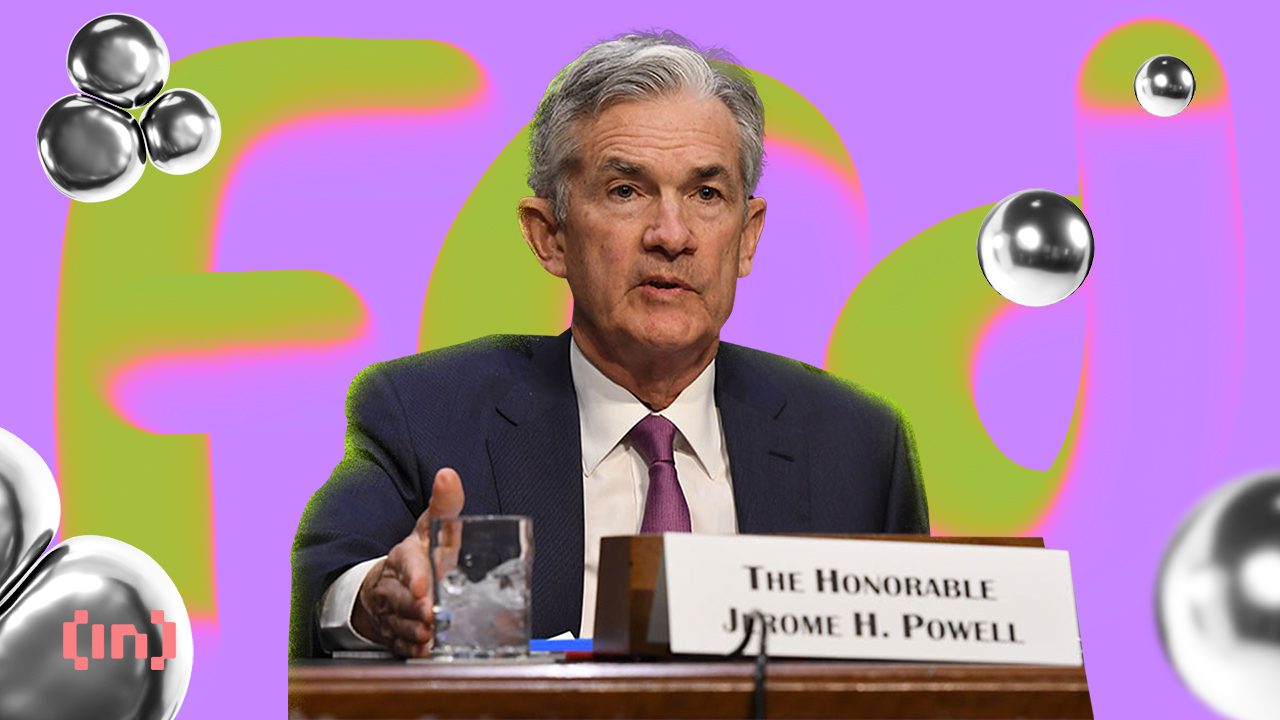

Federal Reserve Chair Jerome Powell assured the country, asserting a strong position versus the looming worry of economic downturn, while Bitcoin gains as a hedge.

Powell’s self-confidence comes from evaluating present financial information and patterns, disassociating from political impacts frequently cloud financial projections. This assertion comes in the middle of an environment of apprehension towards financial policy’s function in guaranteeing long-lasting financial stability.

Economic crisis Is Unlikely This Year

Jerome Powell’s statement lines up with his previous remarks, highlighting the Federal Reserve’s dedication to data-driven choices.

The core PCEremoving out the unstable expenses of food and energy, increased by 2.8% over the previous 12 months. The total inflation rate stood at 2.5% from the previous year. Powell stated that this lines up with his projections, and it is motivating to witness results that satisfy expectations.

Powell’s optimism, acknowledging a low threat of economic crisis, shows a practical view of the economy. He minimized the possibility of minimizing rate of interest up until the “Federal Open Market Committee is positive that inflation is moving down to 2% on a continual basis.”

“Growth is strong. As I discussed, the economy remains in a great location. And there’s no factor to believe the economy remains in an economic downturn or is at the edge of one,” Powell stated.

This viewpoint reroutes focus towards structural components of financial development, far from the short-term impacts of financial changes.

Learn more: How to Protect Yourself From Inflation Using Cryptocurrency

While Powell preserved that an economic crisis is not likely this year, Bitcoin advantages from the unsure financial and financial environment.

Jason Trennert, CEO Strategas Research Partners, associated this to current regulative improvements and the growing desire for options to standard fiat currencies. The approval of a Bitcoin ETF and the synchronised increase in gold rates show a cumulative hedge versus the debasement of the United States dollar.

“In the United States, there’s actually no coordination in between financial and financial policy when it pertains to inflation. And I believe individuals are trying to find hedges versus fiat currencies, especially the dollar. I believe that’s another factor why individuals are looking for options to what would generally be, once again, seen as, as fiat currencies,” Trennert described.

Learn more: Jerome Powell Loses America’s Trust: Is Bitcoin the Solution?

As Powell guides the financial helm with a constant hand, the discussion around Bitcoin’s practicality as a safe house magnifies. With the United States facing a ballooning nationwide financial obligation and the looming reevaluation of financial obligation terms, Bitcoin’s function as a prospective bulwark versus financial instability has actually gotten traction.

Relied on

Disclaimer

In adherence to the Trust Project standards, BeInCrypto is devoted to impartial, transparent reporting. This news short article intends to supply precise, prompt info. Readers are recommended to validate truths separately and seek advice from with an expert before making any choices based on this material. Please keep in mind that ourConditionsPersonal privacy PolicyandDisclaimershave actually been upgraded.