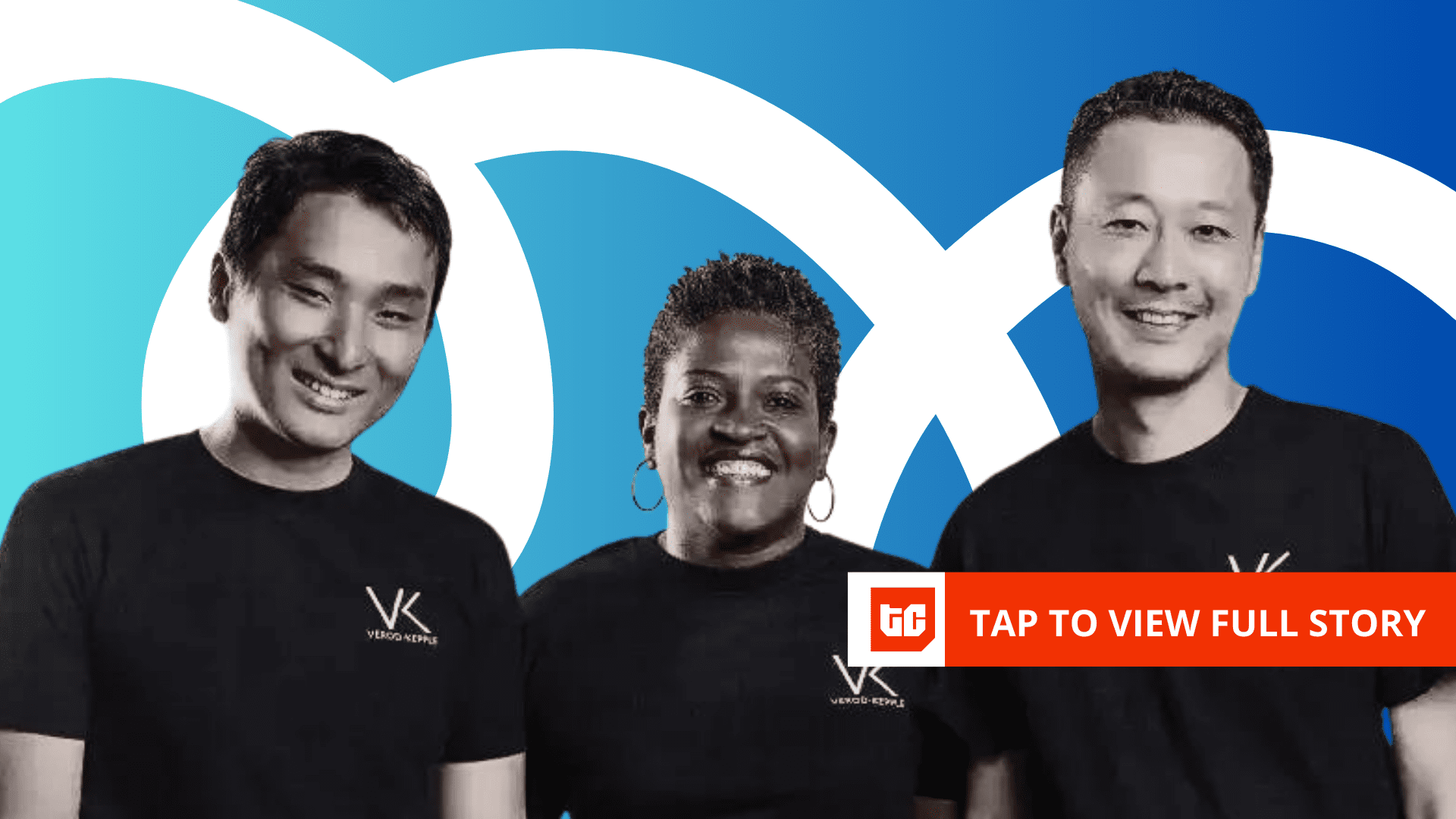

Equipped with a $45 million war chestthe Verod-Kepple Africa Ventures (VKAV) management group– Ory Okolloh, Ryosuke Yamawaki, and Satoshi Shinada– have years of experience operating and investing in Africa in between them.

Yamawaki established Japan’s embassy in Botswana in 2008 however left after 2 years since “there’s no equity upside to being the creator of an embassy.”

He then relocated to Mitsui, among the biggest financial investment homes in Japan, simply as the business was broadening into Africa. After an MBA from Berkeley, he released Kepple Africa Ventures with Shinada, who signed up with after purchasing energy and facilities jobs in West Africa for 7 years.

Over the next 3 years, they purchased over 100 African start-ups. “We are not scared of making errors, however we fear not discovering anything due to absence of execution and speed,” was Kepple’s mantra as it invested in between $50,000 and $150,000 in each pre-seed and seed-stage start-up it backed.

Following the complete implementation of its $20 million fund in 2021, Kepple Africa, which intentionally structured itself as a “hands-off” fund from a portfolio assistance viewpoint, was efficiently closed down to line up with a brand-new concentrate on growth-stage start-ups. (Yamawaki and Shinada still screen, track and report on Kepple Africa portfolio business.)

The set then partnered with Ory Okolloh, a tech and financial investment expert in Africa with experience at Google and Safaricom, to begin Verod-Kepple Africa (VKAV), an equity capital fund that is partnered with Verod Capital, a Lagos-based personal equity company. The company’s typical ticket size is in between $1 million and $3 million and it has actually purchased 11 growth-stage start-ups, like Moove (a Kepple Africa portfolio business), Shuttlers Chariand Julaya

While Verod-Kepple has actually shed the seed-stage investing and speed that Kepple Africa was understood for, it still keeps the Japanese connection of its predecessor as it purchases growth-stage start-ups at the Series A and B phases. The equity capital company normally causes its restricted partners, primarily Japanese business, as co-investors in offers and, in many cases, ultimately establishes an acquisition occasion for its portfolio start-ups for its financiers.

TechCabal talked to all 3 partners for this interview as they shared their financial investment thesis and why they are backing African start-ups.

Equity capital companies and personal equity companies vary in their techniques to financial investment. Why did you partner with Verod Capital?

Shinada:

As the environment grows, more start-ups remain in the development stage. They’re dealing with numerous concerns, like governance, operation, working with, financing, monetary reporting, and so on. These things are handled far better by Private Equity funds. They have substantial stakes in their portfolio business and attempt to make a turn-around rapidly. They are really hands-on and concentrated on enhancing the efficiency of their portfolio business.

We believed we [could] institutionalise that type of experience and understanding in the VC context if we kept buying the development stage of the start-ups. [Our partnership] Corresponded with when we chose to move up from seed financial investments to Series A and Series B financial investments.

From Verod’s viewpoint, I believe they wished to diversify their property class. As part of their worth include to their portfolio business, they were looking for more tech options to enhance the effectiveness and performance of their portfolio business.

Read likewise: Verod Capital purchases out Cardinal Stone’s stake in iFitness

Kepple bought lots of early-stage start-ups in simply 3 years. Now Verod-Kepple has actually backed 11 growth-stage start-ups in 2 years. What are a few of the obstacles dealt with by early-stage start-ups and late-stage business?

Shinada: For early-stage start-ups, the most significant challenge is adjusting the truth of the African market to financiers’ expectations as a tech business.

Start-ups require to concentrate on African issues if they wish to monetise. On the other hand, lots of financier point of views are formed by worldwide patterns. I believe that’s why, in between 2020 and 2021, great deals of cash flew into African copies of international organization designs that were presumed to be asset-light and tech-driven. It didn’t work because, in Africa, it’s more crucial to produce deals than to get income share by taking advantage of existing deal streams with tech services.

For later-stage business, exits are a huge headache. To leave, they require to comprehend what brings in international financiers and likewise, from the viewpoint of public stock exchange financiers, make an IPO take place. There has actually been a great deal of misalignment in between what financiers are searching for and what African services are doing. No worldwide financier is trying to find a single service design with a single market direct exposure since Africa is dangerous. Financiers are searching for a pan-African, wider, and easier index to diversify their direct exposure to emerging markets.

You have a varied variety of business in your existing portfolio. How do you evaluate which business get to remain in the Verod-Kepple portfolio? What’s your financial investment method?

Yamawaki: We constantly try to find scalable and untapped chances that deal with a few of the greatest frictions in Africa. We have 3 pillars on our site that represent the lens through which we see those chances, to ensure these chances are big adequate and scalable.

Facilities. We wish to back companies that attempt to fix friction for the public that ought to have been supplied by the federal government. Shuttlers is one: mass transit is possibly a human right, however there is no dependable and cost effective option for it [in Nigeria]

Inadequacy solvers. This is fixing friction for companies. For this, we have Julaya

The last pillar is homegrown services. We have actually modified that to market developers. Market developers describe those producing financial chances for individuals based upon the altering characteristics of the general African economy, for example, increasing GDP.

When it pertains to evaluation, we take a look at the offer to see whether the chance falls under these pillars effectively. We do not wish to buy designs reproduced from other parts of the world or services that simply have a tech layer. We wish to back services and creators that take on deep concerns and issues in Africa.

Concerning the real procedure, we have 2 IC (financial investment committee) detailed procedures with a modest degree of due diligence. After that, we do a deep dive into the information of business and after that make a decision.

You discussed that you do a modest degree of due diligence. Understanding that personal equity companies take due diligence really seriously, does Verod-Kepple count on Verod for assistance for due diligence?

Yamawaki: We run Verod-Kepple as a VC fund, and it is independent of Verod. How our organisation is structured is that we share back and legal workplace functions, such as legal, financing, human resources, and other assistance functions, other than for the real financial investment group.

This does not indicate we have the exact same list of due diligence for legal or financing. Particularly for financing, since if you do the very same level of financing due diligence simply to examine every proof of payment for start-ups, it is overkill.

We change our due diligence requirements for VC, however it likewise depends upon the phase. Individuals behind the scenes who are running together with us are the exact same set of individuals [with Verod]They have much deeper sets of understanding, particularly on the danger side; they know a prospective danger location.

What kind of creator is Verod-Kepple wanting to back?

Shinada:

We desire the creator to be extremely visionary and efficient in putting that huge vision into stepping stones. Having a huge vision is not the like having a huge dream. When you call it a vision, you likewise need to have a robust thesis and background that underpin that huge vision.

We likewise require creators to have international point of views since we anticipate competitors to come from anywhere, and we likewise desire the creators to have the ability to gain from the successes and errors of various start-ups in Africa and the international market.

We likewise desire creators to be strong sufficient to change their company designs. We have not seen any creators simply show themselves by following their preliminary presumptions or preliminary service design. The majority of them have actually been individuals considering and changing their company designs.

Yamawaki: We constantly look for chemistry in between us and the creator on an individual level. We have a strong objective to include worth to our business, and to do so, having great chemistry or possibly an individual connection with the creator is really essential.

What about warnings?

Okolloh: Satoshi mentioned this earlier, however the very first is if there is no pain-market fit. Exists a discomfort market fit even before the product-market fit? Due to the fact that if you’re not fixing that discomfort, you may obtain consumers, however maintaining them would be difficult. You may subsidise them at first, however getting them to spend for it ends up being hard.

The 2nd is around individuals. If there’s high turnover within your group, if you get an ambiance when you go to the workplace. How are the staff members sensation? What’s the energy? What’s the interest? Since these are the important things that will sustain you in the long term. Another red flag we look at is turnover and staff member complete satisfaction.

Another warning is the absence of openness. If you need to keep digging around for every single little thing, then that’s a warning. As soon as we get a sense of a misalignment of worths, that is likewise a huge warning for us when we’re doing our diligence.

What are the methods Verod-Kepple supports its creators and start-ups besides financing?

Okolloh: Both internally and in cooperation with the Verod group, we cover hands-on assistance through governance. We’ve assisted one of our business move from an advisory board to a more official board and assisted with preparing a board charter.

We have actually likewise aided with whatever from recruitment and putting procedures in location on an HR basis to ESG and effect. A few of our business are beginning their journey around tracking effect or putting in much better ESG procedures and we’re able to support that.

The most crucial one is developing a peer network in our portfolio. We securely think that the very best source of knowing, sharing, and even collaboration will originate from business owners dealing with other business owners. This is an essential metric that we will be tracking in regards to the worth included that we brought as financiers.

Kepple signed a great deal of cheques in a brief duration. Purchasing more than 100 start-ups need to have featured lessons. What would you state are your most significant knowings from purchasing Africa?

Yamawaki: Something that struck me most is that the overall market size matters. As a start-up, beginning in one particular nation, it is very important to have a massive aspiration or market capacity. If you end up being a specific niche in a single nation in Africa, I do not believe you can be a VC-backed organization even if of an absence of scalability or prospective optimum size, or if it takes 30 years to get the bulk market share in a provided market, then it’s not a VC market.

It takes some time to develop a practical service design; you can not simply introduce your app and after that do the marketing. Frequently, you need to go up and down the worth chain and construct whatever for it to make good sense. Since it takes time and cash for it to be warranted, it requires to have a big prospective market size.

As Africa emerges from the post-bubble evaluations, how does Verod-Kepple consider future financial investments?

Okolloh: It’s cyclical. That’s the very first thing to keep in mind. For numerous folks, this is the very first decline in the African VC market, however there was [a downturn] in 2014/2015 and entering into 2016. Out of that came a great deal of the winners that we see now in the area, like Paystack and Flutterwave. It’s crucial for financiers not to see this as a one-off or a special phenomenon. It’s simply the cyclical nature of VC throughout the world, and Africa is no exception. I believe there was some correction that required to occur. Our point of view is that it’s a fun time to be investing and releasing capital. It’s likewise a good time to see the creators who make those difficult choices, pivot early, get used to the truths and hone their service designs.

For the business dealing with obstacles that run out their control, specifically on the macro side, [we are] partnering with other financiers, other sources of capital and resources that we can offer to assist them browse this difficult duration.

Shinada: It’s time that client creators need to be rewarded with patient capital. Before this market decline, creators who wished to make fast cash were rewarded by fast cash financiers. The good idea is that those who wished to make fast cash currently passed away and those financiers who had a really short-term reward likewise burned a lot due to the fact that of this decline.

How does Verod-Kepple consider exits?

Yamawaki:

We require to have an excellent portfolio of various kinds of exits. Unlike in other markets, we can not simply depend on IPOs. 3 kinds of exits are possible: secondaries, buyouts and IPOs.

For secondaries, we can not simply wait on it to take place. We likewise require to craft it when the timing is. The most significant variety of exits that we can make from our portfolio will be from secondaries.