Home Fossil Energy WoodMac: Are shifts in energy policy on the cards for oil & & gas environment and which forces will be at play in 2024?

The moving sands of time are bringing winds of modification to the worldwide energy landscape in a quote to make it more sustainable, so that, the environment modification concerns can be dealt with before time goes out. This has actually stimulated decarbonization throughout the years, imbuing it with higher vitality. These efforts are not yet on a grand sufficient scale to usher in a tidy energy future needed for net no goals. While using its forecasts for 2024, Wood Mackenzie, an energy intelligence group, has actually laid out numerous essential styles to enjoy in international and business upstream sectors.

The issues concerning energy security function as both a motivation to speed up green energy implementation and likewise as an obstacle considering that the exact same argument is utilized to extend the life time of nonrenewable fuel sources. Within its ‘What to Look for in 2024’ upstream series, Wood Mackenzie declares that the crucial styles to look out for incorporate continued debt consolidation in the oil and gas market, increased activity from National Oil Companies (NOCs), reversing decarbonization gains, shifts in tactical playbooks, and an upstream financial investment plateau.

Fraser McKayWood Mackenzie’s Head of Upstream Analysis, detailed: “Geopolitical stress, a record year for elections and financial unpredictability will supply the background to 2024. Energy policy will continue to be a frontline problem, exposing broad divides in nations’ energy shift methods. Many upstream operators have little impact on these external forces. They will look for to alleviate their effect by focusing on performance, sustainability and concentration danger. Upstream operators will stay concentrated on durability, sustainability and performance.”

According to Wood Mackenzie, another banner year for mergers and acquisitions (M&A) is in the offing, which will concentrate on scale, efficiency enhancement, and diversity, because sector debt consolidation will continue to be a crucial pattern in 2024. While there is no unifying style throughout all these possible huge offers, the energy intelligence group highlights that the market is developing, and size matters, hence, as greater market appraisal multiples, much easier access to fund for bigger business, lower expenses, and much better execution are a few of the rewards.

“For offers to work, they require to show better functional, monetary and, for some offers, emissions efficiency. Some purchasers might follow ExxonMobil’s playbook with Pioneer and want to bring distinct information, innovation, and processes to a basin. Others will be marital relationships of benefit. Not all offers will work, and it will stay difficult for smaller sized worldwide independents to show concrete synergies in between diverse portfolios than their bigger more varied brethren,” included McKay.

Throughout 2024, NOCs– a peer group that produces half of the world’s oil and gas– are anticipated to step up activity, as COP 28 has actually put higher focus on sustainability strategies. Wood Mackenzie highlights that the result on some NOCs will be shown through larger aspirations in low carbon and emissions reduction, especially for those that registered to the Oil and Gas Decarbonisation Charter (OGDC)In spite of this, the business is determined that upstream development will be on the program for the majority of NOCs in 2024.

-

-

long check out

Published: 2 months ago

-

Neivan BoroujerdiDirector of Corporate Research and NOC Lead at Wood Mackenzie, commented: “Most NOCs are still in business of growing upstream capability. It is a method that has actually been pushed by the energy security issues of the last 24 months.”

Based Upon Wood Mackenzie’s analysis, the Middle East heavyweights will lead much of the development, with ADNOC, Aramco, and KPC increase investing to satisfy domestic capability targets. Aside from these, the Chinese NOCs might likewise step up their financial investment ante, albeit from a low base, therefore, upstream equity, LNG offtake, and tactical collaborations in the Middle East, Africa, and Latin America are possibilities. Furthermore, mergers and acquisitions are likewise anticipated to get an increase.

“The NOCs have reset monetary strength and will target M&A s to plug tactical spaces in gas, LNG, short-cycle oil and global expedition. With this quantity of development and activity, there is a threat that shift techniques might slow, however many will continue to speed up worldwide shift styles,” kept in mind Boroujerdi.

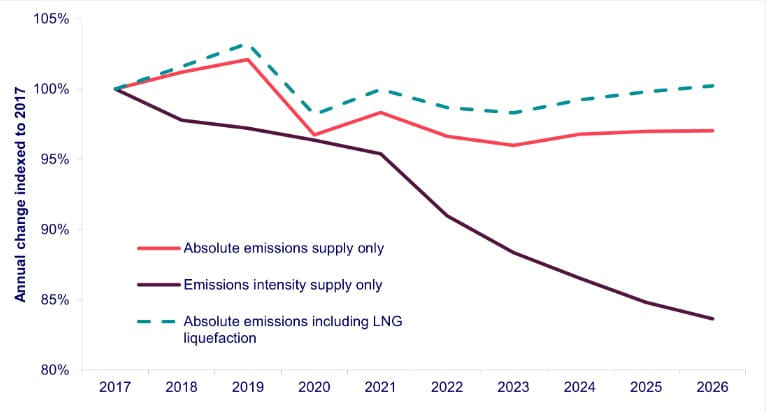

Wood Mackenzie thinks that some decarbonization gains will reverse in 2024, as production is set to increase by 3% without decarbonization keeping up. As an outcome, upstream scope 1 and 2 emissions are most likely to increase by 12 million lots of CO2e year-on-year.

-

Published: 2 months ago

Adam PollardWood Mackenzie’s Principal Analyst of Upstream Emissions Research, stressed:“Emissions strength will keep failing flaring decreases, more electrification, CCUS and greenfield tasks, which will all assist to decrease emissions per barrel, by a minimum of 2%. The greatest motorist is increasing volumes of advantaged low-intensity oil and gas from the Middle East and U.S.

“Incremental strength enhancements are excellent, however more work is needed to lower outright emissions. Harder brand-new guidelines are on the method, much of which will deal with political hold-ups. Oil and gas stay low hanging fruit for some federal governments’ decarbonisation efforts. The sector will get more enthusiastic with brand-new efforts revealed and significant jobs approved, however it will take numerous years to see the influence on international emissions decreases.”

Wood Mackenzie anticipates shifts in the tactical playbook for oil and gas gamers, with sustainability issues, stakeholder pressures, and low evaluation multiples driving business to change their tactical roadmaps.

Tom EllacottSenior Vice President of Corporate Research for Wood Mackenzie, mentioned: “Investors desire a trustworthy, growing base dividend as a benefit for increasing energy shift threats. Business will have to grow money circulation if they desire to grow dividends, re-balancing capital allowance towards financial investment to preserve sustainable cash-generating services.”

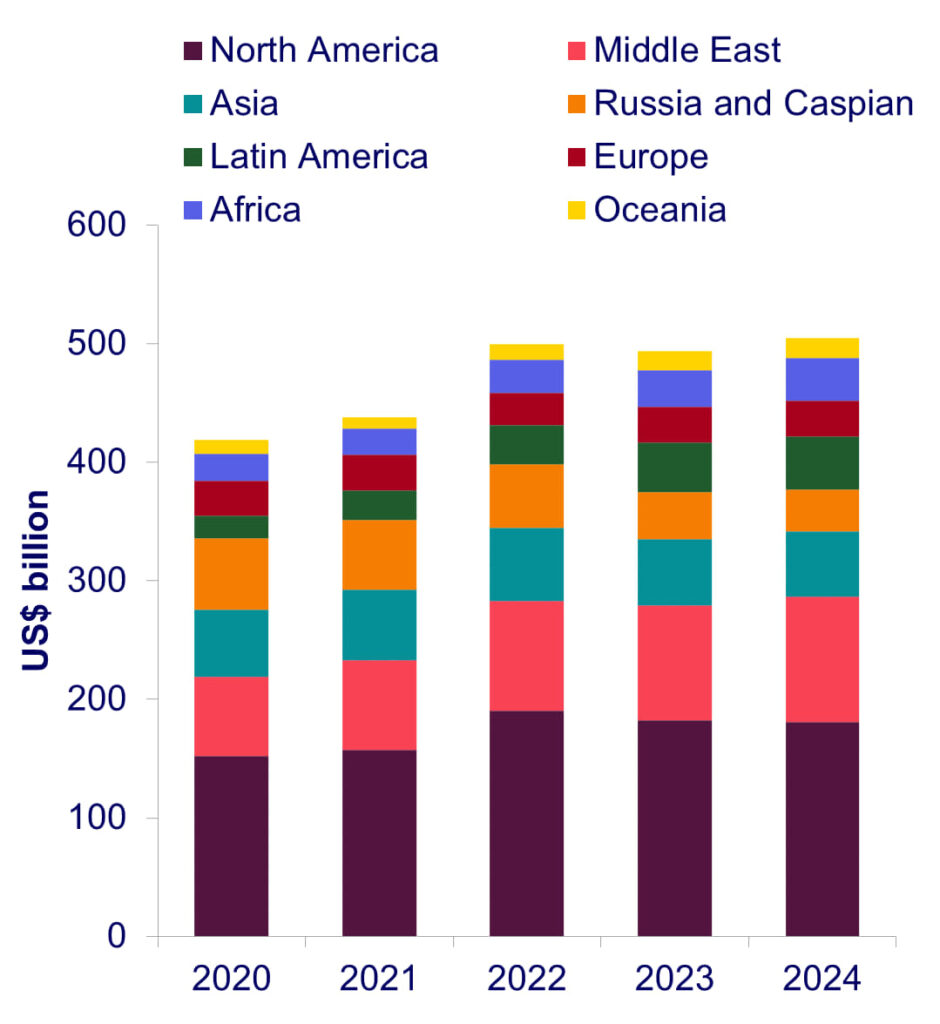

While upstream financial investment is anticipated to plateau, Wood Mackenzie provides more insight on more patterns in local reports forAsia PacificCanadaCaspianContinental EuropeLatin AmericaMiddle East and North AfricaNorth SeaRussian FederationSub Saharan AfricaandUnited States Lower 48The business declares that international costs in 2024 will reach simply over $500 billion in 2024up 2% from 2023 after an increase of 18% over the last 3 years. This incremental increase is stated to belie crucial underlying shifts.

In line with this, Wood Mackenzie highlights that upstream operators will stay concentrated on durability, sustainability, and performance, with a lot of expected to work out care in the face of inflation, traffic jams, and rate unpredictability, as self-confidence is weakened by broadening OPEC+ production cuts.

Ian ThomWood Mackenzie’s Director of Upstream Research, stated: “Investment will increase in the Middle East, however fall in the United States Lower 48. The brand-new job pipeline stays healthy, with 45 jobs competing to take last financial investment choice (FID)– a possible financial investment dedication of US$ 170 billion to establish 25.5 billion boe.

“Around 30 will continue in 2024. A number of these will be deepwater discoveries, with the 10 greatest deepwater oil jobs needing US$ 52 billion of financial investment for recoverable resources of 5 billion barrels of oil.”

Worldwide financial weak point or a loss of unity in OPEC+ are viewed to be crucial financial investment wildcards. Because a high cost recession might speed up the 3rd financial investment collapse in a years, Thom declares that “operators can and will slash budget plans rapidly if they require to.”