Yuan funding is ending up being expensive and sporadic in Russia, choking off a path to foreign capital for business that are currently dealing with much greater domestic rate of interest and a wave of financial obligation due this year.

(Bloomberg)– Yuan funding is ending up being expensive and sporadic in Russia, choking off a path to foreign capital for business that are currently dealing with much greater domestic rate of interest and a wave of financial obligation due this year.

2 years after the intrusion of Ukraine separated Russia from the Western monetary system, significant energy and mining business have actually pertained to count on the yuan for the majority of their foreign-currency requires. Even as yields on China’s benchmark federal government bonds hover around a two-decade low, inadequate yuan liquidity in Russia and need for the currency from importers are contributing to greater loaning costs.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to check out the most recent news in your city and throughout Canada.

- Special short articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily material from Financial Times, the world’s leading international service publication.

- Unrestricted online access to check out posts from Financial Post, National Post and 15 news websites throughout Canada with one account.

- National Post ePaper, an electronic reproduction of the print edition to see on any gadget, share and talk about.

- Daily puzzles, consisting of the New York Times Crossword.

REGISTER FOR UNLOCK MORE ARTICLES

Subscribe now to check out the current news in your city and throughout Canada.

- Special short articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, Victoria Wells and others.

- Daily material from Financial Times, the world’s leading worldwide organization publication.

- Limitless online access to check out short articles from Financial Post, National Post and 15 news websites throughout Canada with one account.

- National Post ePaper, an electronic reproduction of the print edition to see on any gadget, share and discuss.

- Daily puzzles, consisting of the New York Times Crossword.

REGISTER/ SIGN IN TO UNLOCK MORE ARTICLES

Develop an account or check in to continue with your reading experience.

- Gain access to posts from throughout Canada with one account.

- Share your ideas and sign up with the discussion in the remarks.

- Delight in extra posts each month.

- Get e-mail updates from your preferred authors.

Check in or Create an Account

or

Post material

Post material

The financing issue leaves business like Russia’s greatest miner, MMC Norilsk Nickel PJSC, selecting in between costly ruble financing or the increasing expense of domestic yuan financial obligation.

Russia more than doubled its criteria in 2015, saddling business debtors with as much as 1.2 trillion rubles ($13 billion) in additional debt-servicing expenses, according to Moscow-based consultancy Yakov & & Partners.

“Given existing truths, the typical expense of financial obligation will be raising,” Sergey Malyshev, Nornickel’s primary monetary officer, stated in a declaration sent out to press reporters last month.

Nornickel’s interest payments are set to reach $1 billion in 2024 after $800 million in 2023– compared to $315 million in 2021, the last complete year before the war. The concern is almost as extreme for the biggest oil manufacturer, Rosneft PJSC, pressing it to speed up financial obligation payments after interest taken in 50% more cash in the 4th quarter than a year previously.

Not Widespread

After their launching in 2022, yuan bonds “have not yet ended up being extensive” in the Russian market, the reserve bank stated in a report released Monday. It noted restricted totally free liquidity in yuan amongst loan providers and the requirement to provide greater yields as elements “limiting prospective interest in such positionings amongst financiers and providers.”

By registering you grant get the above newsletter from Postmedia Network Inc.

Post material

Short article material

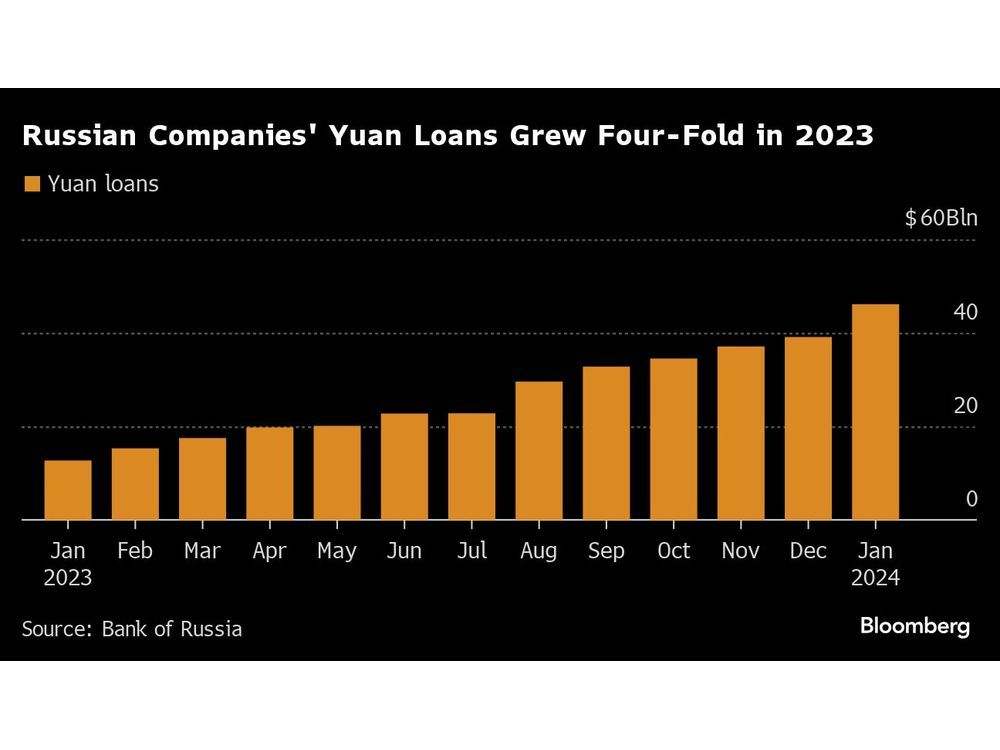

The volume of Russian business yuan bonds– all offered on the domestic market– practically stalled in the last 3 quarters of in 2015 and reached the equivalent of 800 billion rubles, according to the Russian reserve bank. And although loans in the Chinese currency almost quadrupled to a record $46 billion in 2023, their share in business credit portfolios was still just in single digits.

The typical yield on yuan securities for companies increased by almost 2 portion points in the course of in 2015 and approached 6%, according to the Bank of Russia.

The short-term expense of loaning yuan on the Moscow Exchange has actually been so unpredictable that it increased to 15.7% on March 1 before dropping to 4.1% 3 days later on, according to estimations by Bloomberg Economics. The unwillingness of significant Chinese banks to connect Moscow’s yuan market with overseas markets is probably a crucial aspect, according to Bloomberg financial expert Alexander Isakov.

What Bloomberg Economics Says …

“Yuan liquidity in Moscow is ending up being more limited and its expenses more unpredictable. Yuan scarcities in the Russian monetary system show emerging issues for growing yuan loaning for domestic banks– 2 years after the start of the war they still have a hard time to bring in an adequately big and steady yuan deposit base.”

Post material

— Alexander Isakov, Russia economic expert.

Yuan bond issuance in 2022-2023 represented a “inexpensive source of financing,” according to Alexey Tretyakov, among the creators of Aricapital in Moscow.

Dealing with a getting worse yuan liquidity crunch, Russian loan providers have actually needed to turn to the reserve bank’s Chinese currency swaps to fulfill their requirements, leading to a “substantial boost in yuan financing expenses,” Tretyakov stated. “An ongoing deficit might cause a more increase in yuan bond yields,” he stated.

Russian business likewise have not obtained within China itself, according to information put together by Bloomberg, due to the fact that capital controls there make complex the repatriation of cash abroad. They have not offered yuan securities like panda or dim amount bonds considering that 2018 after 11 such problems in the previous 8 years.

The barriers are showing expensive to conquer even for the federal government, which has actually invested years preparing its own yuan bonds. Financing Minister Anton Siluanov stated in a February interview with RIA Novosti that conversations with China over getting loans in yuan likewise have yet to produce outcomes.

Short article material

Chinese lending institutions consisting of Industrial and Commercial Bank of China Ltd.– the world’s greatest by properties– have actually been increase their direct exposure to Russia through overseas branches. ICBC’s Russian subsidiary alone saw a five-fold boost in overall regional possessions from the start of 2022 and through Oct. 1 in 2015, according to the current information released by the Bank of Russia.

The stress on Russian business coffers dangers denying markets of capital in a year when re-financing requirements are dramatically growing. In spite of outstanding revenues, business are feeling the pinch after the federal government enforced brand-new export taxes to assist money the war, additional weakening the advantage of a weaker ruble that assisted drive record margins.

“High rates imply that the business will be more mindful with financial investments that need substantial financial obligation capital,” stated Dmitry Kazakov, expert at BCS in Moscow.

Post material