Healthy United States work gains continued in March while wage development moderated, suggesting the country’s labor market is poised to keep stiring the economy with minimal threat of an inflation revival.

Author of the post:

Bloomberg News

Vince Golle and Craig Stirling

Released Mar 30, 2024 – Last upgraded 2 hours ago – 6 minute checked out

(Bloomberg)– Healthy United States work gains continued in March while wage development moderated, suggesting the country’s labor market is poised to keep stiring the economy with minimal danger of an inflation renewal.

Payrolls worldwide’s biggest economy are seen increasing by a minimum of 200,000 for a 4th straight month, according to a Bloomberg study of economic experts. Typical per hour incomes are forecasted to climb up 4.1% from the exact same month in 2015, the tiniest yearly advance because mid-2021.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to check out the current news in your city and throughout Canada.

- Unique posts from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily material from Financial Times, the world’s leading international organization publication.

- Unrestricted online access to check out posts from Financial Post, National Post and 15 news websites throughout Canada with one account.

- National Post ePaper, an electronic reproduction of the print edition to see on any gadget, share and talk about.

- Daily puzzles, consisting of the New York Times Crossword.

SIGN UP FOR UNLOCK MORE ARTICLES

Subscribe now to check out the most recent news in your city and throughout Canada.

- Special posts from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily material from Financial Times, the world’s leading worldwide organization publication.

- Unrestricted online access to check out short articles from Financial Post, National Post and 15 news websites throughout Canada with one account.

- National Post ePaper, an electronic reproduction of the print edition to see on any gadget, share and discuss.

- Daily puzzles, consisting of the New York Times Crossword.

REGISTER/ SIGN IN TO UNLOCK MORE ARTICLES

Produce an account or check in to continue with your reading experience.

- Gain access to short articles from throughout Canada with one account.

- Share your ideas and sign up with the discussion in the remarks.

- Delight in extra short articles monthly.

- Get e-mail updates from your preferred authors.

Check in or Create an Account

or

Post material

Short article material

Resistant hiring is keeping need and the economy moving on at the very same time inflation is slowing, albeit unevenly. It’s likewise permitting Federal Reserve policymakers to hold back decreasing rates of interest as they wait for additional decreases in rate pressures.

Find out more: Powell Says Latest Inflation Data ‘In Line With Expectations’

Fed Chair Jerome Powell, on Wednesday, headings a big cast of Fed policymakers who are because of speak today. To name a few appearing are John Williams, Adriana Kugler, Mary Daly, Austan Goolsbee, Lorie Logan and Thomas Barkin.

A boost in labor supply is assisting to restrict wage pressures that otherwise would run the risk of infiltrating to a continual pickup in inflation.

Friday’s payrolls report is likewise anticipated to reveal the joblessness rate inched down to 3.8%, simply listed below a two-year high hit in February, recommending the task market is losing a little momentum.

What Bloomberg Economics Says:

“The 2 significant studies utilized to develop the tasks report appear to catch various elements of the United States economy. Investing in services by those taking advantage of possession rate gratitude– mainly infant boomers– has actually supported work in leisure and hospitality and healthcare.

By registering you grant get the above newsletter from Postmedia Network Inc.

Short article material

Post material

At the very same time, minimized need from the less affluent part of the population has actually equated to slowing service sales, and lowered working with or increased layoffs in other sectors. We anticipate that dichotomy to when again appear in the March report, sending out blended messages to policymakers.”

— Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, financial experts. For complete analysis, click on this link

February task openings information on Tuesday will use a peek into labor need. While economic experts forecast a decrease, jobs stay above their pre-pandemic level.

Other reports in the coming week consist of a set of acquiring supervisors studies from producers and company.

- For more, check out Bloomberg Economics’ complete Week Ahead for the United States

Turning north, studies from the Bank of Canada will use insights into inflation expectations ahead of its April 10 rate choice. Canada’s tasks information will be launched simultaneously with the United States numbers, and trade information will likewise be released.

Somewhere else, a raft of essential inflation numbers are due from the euro zone to Turkey to Colombia. Reserve banks from India to Chile will set rates of interest.

Post material

Click on this link for what took place recently, and listed below is our wrap of what’s turning up in the worldwide economy.

Asia

China’s main buying supervisors index, released Sunday, revealed production activity broadened in March for the very first time because September, a more indication that the world’s second-largest economy is supporting.

The Caixin production determine the following day is seen revealing a smaller sized growth in its procedure of activity that focuses more on the economic sector.

PMIs from economies throughout the Asia-Pacific area the exact same day will offer a feel for the local development outlook.

The Bank of Japan’s quarterly Tankan study will most likely show a continuing divergence in belief by market. The gauge for big makers is seen slipping for the very first time in a year, while the reading for big non-manufacturers might skyrocket to a 32-year high.

Smaller sized companies will likely be cynical, a result that might endanger wage gains at SMEs required to power the virtuous cycle looked for by the BOJ.

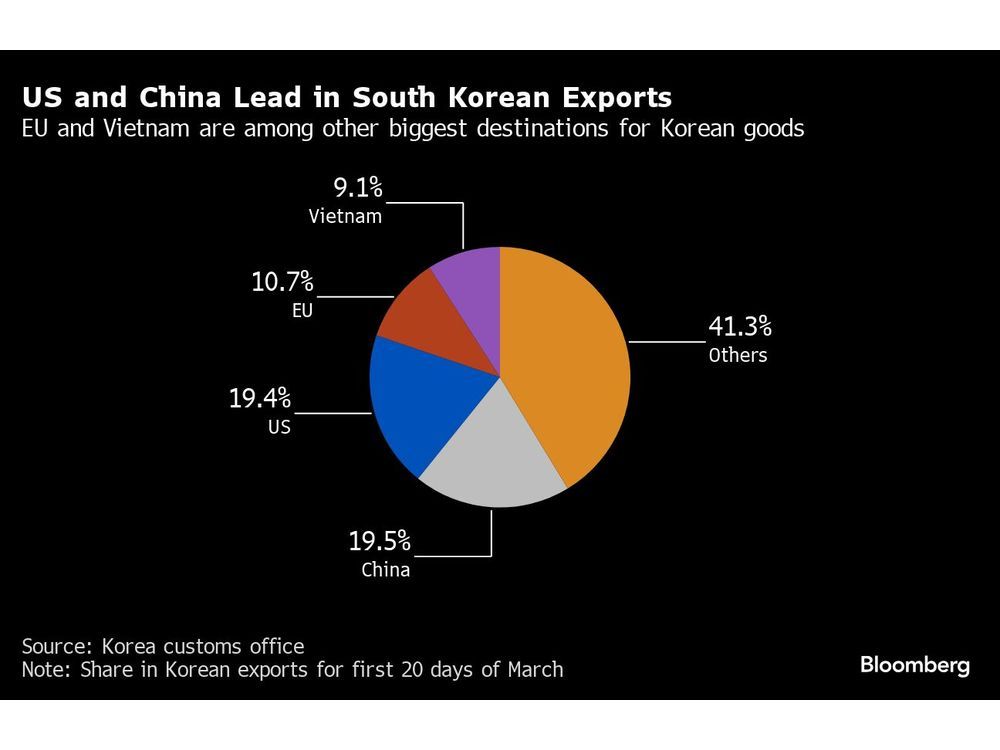

South Korean export development is anticipated to cool in March, while customer inflation information out Tuesday most likely reduced a tick there.

Post material

Cost gains might accelerate reasonably in Indonesia and the Philippines. Decreases in Thai rates are forecasted to reduce.

The Reserve Bank of Australia launches minutes from its March conference on Tuesday, with 2 board members due to speak throughout the week. The Reserve Bank of India is anticipated to keep its primary policy rates constant on Friday.

- For more, check out Bloomberg Economics’ complete Week Ahead for Asia

Europe, Middle East, Africa

After recently’s consumer-price reports from France, Italy and Spain, and following a region-wide vacation on Monday, additional puzzle pieces will emerge exposing the strength, or otherwise, of euro-area pressures.

German inflation on Tuesday is expected to reveal additional weakening towards the 2% target. The European Central Bank will reveal its study of customer expectations the very same day.

The euro-zone inflation number will be released on Wednesday. Results expected by economic experts at 2.5%– and 3% for the hidden gauge that removes out unstable energy and food products– might keep authorities just inching towards cutting rates in the coming months as they determine how their policy is restricting development.

Post material

Governing Council members have up until completion of day Wednesday to share their views before a blackout duration starts ahead of their April 11 choice. More hints about their thinking might emerge the following day, when an account of their last conference is released.

On Thursday, Sweden’s Riksbank will launch minutes of its March choice, clarifying a result that saw authorities company up strategies to cut rates at some time in the 2nd quarter.

Switzerland will launch inflation numbers on Thursday. While a velocity is anticipated, if it can be found in as projection at 1.4% that would still be well listed below the ceiling targeted by the Swiss National Bank, which just recently cut rates.

And in Turkey, where the reserve bank has actually been strongly tightening up, information on Wednesday might reveal another velocity in consumer-price development towards 70%.

- For more, check out Bloomberg Economics’ complete Week Ahead for EMEA

A number of financial conferences will occur today in Europe and Africa:

- In Sierra Leone, with inflation still above 40%, authorities may be encouraged to raise loaning expenses once again on Tuesday.

- The exact same day, Lesotho, which pegs its currency to the South African rand, might follow its next-door neighbor and hold the essential rate at 7.75% to support its economy.

- In East Africa, Kenya’s financial authority is likewise set to leave its criteria on hold on Wednesday after a currency rally assisted mood rates.

- More east, Mauritian authorities might trek loaning expenses after inflation struck an eight-month high amidst current heavy rains from cyclones.

- Back to Europe, Poland’s reserve bank is poised to keep its standard at 5.75% on Thursday versus the background of a standoff with the federal government.

- Romania’s reserve bank might think about the timing for its very first rate cut after inflation began to recede. That’s likewise on Thursday.

Short article material

Latin America

Chile on Monday posts February GDP-proxy information, most likely sealing the view that its economy is on the rebound.

The reserve bank on Tuesday is all however particular to cut loaning expenses for a 6th straight conference, with an early agreement forecasting a 75 basis-point cut to 6.5%, though an uptick in customer costs and wobble in inflation expectations might put a smaller sized decrease in play.

Brazil launches a raft of information, consisting of month-to-month trade, commercial production, bank account, foreign direct financial investment and main and small budget plan figures.

The week’s emphasize in Mexico features the publishing of the minutes of Banxico’s March 21 choice to cut the essential rate to 11%. While the post-meeting communique slanted hawkish, the minutes might press that ambiance up a notch or more.

Peru’s inflation information on Monday might reveal the yearly print falling listed below 3%, enough to encourage bank President Julio Velarde and associates to return to cutting loaning expenses at their April 11 conference.

Colombia’s reserve bank posts the minutes of its March 22 choice, when it doubled the rate of relieving and decreased its rate to 12.25%.

With March customer rate information on Friday anticipated to reveal a 12th straight month of disinflation, the chances are stacked in favor of another half-point relocation at BanRep’s April conference.

- For more, check out Bloomberg Economics’ complete Week Ahead for Latin America

— With support from Zoe Schneeweiss, Robert Jameson, Patrick Donahue, Brian Fowler, Laura Dhillon Kane and Molly Smith.

(Updates with China PMIs in Asia area)

Post material