Toronto-Dominion Bank is poised to challenge investors at a minute when financiers and executives alike are demanding clearness on prospective charges in a United States probe and the future of the company’s management.

Author of the short article:

Bloomberg News

Christine Dobby and Hannah Levitt

Released Apr 18, 2024 – 4 minute read

(Bloomberg)– Toronto-Dominion Bank is poised to face investors at a minute when financiers and executives alike are demanding clearness on prospective charges in a United States probe and the future of the company’s management.

The bank’s yearly investors fulfilling on Thursday comes as the company competes with an examination into its anti-money-laundering controls that has actually hindered the lending institution’s development method, injured its stock and quickened concerns about who may ultimately increase to be successful Chief Executive Officer Bharat Masrani, 67, when he eventually retires.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to check out the most recent news in your city and throughout Canada.

- Unique posts from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily material from Financial Times, the world’s leading international company publication.

- Endless online access to check out short articles from Financial Post, National Post and 15 news websites throughout Canada with one account.

- National Post ePaper, an electronic reproduction of the print edition to see on any gadget, share and discuss.

- Daily puzzles, consisting of the New York Times Crossword.

REGISTER FOR UNLOCK MORE ARTICLES

Subscribe now to check out the most recent news in your city and throughout Canada.

- Special posts from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily material from Financial Times, the world’s leading worldwide organization publication.

- Unrestricted online access to check out posts from Financial Post, National Post and 15 news websites throughout Canada with one account.

- National Post ePaper, an electronic reproduction of the print edition to see on any gadget, share and discuss.

- Daily puzzles, consisting of the New York Times Crossword.

REGISTER/ SIGN IN TO UNLOCK MORE ARTICLES

Produce an account or check in to continue with your reading experience.

- Gain access to short articles from throughout Canada with one account.

- Share your ideas and sign up with the discussion in the remarks.

- Delight in extra posts each month.

- Get e-mail updates from your preferred authors.

Check in or Create an Account

or

Short article material

Post material

Senior executives have actually grown dissatisfied with the absence of a beneficiary obvious, according to individuals with understanding of the circumstance. The unpredictability has actually intensified supervisors’ aggravations over business problems and their capability to outline their futures, individuals stated, asking not to be called talking about personal discussions.

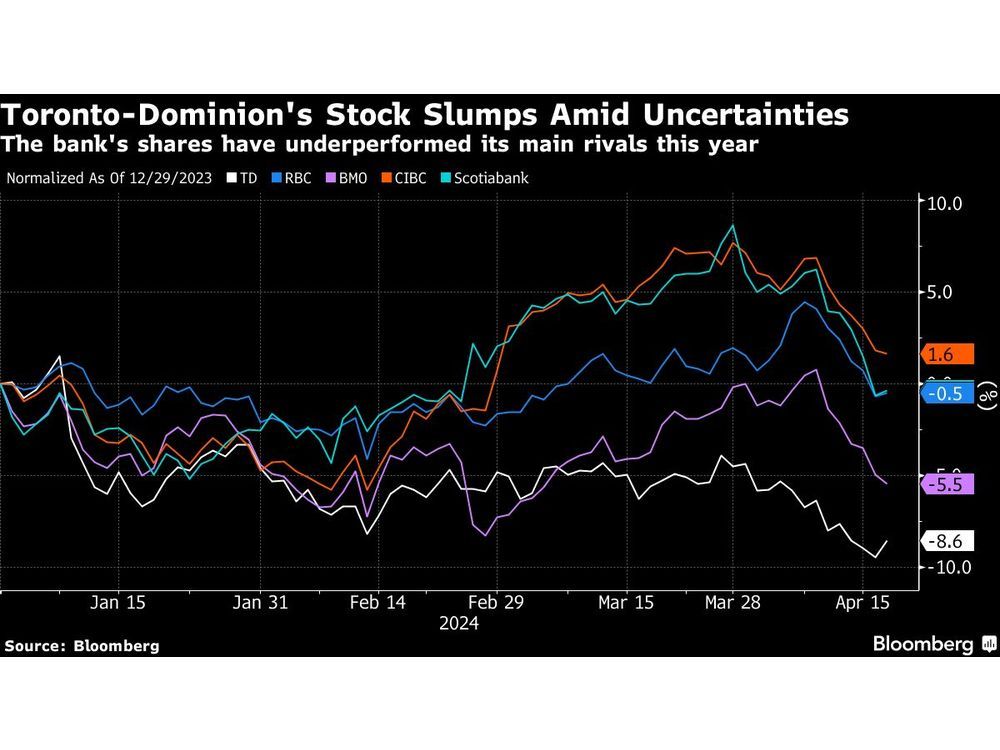

Much of the stress comes from the bank’s effort to purchase Memphis-based First Horizon Corp., which was cancelled practically a year ago amidst the United States regulative probe into how the Toronto-based lending institution managed suspicious consumer deals. The relocation left Toronto-Dominion with adequate capital to release and restricted choices, with its United States development method in limbo. The stock has actually toppled in current months, falling practically 9% this year, compared to a 2.5% decrease for the S&P/ TSX Commercial Banks Index.

Masrani, who’s been CEO for practically a years, willingly took a C$ 1 million ($725,000) pay cut for the last over the scuttled acquisition of First Horizon and regulative probe. Now, without any clear follower lined up, a brand-new board chair is under pressure to come up with a method forward to please financiers and staff members.

By registering you grant get the above newsletter from Postmedia Network Inc.

Post material

Short article material

“The unpredictability is the greatest source of consternation,” stated Dan Rohinton, portfolio supervisor at iA Global Asset Management. The company’s retail shared funds have about 4 million Toronto-Dominion shares.

Financiers in Canada’s second-largest bank desire more information on the fines it’s most likely to pay, Rohinton stated, in addition to whether it might be limited from mergers and acquisitions– or, in a worst-case situation, deal with a cap on growing United States properties naturally.

Experts have actually approximated the fine might top $1 billion, and the bank is currently investing numerous countless dollars on upgrades to its threat and control systems in the United States.

“We understand what the AML issue is,” Masrani stated on a teleconference in February to go over the bank’s financial first-quarter outcomes, including that the bank is working to repair it.

With the wider regulative charges still up in the air, financiers do not yet appear persuaded.

“That unpredictability is weighing on the stock,” stated Nigel D’Souza, an expert with Veritas Investment Research Corp. “And then you have concerns about succession preparation also.”

Short article material

“Bharat is concentrated on enhancing the bank, serving our clients and producing worth for investors,” Toronto-Dominion representative Lisa Hodgins stated in an e-mail. “He leads a deep and extremely skilled bench of leaders with tested performance history driving development throughout big complicated organizations. As you would anticipate, we have an extremely in-depth and robust succession strategy, managed by the board, which continues to serve us well.”

Still, to outsiders, concerns about his replacement have actually grown murkier this year. Michael Rhodes, who was leading the business’s Canadian retail bank, left in December to end up being CEO of Discover Financial Services, a function he has actually considering that left. His exit from Toronto-Dominion came as a shock to lots of executives, among individuals with understanding of the discussions stated.

Find out more: Discover CEO Michael Rhodes Resigns to Become Ally’s Head

Leo Salom, who directs Toronto-Dominion’s United States operations, has actually long been viewed as a possible CEO prospect, however it’s uncertain how the anti-money-laundering mess in the nation may affect his course to the top.

Post material

The company has a “strong and growing franchise in the United States,” Hodgins kept in mind in the emailed declaration, indicating more than 10 million clients in “significant markets and neighborhoods from Maine to Florida.”

Another competitor has actually been Riaz Ahmed, the previous chief monetary officer who was tapped to lead the capital-markets system in 2021. Some within the business have actually hypothesized he might be called CEO however handle the function for a shorter-than-normal duration– 5 years or less. Still, Ahmed’s age– he’s in his early 60s– might be a knock versus him. He’s been with the bank because the 1990s and on its senior executive group given that 2009, a prolonged period when a more-dramatic modification might be chosen.

One brand-new name in the mix is Ray Chun, the previous head of wealth management who was called to run the Canadian personal-banking service after Rhodes left. The brand-new post is an essential function, frequently considered as part of the CEO pipeline.

The succession concern– linked as it is with the United States concerns– will be leading of mind for the board’s brand-new chair, Alan MacGibbon. The veteran director took over from Brian Levitt on Feb. 1 and is anticipated to lead the bank’s yearly investor conference in Toronto.

Short article material

In spite of the remaining concerns, a minimum of one prominent market watcher sees upside in Toronto-Dominion’s shares. Meny Grauman, a handling director in Bank of Nova Scotia’s Global Equity Research system, updated the stock to exceed on Wednesday.

“We think that worry has actually surpassed rationality on this name,” Grauman stated in a report to customers co-written by associate Felix Fang.

The stock is trading at about 10 times incomes, compared to about 12 times incomes for competing Royal Bank of Canada and about 13 times revenues at Bank of Montreal, according to information assembled by Bloomberg.

“Concerns about the bank’s United States regulative issues and stress over succession at the bank are all legitimate,” Grauman and Fang composed. “But we now think that the drawback threat from both of those concerns is more than totally priced into the shares today.”

Short article material