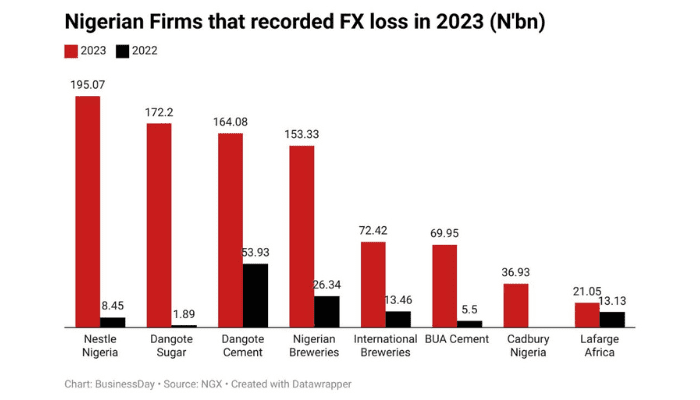

Nestle Plc, Dangote Sugar Refinery Plc and Dangote Cement Plc are the leading noted customer companies that reported the greatest Foreign Exchange loss in 2015, according to information put together by BusinessDay.

The rest are Nigerian Breweries Plc, International Breweries Plc, BUA Cement Plc, Cadbury Nigeria Plc and Lafarge Africa Plc.

Analysis of the companies ‘monetary declarations from the Nigerian Exchange Limited reveals that Nestle’s FX loss increased to N195.07 billion in 2023 from N8.45 billion in 2022.

Read likewise:FX Losses: Unmasking the susceptible sectors

Dangote Sugar’s FX loss amounted to N172.2 billion, up from N1.89 billion, Dangote Cement taped N164.08 billion, up from N53.93 billion; Nigeria Breweries taped N153.33 billion, up from N26.34 billion.

International Breweries increased to N72.42 billion from N13.46 billion; BUA Cement taped N69.95 billion, up from N5.5 billion.

Additional analysis of declarations exposed that their overall FX loss was N885.0 billion, up from N122.7 billion in 2022.

“The FX loss widening is because of the result of the naira devaluation. These business had foreign currency-denominated commitments in their books,” Israel Odubola, a Lagos-based research study financial expert, stated.

He included that with the huge devaluation of the naira, over 40 percent in 2023, the naira equivalent of their foreign currency-denominated commitments expanded.

PZ Cussons reported an FX loss of N87.1 billion for the 6 months ended November, up from N2.7 billion in 2022.

Guinness had a loss of N15.7 billion for the 6 months ended December, up from N4.53 billion in the exact same duration of 2022.

“The decline was huge as we moved from about N450/$ at the main rate to practically N1,600/$,” Muda Yusuf, president of the Centre for Promotion of Private Enterprises, stated.

He stated the majority of the customer companies have direct exposure in regards to their foreign liabilities that they utilized to get their basic materials, centers or all sorts of things from their moms and dad business.

Last June, the Central Bank of Nigeria combined all sections of the FX market into the Investors and Exporters window and reestablished the prepared purchaser, ready seller design.

The liberalisation of the forex program compromised the naira from 463.38/$ to 1,602/$ since March 5, 2024. At the parallel market, the naira diminished to 1,590/$ from 762/$.

The boost in gas costs and forex expenses added to the rise in the nation’s heading inflation rate, which increased to 29.90 percent in January from 28.92 percent in the previous month, according to the National Bureau of Statistics.

The difficult company environment likewise pressed multinationals to leave Africa’s most significant economy as Procter & & Gamble, GlaxoSmithKline Consumer Nigeria, Equinor, Sanofi and Bolt Food revealed strategies to leave the nation this year.