollars per animals system at the works, reliable instantly.

Group chair Mark Wynne stated there was “most likely never ever a fun time to request cash from investors”.

“We acknowledge that times are incredibly difficult on-farm, and this is not a perfect time to execute such modifications. We have actually checked out all other practical chances to lower working capital before looking for capital from farmers,” he stated.

“However, in order to stay a 100 percent farmer-owned co-operative and continue to drive towards our objective of being New Zealand’s most effective processor, a boost in investor equity is needed.”

Alliance was the nation’s only completely farmer-owned red meat cooperative, utilizing more than 5000 individuals at its 7 processing plants throughout Southland, north Otago, Timaru and Nelson. In 2015’s loss suggested its 4500 farmer investors did not get a circulation payment.

Wynne stated regardless of anticipating a modest earnings this , it still required capital financing without having a dependence on financial obligation financing.

He stated it required in between $100 million to $150 million over the next 2 to 3 years to bring back Alliance’s balance sheet, however that would not come entirely from farmer-shareholder contributions.

“With investor financial investment, we can lower our dependence on lending institutions to money our working capital financial obligation, broaden our item offerings and check out brand-new chances to support the change of the co-operative to provide more worth to our farmers.

“We will likewise continue to pursue other choices to decrease working capital requirements,” he stated.

Wynne acknowledged Alliance might lose a few of its farmers at the same time, which will be exposed over the next couple of months.

“Obviously, [farmers] will have alternatives. They will either send their stock to Alliance and continue to share-up, or our company believe a little portion – and genuinely hope it is just a really little portion – that might choose to send out stock somewhere else,” he stated.

“That will be up for the farmers to choose.”

Affected farmers and investors will get letters about what the modifications may imply for them, and they will have the ability to engage with directors straight in the coming weeks.